Statistical Analysis of S&P, Yahoo, and Google Stock Data

VerifiedAdded on 2020/02/17

|11

|2258

|347

Homework Assignment

AI Summary

This assignment analyzes the stock performance of S&P, Yahoo, and Google using statistical methods. The analysis begins with creating line charts of closing prices and calculating monthly returns for each stock. Summary statistics, including mean, standard deviation, and correlation, are computed to assess risk and return relationships. The assignment explores sampling distributions, probabilities of returns, and likelihood of losses. Furthermore, it delves into creating excess returns and estimating the Capital Asset Pricing Model (CAPM) using linear regression. The interpretation of regression coefficients, R-squared values, and confidence intervals is also provided. The analysis concludes with a confidence interval approach to evaluate stock efficiency. The assignment provides a comprehensive overview of statistical techniques applied to financial data analysis, offering valuable insights into stock market behavior and risk assessment.

STATISTICS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

QUESTION 1..................................................................................................................................3

1. Creating line charts for closing prices of S&P, Yahoo and Google series..............................3

Question 2........................................................................................................................................3

2a. Calculation of returns for the S&P, Yahoo and Google.........................................................3

2b. Obtaining summary statistics and risk and average return relationship.................................5

Question 3........................................................................................................................................7

A) Sampling distribution of mean..............................................................................................7

(b) Probability of return of 4%.....................................................................................................7

© Likelihood of loss.....................................................................................................................7

4 Creating excess return on preferred stock and excess market return........................................7

QUESTION 5 and 6.......................................................................................................................10

6A. Estimating CAPM using linear regression..........................................................................10

6b. Interpretation of the coefficient............................................................................................11

6c. interpreting the value of R2...................................................................................................12

6d. Interpreting 95% confidence interval for the slope coefficient............................................12

7 Using confidence interval approach...........................................................................................12

Table 1Calculation of probability....................................................................................................8

Table 2Likelihood of loss................................................................................................................8

QUESTION 1..................................................................................................................................3

1. Creating line charts for closing prices of S&P, Yahoo and Google series..............................3

Question 2........................................................................................................................................3

2a. Calculation of returns for the S&P, Yahoo and Google.........................................................3

2b. Obtaining summary statistics and risk and average return relationship.................................5

Question 3........................................................................................................................................7

A) Sampling distribution of mean..............................................................................................7

(b) Probability of return of 4%.....................................................................................................7

© Likelihood of loss.....................................................................................................................7

4 Creating excess return on preferred stock and excess market return........................................7

QUESTION 5 and 6.......................................................................................................................10

6A. Estimating CAPM using linear regression..........................................................................10

6b. Interpretation of the coefficient............................................................................................11

6c. interpreting the value of R2...................................................................................................12

6d. Interpreting 95% confidence interval for the slope coefficient............................................12

7 Using confidence interval approach...........................................................................................12

Table 1Calculation of probability....................................................................................................8

Table 2Likelihood of loss................................................................................................................8

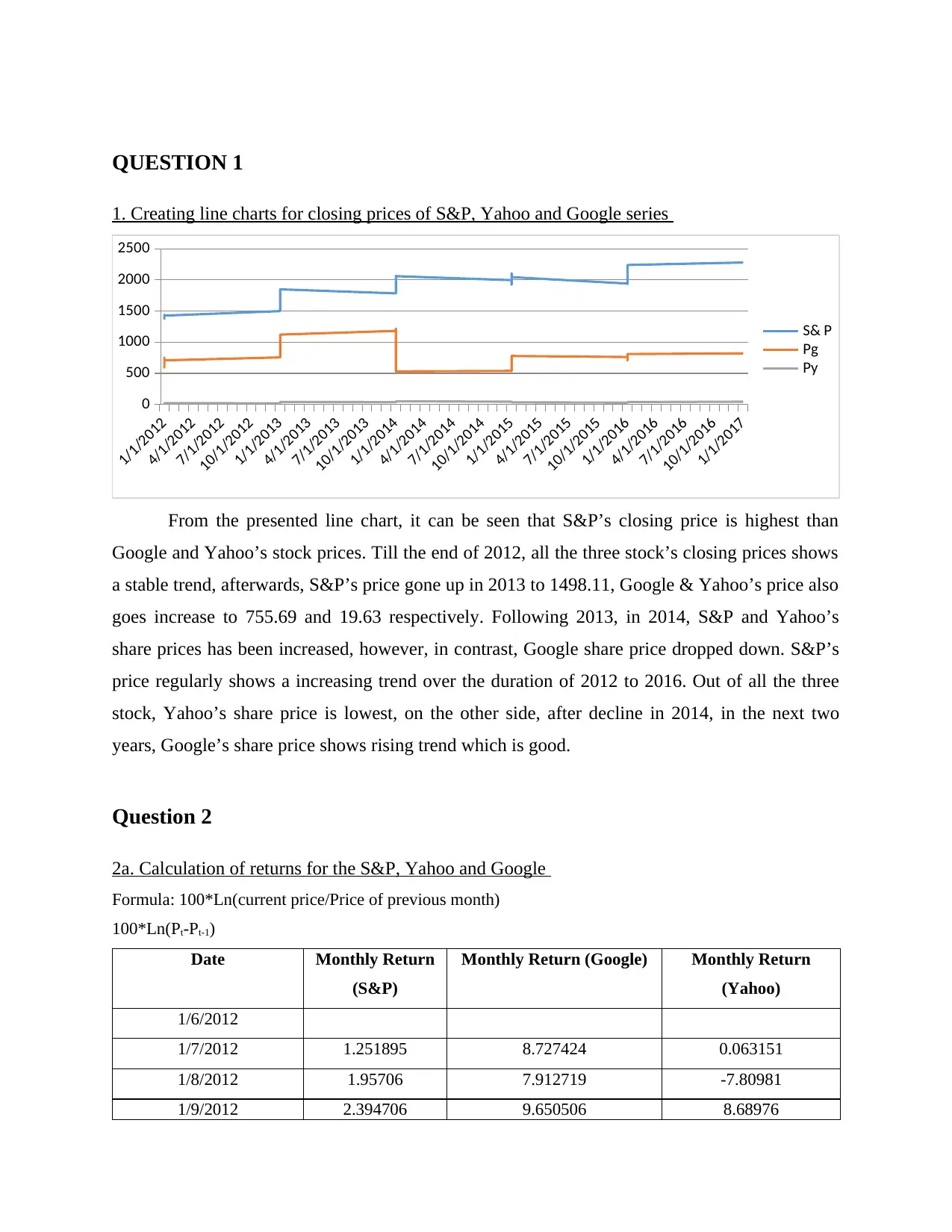

QUESTION 1

1. Creating line charts for closing prices of S&P, Yahoo and Google series

1/1/2012

4/1/2012

7/1/2012

10/1/2012

1/1/2013

4/1/2013

7/1/2013

10/1/2013

1/1/2014

4/1/2014

7/1/2014

10/1/2014

1/1/2015

4/1/2015

7/1/2015

10/1/2015

1/1/2016

4/1/2016

7/1/2016

10/1/2016

1/1/2017

0

500

1000

1500

2000

2500

S& P

Pg

Py

From the presented line chart, it can be seen that S&P’s closing price is highest than

Google and Yahoo’s stock prices. Till the end of 2012, all the three stock’s closing prices shows

a stable trend, afterwards, S&P’s price gone up in 2013 to 1498.11, Google & Yahoo’s price also

goes increase to 755.69 and 19.63 respectively. Following 2013, in 2014, S&P and Yahoo’s

share prices has been increased, however, in contrast, Google share price dropped down. S&P’s

price regularly shows a increasing trend over the duration of 2012 to 2016. Out of all the three

stock, Yahoo’s share price is lowest, on the other side, after decline in 2014, in the next two

years, Google’s share price shows rising trend which is good.

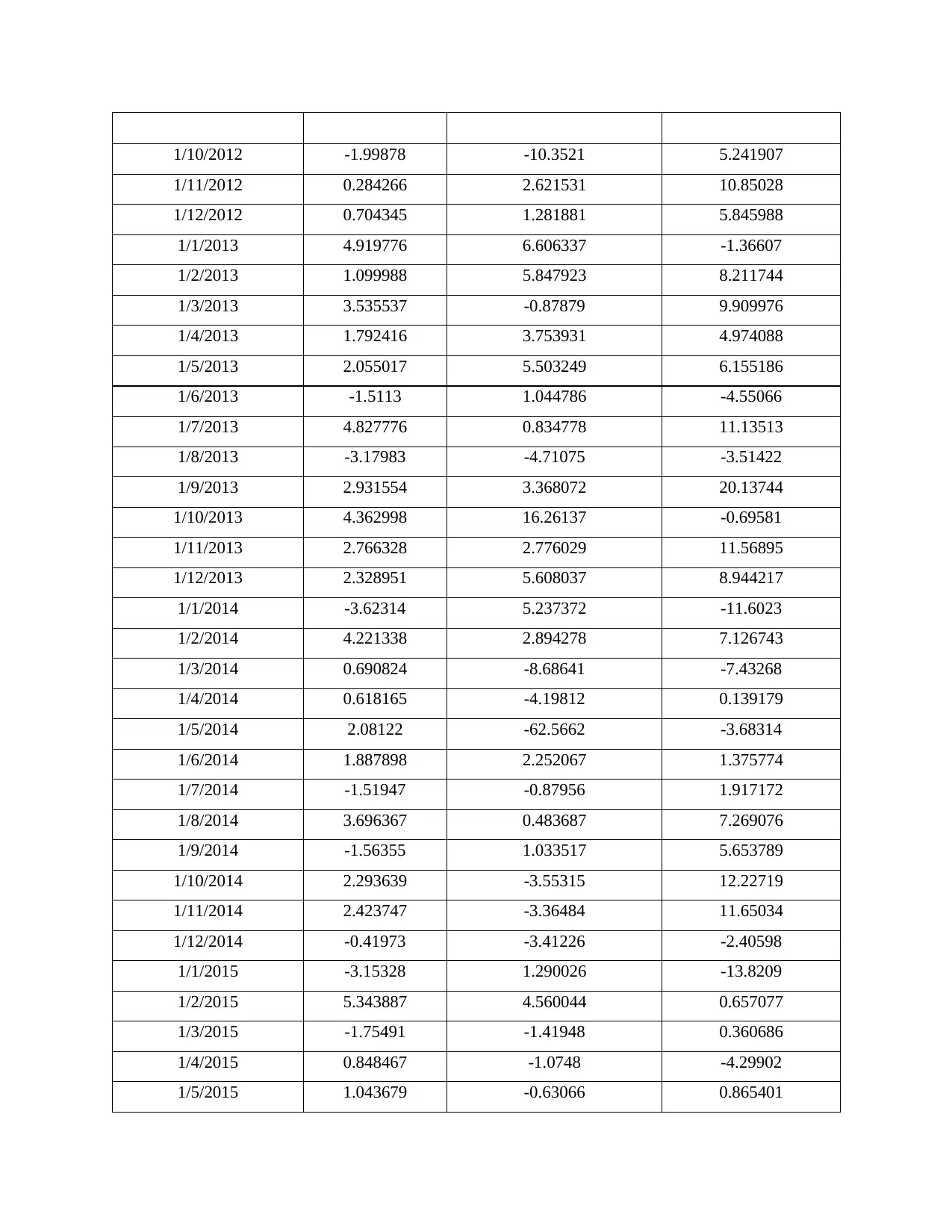

Question 2

2a. Calculation of returns for the S&P, Yahoo and Google

Formula: 100*Ln(current price/Price of previous month)

100*Ln(Pt-Pt-1)

Date Monthly Return

(S&P)

Monthly Return (Google) Monthly Return

(Yahoo)

1/6/2012

1/7/2012 1.251895 8.727424 0.063151

1/8/2012 1.95706 7.912719 -7.80981

1/9/2012 2.394706 9.650506 8.68976

1. Creating line charts for closing prices of S&P, Yahoo and Google series

1/1/2012

4/1/2012

7/1/2012

10/1/2012

1/1/2013

4/1/2013

7/1/2013

10/1/2013

1/1/2014

4/1/2014

7/1/2014

10/1/2014

1/1/2015

4/1/2015

7/1/2015

10/1/2015

1/1/2016

4/1/2016

7/1/2016

10/1/2016

1/1/2017

0

500

1000

1500

2000

2500

S& P

Pg

Py

From the presented line chart, it can be seen that S&P’s closing price is highest than

Google and Yahoo’s stock prices. Till the end of 2012, all the three stock’s closing prices shows

a stable trend, afterwards, S&P’s price gone up in 2013 to 1498.11, Google & Yahoo’s price also

goes increase to 755.69 and 19.63 respectively. Following 2013, in 2014, S&P and Yahoo’s

share prices has been increased, however, in contrast, Google share price dropped down. S&P’s

price regularly shows a increasing trend over the duration of 2012 to 2016. Out of all the three

stock, Yahoo’s share price is lowest, on the other side, after decline in 2014, in the next two

years, Google’s share price shows rising trend which is good.

Question 2

2a. Calculation of returns for the S&P, Yahoo and Google

Formula: 100*Ln(current price/Price of previous month)

100*Ln(Pt-Pt-1)

Date Monthly Return

(S&P)

Monthly Return (Google) Monthly Return

(Yahoo)

1/6/2012

1/7/2012 1.251895 8.727424 0.063151

1/8/2012 1.95706 7.912719 -7.80981

1/9/2012 2.394706 9.650506 8.68976

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1/10/2012 -1.99878 -10.3521 5.241907

1/11/2012 0.284266 2.621531 10.85028

1/12/2012 0.704345 1.281881 5.845988

1/1/2013 4.919776 6.606337 -1.36607

1/2/2013 1.099988 5.847923 8.211744

1/3/2013 3.535537 -0.87879 9.909976

1/4/2013 1.792416 3.753931 4.974088

1/5/2013 2.055017 5.503249 6.155186

1/6/2013 -1.5113 1.044786 -4.55066

1/7/2013 4.827776 0.834778 11.13513

1/8/2013 -3.17983 -4.71075 -3.51422

1/9/2013 2.931554 3.368072 20.13744

1/10/2013 4.362998 16.26137 -0.69581

1/11/2013 2.766328 2.776029 11.56895

1/12/2013 2.328951 5.608037 8.944217

1/1/2014 -3.62314 5.237372 -11.6023

1/2/2014 4.221338 2.894278 7.126743

1/3/2014 0.690824 -8.68641 -7.43268

1/4/2014 0.618165 -4.19812 0.139179

1/5/2014 2.08122 -62.5662 -3.68314

1/6/2014 1.887898 2.252067 1.375774

1/7/2014 -1.51947 -0.87956 1.917172

1/8/2014 3.696367 0.483687 7.269076

1/9/2014 -1.56355 1.033517 5.653789

1/10/2014 2.293639 -3.55315 12.22719

1/11/2014 2.423747 -3.36484 11.65034

1/12/2014 -0.41973 -3.41226 -2.40598

1/1/2015 -3.15328 1.290026 -13.8209

1/2/2015 5.343887 4.560044 0.657077

1/3/2015 -1.75491 -1.41948 0.360686

1/4/2015 0.848467 -1.0748 -4.29902

1/5/2015 1.043679 -0.63066 0.865401

1/11/2012 0.284266 2.621531 10.85028

1/12/2012 0.704345 1.281881 5.845988

1/1/2013 4.919776 6.606337 -1.36607

1/2/2013 1.099988 5.847923 8.211744

1/3/2013 3.535537 -0.87879 9.909976

1/4/2013 1.792416 3.753931 4.974088

1/5/2013 2.055017 5.503249 6.155186

1/6/2013 -1.5113 1.044786 -4.55066

1/7/2013 4.827776 0.834778 11.13513

1/8/2013 -3.17983 -4.71075 -3.51422

1/9/2013 2.931554 3.368072 20.13744

1/10/2013 4.362998 16.26137 -0.69581

1/11/2013 2.766328 2.776029 11.56895

1/12/2013 2.328951 5.608037 8.944217

1/1/2014 -3.62314 5.237372 -11.6023

1/2/2014 4.221338 2.894278 7.126743

1/3/2014 0.690824 -8.68641 -7.43268

1/4/2014 0.618165 -4.19812 0.139179

1/5/2014 2.08122 -62.5662 -3.68314

1/6/2014 1.887898 2.252067 1.375774

1/7/2014 -1.51947 -0.87956 1.917172

1/8/2014 3.696367 0.483687 7.269076

1/9/2014 -1.56355 1.033517 5.653789

1/10/2014 2.293639 -3.55315 12.22719

1/11/2014 2.423747 -3.36484 11.65034

1/12/2014 -0.41973 -3.41226 -2.40598

1/1/2015 -3.15328 1.290026 -13.8209

1/2/2015 5.343887 4.560044 0.657077

1/3/2015 -1.75491 -1.41948 0.360686

1/4/2015 0.848467 -1.0748 -4.29902

1/5/2015 1.043679 -0.63066 0.865401

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

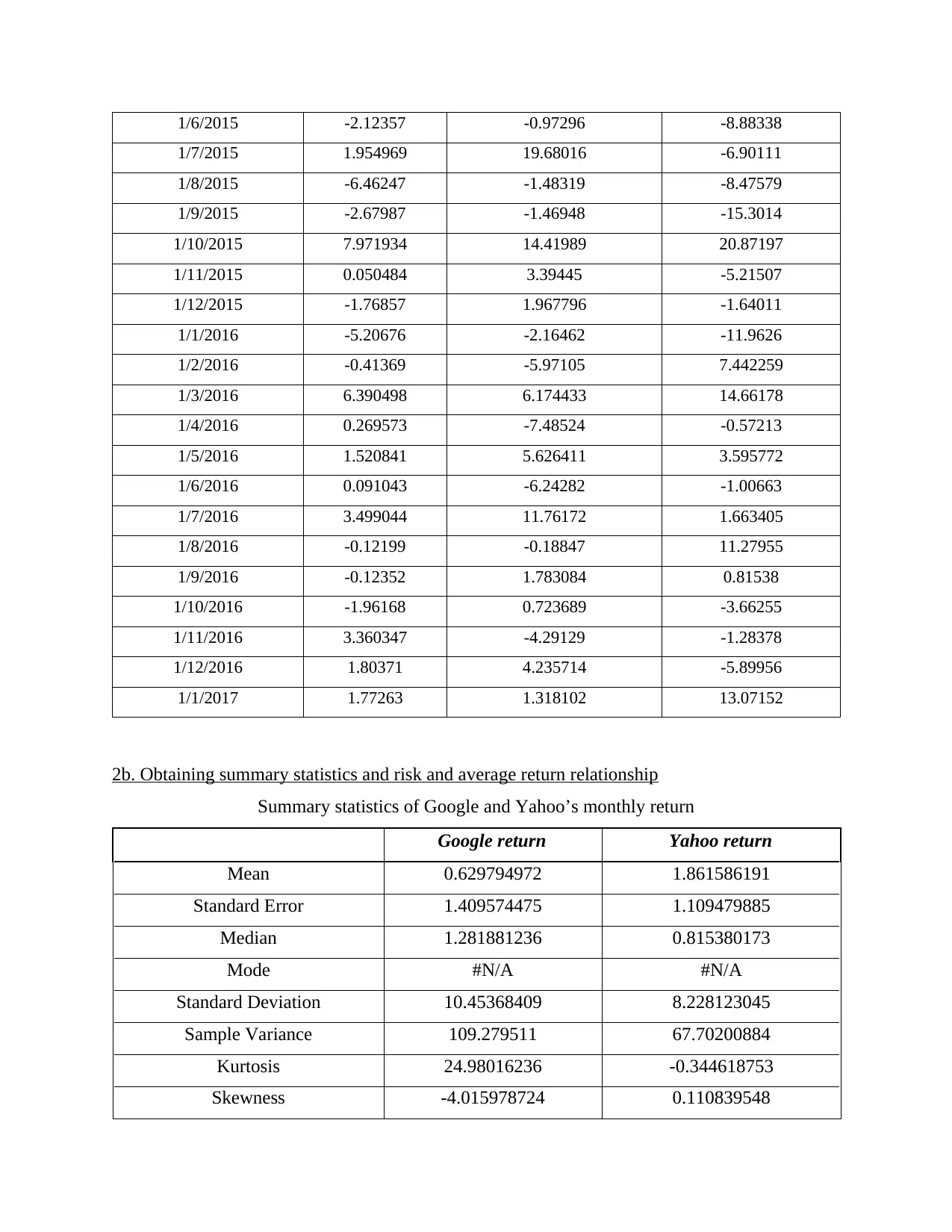

1/6/2015 -2.12357 -0.97296 -8.88338

1/7/2015 1.954969 19.68016 -6.90111

1/8/2015 -6.46247 -1.48319 -8.47579

1/9/2015 -2.67987 -1.46948 -15.3014

1/10/2015 7.971934 14.41989 20.87197

1/11/2015 0.050484 3.39445 -5.21507

1/12/2015 -1.76857 1.967796 -1.64011

1/1/2016 -5.20676 -2.16462 -11.9626

1/2/2016 -0.41369 -5.97105 7.442259

1/3/2016 6.390498 6.174433 14.66178

1/4/2016 0.269573 -7.48524 -0.57213

1/5/2016 1.520841 5.626411 3.595772

1/6/2016 0.091043 -6.24282 -1.00663

1/7/2016 3.499044 11.76172 1.663405

1/8/2016 -0.12199 -0.18847 11.27955

1/9/2016 -0.12352 1.783084 0.81538

1/10/2016 -1.96168 0.723689 -3.66255

1/11/2016 3.360347 -4.29129 -1.28378

1/12/2016 1.80371 4.235714 -5.89956

1/1/2017 1.77263 1.318102 13.07152

2b. Obtaining summary statistics and risk and average return relationship

Summary statistics of Google and Yahoo’s monthly return

Google return Yahoo return

Mean 0.629794972 1.861586191

Standard Error 1.409574475 1.109479885

Median 1.281881236 0.815380173

Mode #N/A #N/A

Standard Deviation 10.45368409 8.228123045

Sample Variance 109.279511 67.70200884

Kurtosis 24.98016236 -0.344618753

Skewness -4.015978724 0.110839548

1/7/2015 1.954969 19.68016 -6.90111

1/8/2015 -6.46247 -1.48319 -8.47579

1/9/2015 -2.67987 -1.46948 -15.3014

1/10/2015 7.971934 14.41989 20.87197

1/11/2015 0.050484 3.39445 -5.21507

1/12/2015 -1.76857 1.967796 -1.64011

1/1/2016 -5.20676 -2.16462 -11.9626

1/2/2016 -0.41369 -5.97105 7.442259

1/3/2016 6.390498 6.174433 14.66178

1/4/2016 0.269573 -7.48524 -0.57213

1/5/2016 1.520841 5.626411 3.595772

1/6/2016 0.091043 -6.24282 -1.00663

1/7/2016 3.499044 11.76172 1.663405

1/8/2016 -0.12199 -0.18847 11.27955

1/9/2016 -0.12352 1.783084 0.81538

1/10/2016 -1.96168 0.723689 -3.66255

1/11/2016 3.360347 -4.29129 -1.28378

1/12/2016 1.80371 4.235714 -5.89956

1/1/2017 1.77263 1.318102 13.07152

2b. Obtaining summary statistics and risk and average return relationship

Summary statistics of Google and Yahoo’s monthly return

Google return Yahoo return

Mean 0.629794972 1.861586191

Standard Error 1.409574475 1.109479885

Median 1.281881236 0.815380173

Mode #N/A #N/A

Standard Deviation 10.45368409 8.228123045

Sample Variance 109.279511 67.70200884

Kurtosis 24.98016236 -0.344618753

Skewness -4.015978724 0.110839548

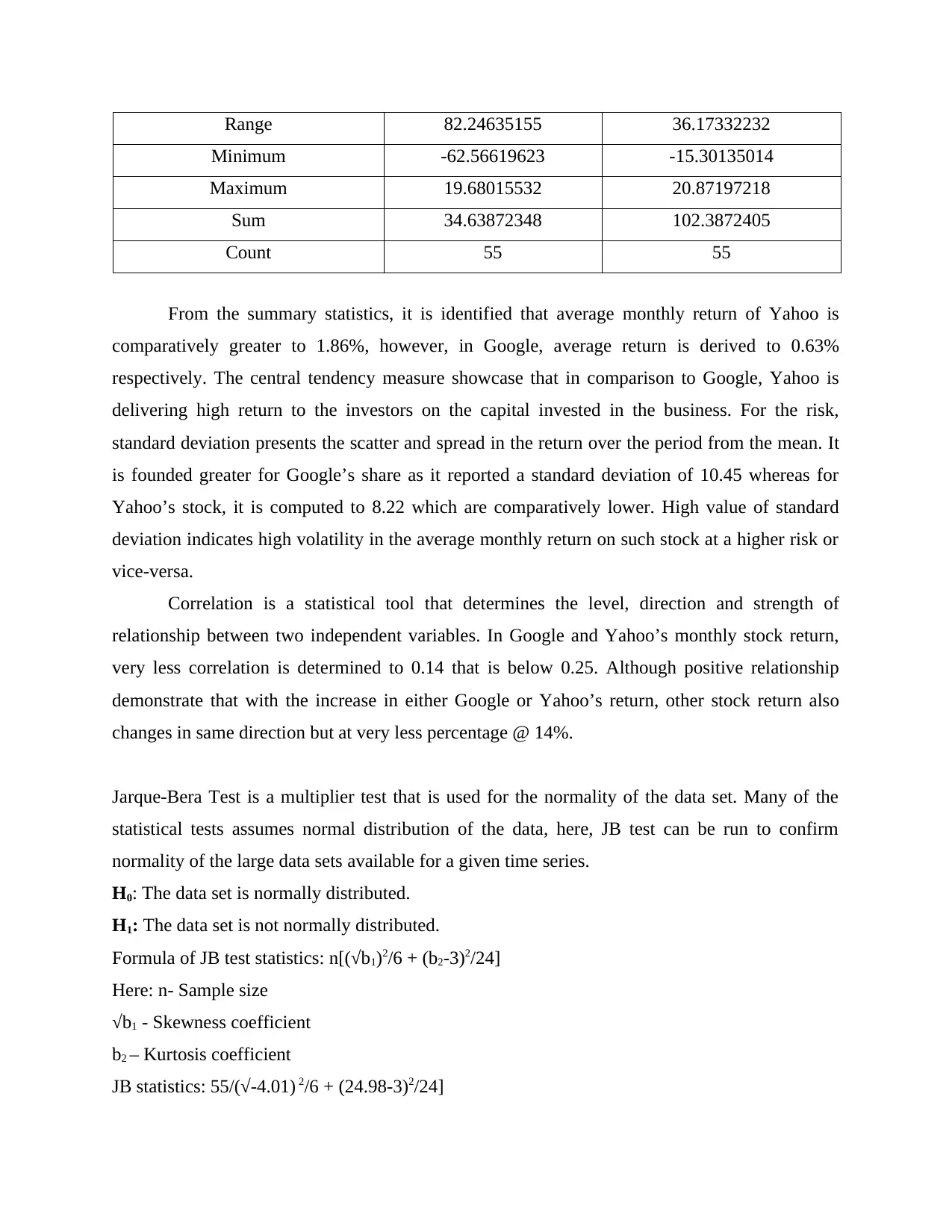

Range 82.24635155 36.17332232

Minimum -62.56619623 -15.30135014

Maximum 19.68015532 20.87197218

Sum 34.63872348 102.3872405

Count 55 55

From the summary statistics, it is identified that average monthly return of Yahoo is

comparatively greater to 1.86%, however, in Google, average return is derived to 0.63%

respectively. The central tendency measure showcase that in comparison to Google, Yahoo is

delivering high return to the investors on the capital invested in the business. For the risk,

standard deviation presents the scatter and spread in the return over the period from the mean. It

is founded greater for Google’s share as it reported a standard deviation of 10.45 whereas for

Yahoo’s stock, it is computed to 8.22 which are comparatively lower. High value of standard

deviation indicates high volatility in the average monthly return on such stock at a higher risk or

vice-versa.

Correlation is a statistical tool that determines the level, direction and strength of

relationship between two independent variables. In Google and Yahoo’s monthly stock return,

very less correlation is determined to 0.14 that is below 0.25. Although positive relationship

demonstrate that with the increase in either Google or Yahoo’s return, other stock return also

changes in same direction but at very less percentage @ 14%.

Jarque-Bera Test is a multiplier test that is used for the normality of the data set. Many of the

statistical tests assumes normal distribution of the data, here, JB test can be run to confirm

normality of the large data sets available for a given time series.

H0: The data set is normally distributed.

H1: The data set is not normally distributed.

Formula of JB test statistics: n[(√b1)2/6 + (b2-3)2/24]

Here: n- Sample size

√b1 - Skewness coefficient

b2 – Kurtosis coefficient

JB statistics: 55/(√-4.01) 2/6 + (24.98-3)2/24]

Minimum -62.56619623 -15.30135014

Maximum 19.68015532 20.87197218

Sum 34.63872348 102.3872405

Count 55 55

From the summary statistics, it is identified that average monthly return of Yahoo is

comparatively greater to 1.86%, however, in Google, average return is derived to 0.63%

respectively. The central tendency measure showcase that in comparison to Google, Yahoo is

delivering high return to the investors on the capital invested in the business. For the risk,

standard deviation presents the scatter and spread in the return over the period from the mean. It

is founded greater for Google’s share as it reported a standard deviation of 10.45 whereas for

Yahoo’s stock, it is computed to 8.22 which are comparatively lower. High value of standard

deviation indicates high volatility in the average monthly return on such stock at a higher risk or

vice-versa.

Correlation is a statistical tool that determines the level, direction and strength of

relationship between two independent variables. In Google and Yahoo’s monthly stock return,

very less correlation is determined to 0.14 that is below 0.25. Although positive relationship

demonstrate that with the increase in either Google or Yahoo’s return, other stock return also

changes in same direction but at very less percentage @ 14%.

Jarque-Bera Test is a multiplier test that is used for the normality of the data set. Many of the

statistical tests assumes normal distribution of the data, here, JB test can be run to confirm

normality of the large data sets available for a given time series.

H0: The data set is normally distributed.

H1: The data set is not normally distributed.

Formula of JB test statistics: n[(√b1)2/6 + (b2-3)2/24]

Here: n- Sample size

√b1 - Skewness coefficient

b2 – Kurtosis coefficient

JB statistics: 55/(√-4.01) 2/6 + (24.98-3)2/24]

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

55/(√-4.01) 2/6 + (24.98-3)2/24]

Question 3

A) Sampling distribution of mean

σp = [ σ / sqrt(n) ] * sqrt[ (N - n ) / (N - 1) ]

[1.40/Sqrt(36)]*Sqrt[(55-36)/(55-1)]

= 0.0187

σp = [ σ / sqrt(n) ] * sqrt[ (N - n ) / (N - 1) ]

[1.20/Sqrt(36)]*Sqrt[(55-36)/(55-1)]

= 0.016

(b) Probability of return of 4%

Table 1Calculation of probability

Return on stock 4%

Average return on market

index 0.935651

Probability 0.42751

© Likelihood of loss

Table 2Likelihood of loss

Value at risk on Google -9.49949

Value at risk on S&P -3.70815

Probability 0.390353

Value at risk on Yahoo 14.49173

Value at risk on S&P -3.70815

Probability -0.25588

Question 3

A) Sampling distribution of mean

σp = [ σ / sqrt(n) ] * sqrt[ (N - n ) / (N - 1) ]

[1.40/Sqrt(36)]*Sqrt[(55-36)/(55-1)]

= 0.0187

σp = [ σ / sqrt(n) ] * sqrt[ (N - n ) / (N - 1) ]

[1.20/Sqrt(36)]*Sqrt[(55-36)/(55-1)]

= 0.016

(b) Probability of return of 4%

Table 1Calculation of probability

Return on stock 4%

Average return on market

index 0.935651

Probability 0.42751

© Likelihood of loss

Table 2Likelihood of loss

Value at risk on Google -9.49949

Value at risk on S&P -3.70815

Probability 0.390353

Value at risk on Yahoo 14.49173

Value at risk on S&P -3.70815

Probability -0.25588

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

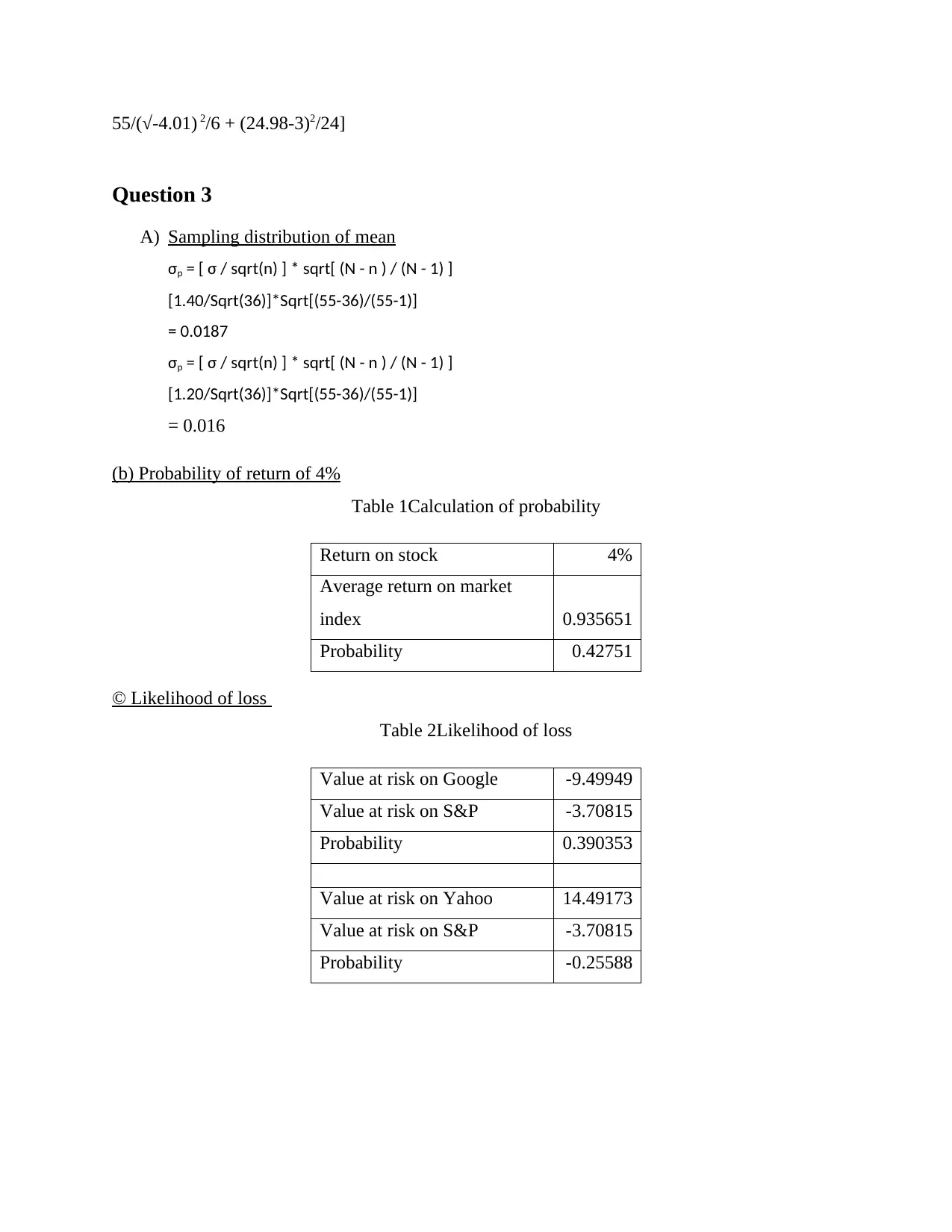

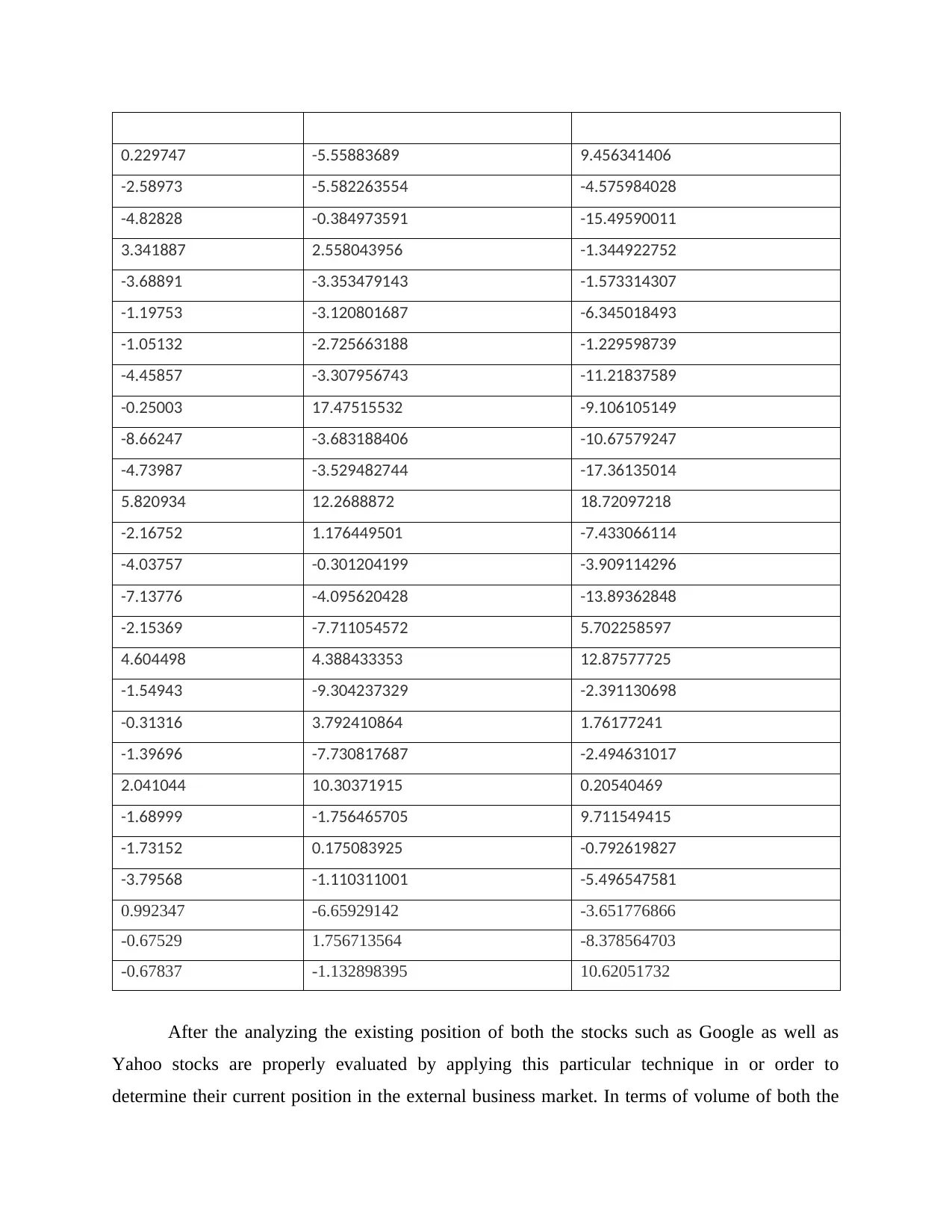

4 Creating excess return on preferred stock and excess market return

excess market return excess return on preferred stock

Google Yahoo

-0.24011 7.235424174 -1.428848751

0.39506 6.350718884 -9.371805092

0.757706 8.013506171 7.052760488

-3.68478 -12.03814009 3.555906848

-1.32173 1.015531412 9.244284178

-1.05166 -0.474118764 4.089988113

2.934776 4.621336768 -3.351072344

-0.78801 3.959923229 6.323743782

1.683537 -2.730787646 8.057975663

0.117416 2.0789311 3.299087879

-0.10898 3.339248986 3.991185765

-3.9893 -1.433214096 -7.028658763

2.234776 -1.758221542 8.542128956

-5.92883 -7.45975479 -6.263217804

0.316554 0.7530722 17.52243899

1.820998 13.71936836 -3.237812821

0.025328 0.03502903 8.827950121

-0.69705 2.582037218 5.918216819

-6.29114 2.569372166 -14.27027165

1.563338 0.236277847 4.468742796

-2.03218 -11.40940667 -10.15568101

-2.02983 -6.846124709 -2.508821133

-0.37578 -65.02319623 -6.140135853

-0.6281 -0.263933049 -1.140225936

-4.07547 -3.435564517 -0.638828227

1.353367 -1.859312713 4.926076382

-4.07155 -1.474482938 3.145789186

-0.04136 -5.888146454 9.892192301

excess market return excess return on preferred stock

Google Yahoo

-0.24011 7.235424174 -1.428848751

0.39506 6.350718884 -9.371805092

0.757706 8.013506171 7.052760488

-3.68478 -12.03814009 3.555906848

-1.32173 1.015531412 9.244284178

-1.05166 -0.474118764 4.089988113

2.934776 4.621336768 -3.351072344

-0.78801 3.959923229 6.323743782

1.683537 -2.730787646 8.057975663

0.117416 2.0789311 3.299087879

-0.10898 3.339248986 3.991185765

-3.9893 -1.433214096 -7.028658763

2.234776 -1.758221542 8.542128956

-5.92883 -7.45975479 -6.263217804

0.316554 0.7530722 17.52243899

1.820998 13.71936836 -3.237812821

0.025328 0.03502903 8.827950121

-0.69705 2.582037218 5.918216819

-6.29114 2.569372166 -14.27027165

1.563338 0.236277847 4.468742796

-2.03218 -11.40940667 -10.15568101

-2.02983 -6.846124709 -2.508821133

-0.37578 -65.02319623 -6.140135853

-0.6281 -0.263933049 -1.140225936

-4.07547 -3.435564517 -0.638828227

1.353367 -1.859312713 4.926076382

-4.07155 -1.474482938 3.145789186

-0.04136 -5.888146454 9.892192301

0.229747 -5.55883689 9.456341406

-2.58973 -5.582263554 -4.575984028

-4.82828 -0.384973591 -15.49590011

3.341887 2.558043956 -1.344922752

-3.68891 -3.353479143 -1.573314307

-1.19753 -3.120801687 -6.345018493

-1.05132 -2.725663188 -1.229598739

-4.45857 -3.307956743 -11.21837589

-0.25003 17.47515532 -9.106105149

-8.66247 -3.683188406 -10.67579247

-4.73987 -3.529482744 -17.36135014

5.820934 12.2688872 18.72097218

-2.16752 1.176449501 -7.433066114

-4.03757 -0.301204199 -3.909114296

-7.13776 -4.095620428 -13.89362848

-2.15369 -7.711054572 5.702258597

4.604498 4.388433353 12.87577725

-1.54943 -9.304237329 -2.391130698

-0.31316 3.792410864 1.76177241

-1.39696 -7.730817687 -2.494631017

2.041044 10.30371915 0.20540469

-1.68999 -1.756465705 9.711549415

-1.73152 0.175083925 -0.792619827

-3.79568 -1.110311001 -5.496547581

0.992347 -6.65929142 -3.651776866

-0.67529 1.756713564 -8.378564703

-0.67837 -1.132898395 10.62051732

After the analyzing the existing position of both the stocks such as Google as well as

Yahoo stocks are properly evaluated by applying this particular technique in or order to

determine their current position in the external business market. In terms of volume of both the

-2.58973 -5.582263554 -4.575984028

-4.82828 -0.384973591 -15.49590011

3.341887 2.558043956 -1.344922752

-3.68891 -3.353479143 -1.573314307

-1.19753 -3.120801687 -6.345018493

-1.05132 -2.725663188 -1.229598739

-4.45857 -3.307956743 -11.21837589

-0.25003 17.47515532 -9.106105149

-8.66247 -3.683188406 -10.67579247

-4.73987 -3.529482744 -17.36135014

5.820934 12.2688872 18.72097218

-2.16752 1.176449501 -7.433066114

-4.03757 -0.301204199 -3.909114296

-7.13776 -4.095620428 -13.89362848

-2.15369 -7.711054572 5.702258597

4.604498 4.388433353 12.87577725

-1.54943 -9.304237329 -2.391130698

-0.31316 3.792410864 1.76177241

-1.39696 -7.730817687 -2.494631017

2.041044 10.30371915 0.20540469

-1.68999 -1.756465705 9.711549415

-1.73152 0.175083925 -0.792619827

-3.79568 -1.110311001 -5.496547581

0.992347 -6.65929142 -3.651776866

-0.67529 1.756713564 -8.378564703

-0.67837 -1.132898395 10.62051732

After the analyzing the existing position of both the stocks such as Google as well as

Yahoo stocks are properly evaluated by applying this particular technique in or order to

determine their current position in the external business market. In terms of volume of both the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

stocks of Google and Yahoo, Google has higher volume size as compared to yahoo which is the

main reason behind the increasing higher market risks as higher the share market higher will be

its overall business risks. Excess return on preferred stock and excess market return of Google is

higher in volume that increases overall risk of an entity which will directly affected all the

shareholders who have invested in the business. The return of Google is decreasing on a constant

basis as compared to the price of Yahoo which is increasing with the passage of time. Volume

size of Yahoo is less that safeguards its entity from the external market changes in terms of risks

incurred on the firm. The share value of Yahoo increases due to higher efforts applied by the

entity owner on improving its existing business performance along with the considerations of

each and every factors considered by the business in order to maintain their survival in the

external environment as costs and risks are eliminated by the firm by focuses on its strength and

the capabilities.

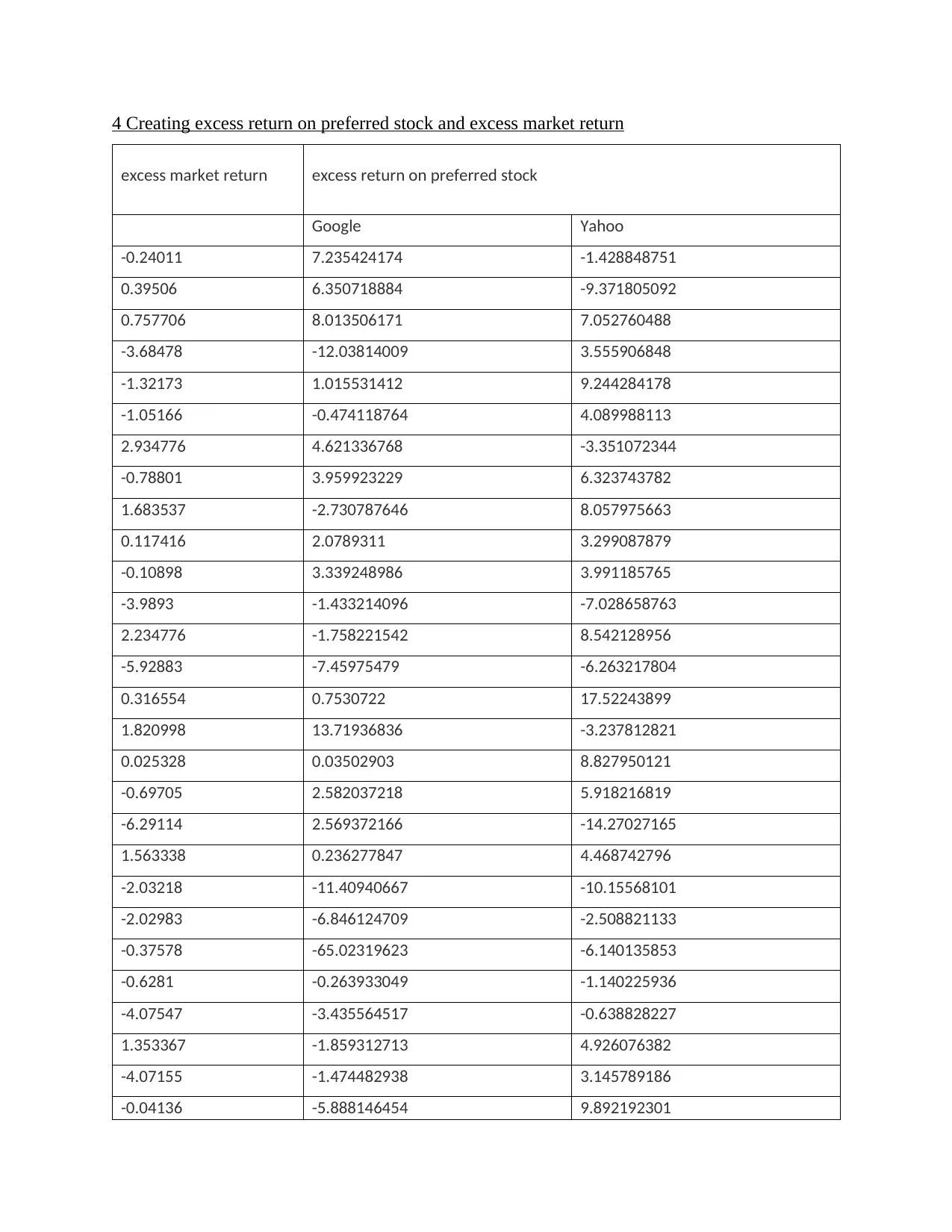

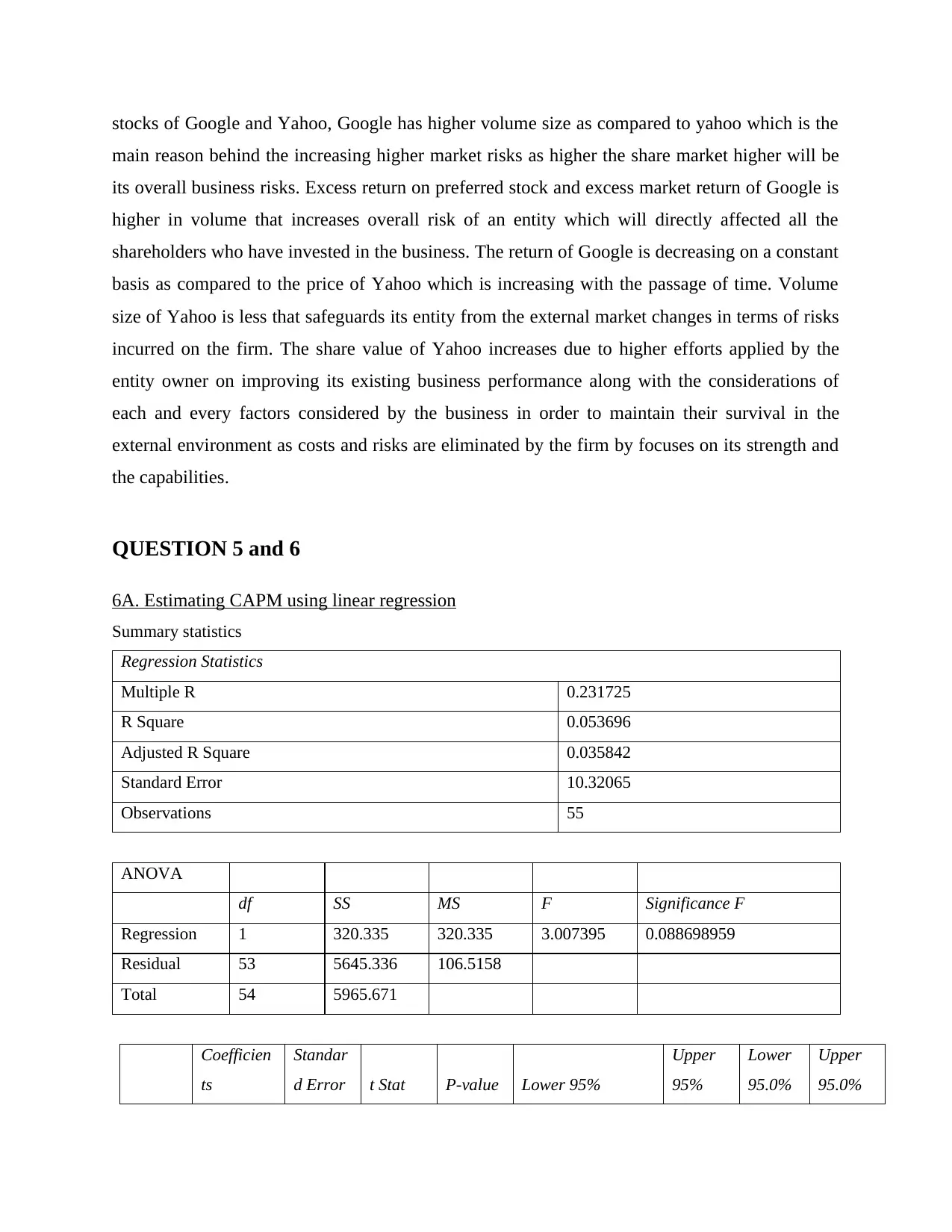

QUESTION 5 and 6

6A. Estimating CAPM using linear regression

Summary statistics

Regression Statistics

Multiple R 0.231725

R Square 0.053696

Adjusted R Square 0.035842

Standard Error 10.32065

Observations 55

ANOVA

df SS MS F Significance F

Regression 1 320.335 320.335 3.007395 0.088698959

Residual 53 5645.336 106.5158

Total 54 5965.671

Coefficien

ts

Standar

d Error t Stat P-value Lower 95%

Upper

95%

Lower

95.0%

Upper

95.0%

main reason behind the increasing higher market risks as higher the share market higher will be

its overall business risks. Excess return on preferred stock and excess market return of Google is

higher in volume that increases overall risk of an entity which will directly affected all the

shareholders who have invested in the business. The return of Google is decreasing on a constant

basis as compared to the price of Yahoo which is increasing with the passage of time. Volume

size of Yahoo is less that safeguards its entity from the external market changes in terms of risks

incurred on the firm. The share value of Yahoo increases due to higher efforts applied by the

entity owner on improving its existing business performance along with the considerations of

each and every factors considered by the business in order to maintain their survival in the

external environment as costs and risks are eliminated by the firm by focuses on its strength and

the capabilities.

QUESTION 5 and 6

6A. Estimating CAPM using linear regression

Summary statistics

Regression Statistics

Multiple R 0.231725

R Square 0.053696

Adjusted R Square 0.035842

Standard Error 10.32065

Observations 55

ANOVA

df SS MS F Significance F

Regression 1 320.335 320.335 3.007395 0.088698959

Residual 53 5645.336 106.5158

Total 54 5965.671

Coefficien

ts

Standar

d Error t Stat P-value Lower 95%

Upper

95%

Lower

95.0%

Upper

95.0%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Interce

pt -0.47396

1.51316

5

-

0.31323

0.75533

9 -3.508985979

2.56106

4

-

3.5089

9

2.56106

4

Google 0.859734

0.49575

7

1.73418

4

0.08869

9 -0.134628726

1.85409

7

-

0.1346

3

1.85409

7

Linear regression equation (Google) Y = a+ bx

= -0.47396 + 0.859734 (S&P 500’s excess market return)

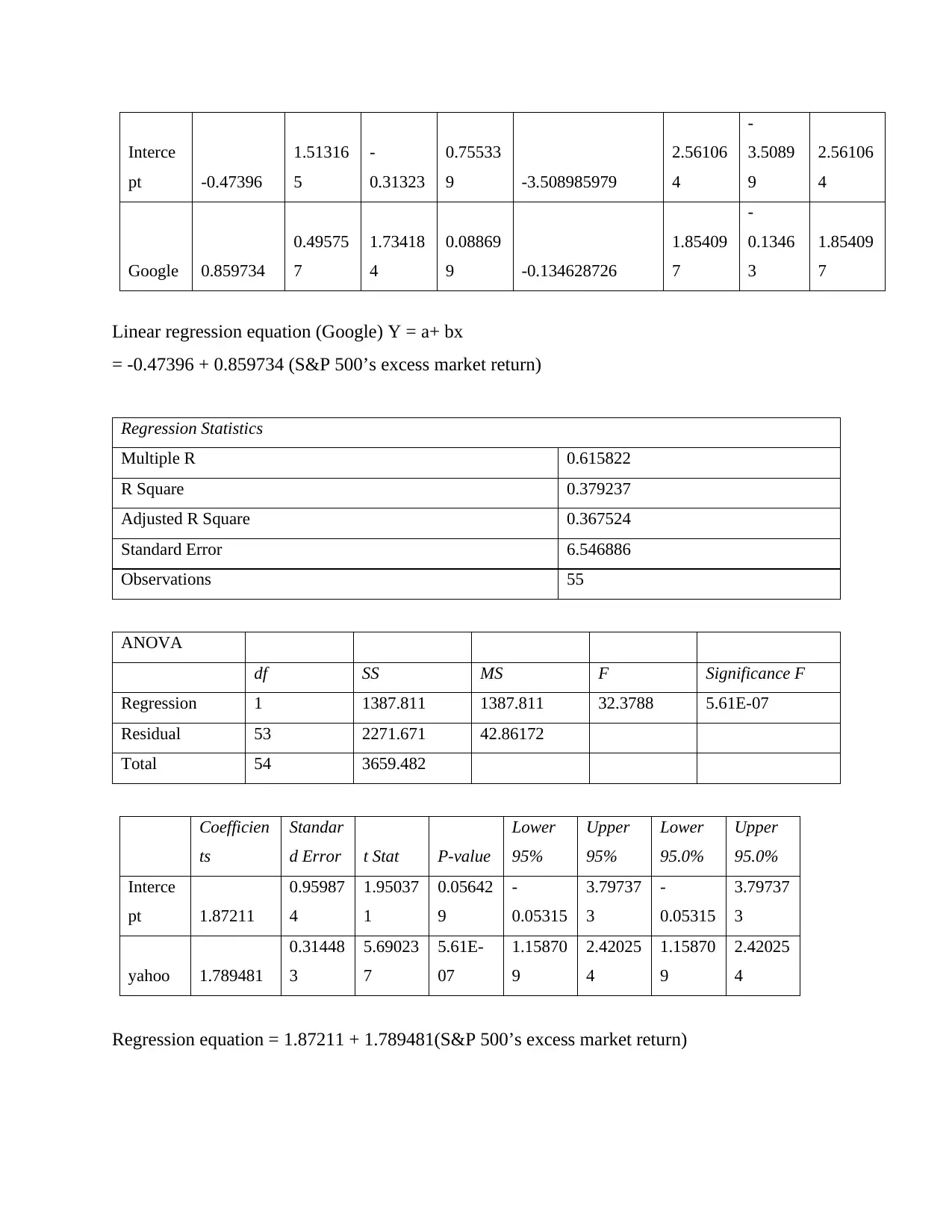

Regression Statistics

Multiple R 0.615822

R Square 0.379237

Adjusted R Square 0.367524

Standard Error 6.546886

Observations 55

ANOVA

df SS MS F Significance F

Regression 1 1387.811 1387.811 32.3788 5.61E-07

Residual 53 2271.671 42.86172

Total 54 3659.482

Coefficien

ts

Standar

d Error t Stat P-value

Lower

95%

Upper

95%

Lower

95.0%

Upper

95.0%

Interce

pt 1.87211

0.95987

4

1.95037

1

0.05642

9

-

0.05315

3.79737

3

-

0.05315

3.79737

3

yahoo 1.789481

0.31448

3

5.69023

7

5.61E-

07

1.15870

9

2.42025

4

1.15870

9

2.42025

4

Regression equation = 1.87211 + 1.789481(S&P 500’s excess market return)

pt -0.47396

1.51316

5

-

0.31323

0.75533

9 -3.508985979

2.56106

4

-

3.5089

9

2.56106

4

Google 0.859734

0.49575

7

1.73418

4

0.08869

9 -0.134628726

1.85409

7

-

0.1346

3

1.85409

7

Linear regression equation (Google) Y = a+ bx

= -0.47396 + 0.859734 (S&P 500’s excess market return)

Regression Statistics

Multiple R 0.615822

R Square 0.379237

Adjusted R Square 0.367524

Standard Error 6.546886

Observations 55

ANOVA

df SS MS F Significance F

Regression 1 1387.811 1387.811 32.3788 5.61E-07

Residual 53 2271.671 42.86172

Total 54 3659.482

Coefficien

ts

Standar

d Error t Stat P-value

Lower

95%

Upper

95%

Lower

95.0%

Upper

95.0%

Interce

pt 1.87211

0.95987

4

1.95037

1

0.05642

9

-

0.05315

3.79737

3

-

0.05315

3.79737

3

yahoo 1.789481

0.31448

3

5.69023

7

5.61E-

07

1.15870

9

2.42025

4

1.15870

9

2.42025

4

Regression equation = 1.87211 + 1.789481(S&P 500’s excess market return)

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.