Strategic Management Application

VerifiedAdded on 2020/01/07

|16

|4407

|208

Essay

AI Summary

This assignment delves into the realm of strategic management within the context of animal production science. It requires students to demonstrate their understanding of key concepts, such as Porter's Five Forces model, and apply them to real-world scenarios in the animal industry. The assignment emphasizes the importance of strategic decision-making for success in this field.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Strategic Management

1

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

1. WHAT IS STRATEGY?.............................................................................................................3

2. INDUSTRY ANALYSIS ...........................................................................................................4

3. INTERNATIONALIZATION.....................................................................................................5

4. DRIVERS OF INTERNATIONALIZATION.............................................................................8

5. BARRIERS IN INTERNATIONALIZATION...........................................................................9

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

2

INTRODUCTION...........................................................................................................................3

1. WHAT IS STRATEGY?.............................................................................................................3

2. INDUSTRY ANALYSIS ...........................................................................................................4

3. INTERNATIONALIZATION.....................................................................................................5

4. DRIVERS OF INTERNATIONALIZATION.............................................................................8

5. BARRIERS IN INTERNATIONALIZATION...........................................................................9

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

2

INTRODUCTION

Strategic management is considered as an effective process under which the management

of organization generally focuses on measuring and assessing the strategies (Luo, Sun and Wang,

2011). So, that manager can select effective plan that supports rendering of better performance

that results in gaining competitive edge for the enterprise. It may also be defined as a procedure

under which manager undertakes different decisions that directly and indirectly affects the

organizational performance. Presently, the report focuses on assessing the different strategies

that a company plan to sustain in the competitive marketplace. For this purpose, the report has to

measure the overall airline industry by assessing porters five forces model and PESTLE analysis.

To study all these aspects, two companies have been selected that is Emirates and British

Airways. Both the firms are considered as renowned airlines in the aviation industry. Emirates is

a subsidiary organization of Emirates group that is generally owned by Dubai government.

However, Emirates is considered as the largest air courier within Middle East with operating

around 3,300 flights per week. On the other hand, another company that is selected in the report

is British Airways that is one of the flag traveller airlines operating services in United Kingdom.

Based on their fleet size, it is considered as the largest airline in UK. Furthermore, report will

also measure the key drivers that assist British Airways and Emirates in the international market.

1. WHAT IS STRATEGY?

In order to survive or sustain in the long run it is effective for the management to

assess and devise an effective plan of action that mainly assist in achieving long-term goals

to succeed in the competitive marketplace (Lucas, 2010). However, it may also define as a

path that directs the organization to attain long term objectives with meeting the needs and

requirement of the stakeholders and customers. British Airways and Emirates both are

considered as the leading organizations within the airline industry. Emirates is the leading

airline that is based and operated in United Arab Emirates that mainly serves the Middle

East region customers. However, the British Airways is the flag carrier airline based in UK

that generally operates in the domestic and international market.

Emirates generally uses Dubai hub for long haul flights that result in proving them

advantageous to sustain in the airline industry (Kuratko and Audretsch, 2009). This airline

3

Strategic management is considered as an effective process under which the management

of organization generally focuses on measuring and assessing the strategies (Luo, Sun and Wang,

2011). So, that manager can select effective plan that supports rendering of better performance

that results in gaining competitive edge for the enterprise. It may also be defined as a procedure

under which manager undertakes different decisions that directly and indirectly affects the

organizational performance. Presently, the report focuses on assessing the different strategies

that a company plan to sustain in the competitive marketplace. For this purpose, the report has to

measure the overall airline industry by assessing porters five forces model and PESTLE analysis.

To study all these aspects, two companies have been selected that is Emirates and British

Airways. Both the firms are considered as renowned airlines in the aviation industry. Emirates is

a subsidiary organization of Emirates group that is generally owned by Dubai government.

However, Emirates is considered as the largest air courier within Middle East with operating

around 3,300 flights per week. On the other hand, another company that is selected in the report

is British Airways that is one of the flag traveller airlines operating services in United Kingdom.

Based on their fleet size, it is considered as the largest airline in UK. Furthermore, report will

also measure the key drivers that assist British Airways and Emirates in the international market.

1. WHAT IS STRATEGY?

In order to survive or sustain in the long run it is effective for the management to

assess and devise an effective plan of action that mainly assist in achieving long-term goals

to succeed in the competitive marketplace (Lucas, 2010). However, it may also define as a

path that directs the organization to attain long term objectives with meeting the needs and

requirement of the stakeholders and customers. British Airways and Emirates both are

considered as the leading organizations within the airline industry. Emirates is the leading

airline that is based and operated in United Arab Emirates that mainly serves the Middle

East region customers. However, the British Airways is the flag carrier airline based in UK

that generally operates in the domestic and international market.

Emirates generally uses Dubai hub for long haul flights that result in proving them

advantageous to sustain in the airline industry (Kuratko and Audretsch, 2009). This airline

3

generally owns two different corporations that are Emirates and Dnata. It generally focuses on

adopting the growth strategy by expanding the number of serving destinations and aircraft

module by increasing the passenger’s capacity. Furthermore, Emirates airline has also focused on

different marketing strategies related with segmentation, targeting and positioning that is

Emirates has segmented their market customers in two different categories they are business and

economy travellers. However, Emirates generally target the businessmen and executive whose

age group is between around 30-60 that generally prefer to have luxurious and comfortable flight

service (Gregorini, 2012).

British Airways is one of the leading airlines in UK region whose main aim is to become

the foremost airline in the global market by targeting different segment customers and

passengers. Therefore, this airline must focus on modifying their aircraft that would attract large

customers towards using their services. However, another strategy that can be used by British

Airways is to attract and influence the business travellers across the globe includes managing the

overall cost of them that supports organization in reducing the pricing of their tickets. However,

cost is considered as a main element of British Airways because many people and travellers

cannot expend on costly services for travelling from one place to another.

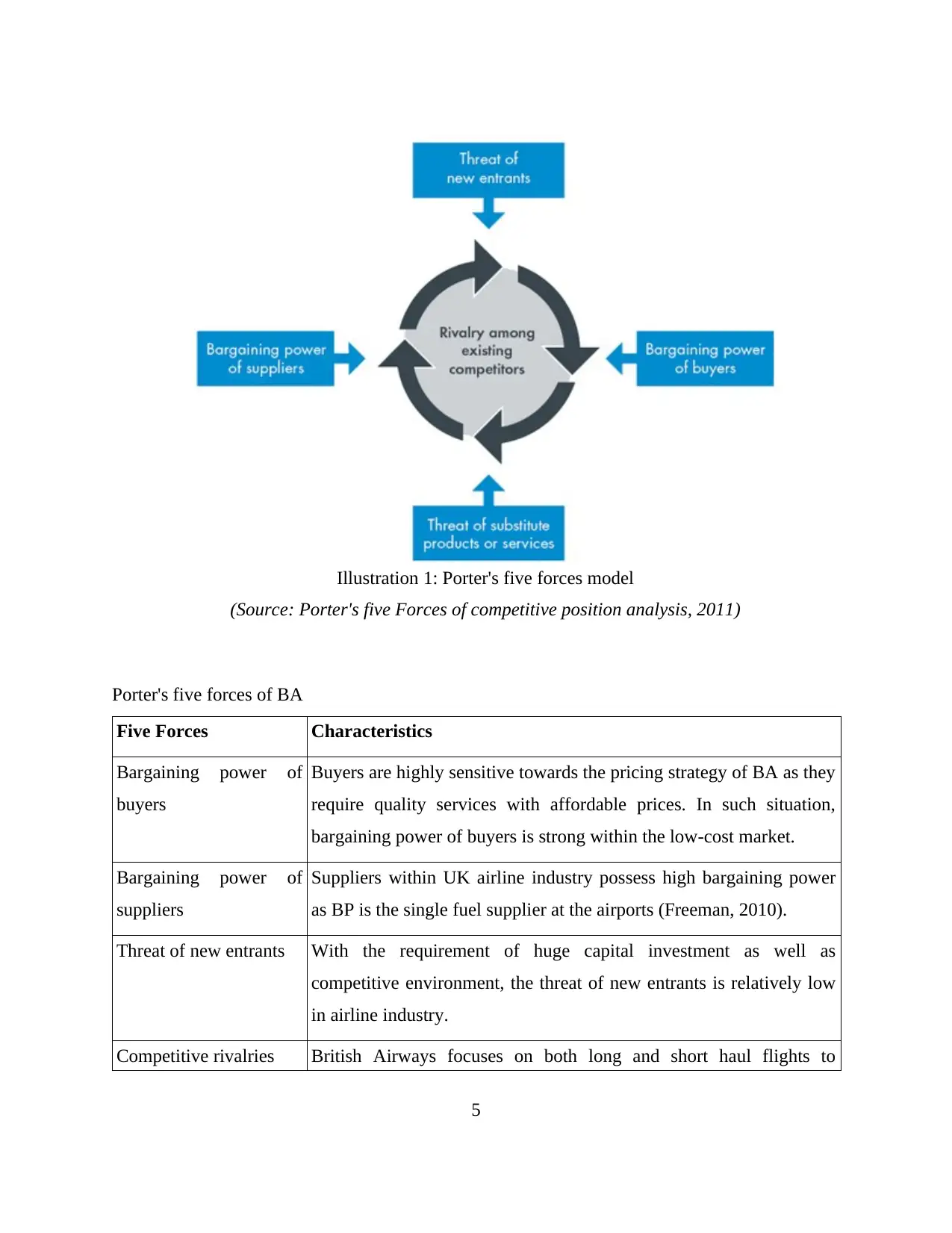

2. INDUSTRY ANALYSIS

Industry analysis is consider as an assessment instrument that is being designed to

support the organization in understanding the different forces existing within the airline

industry (Greco, Cricelli and Grimaldi, 2013). However, understanding the relevant

services is considered as an important aspect within strategic planning. Measuring the five

forces in the external environment will assist BA in taking effective decisions that directly

result in increasing the profit ratio of the company.

4

adopting the growth strategy by expanding the number of serving destinations and aircraft

module by increasing the passenger’s capacity. Furthermore, Emirates airline has also focused on

different marketing strategies related with segmentation, targeting and positioning that is

Emirates has segmented their market customers in two different categories they are business and

economy travellers. However, Emirates generally target the businessmen and executive whose

age group is between around 30-60 that generally prefer to have luxurious and comfortable flight

service (Gregorini, 2012).

British Airways is one of the leading airlines in UK region whose main aim is to become

the foremost airline in the global market by targeting different segment customers and

passengers. Therefore, this airline must focus on modifying their aircraft that would attract large

customers towards using their services. However, another strategy that can be used by British

Airways is to attract and influence the business travellers across the globe includes managing the

overall cost of them that supports organization in reducing the pricing of their tickets. However,

cost is considered as a main element of British Airways because many people and travellers

cannot expend on costly services for travelling from one place to another.

2. INDUSTRY ANALYSIS

Industry analysis is consider as an assessment instrument that is being designed to

support the organization in understanding the different forces existing within the airline

industry (Greco, Cricelli and Grimaldi, 2013). However, understanding the relevant

services is considered as an important aspect within strategic planning. Measuring the five

forces in the external environment will assist BA in taking effective decisions that directly

result in increasing the profit ratio of the company.

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

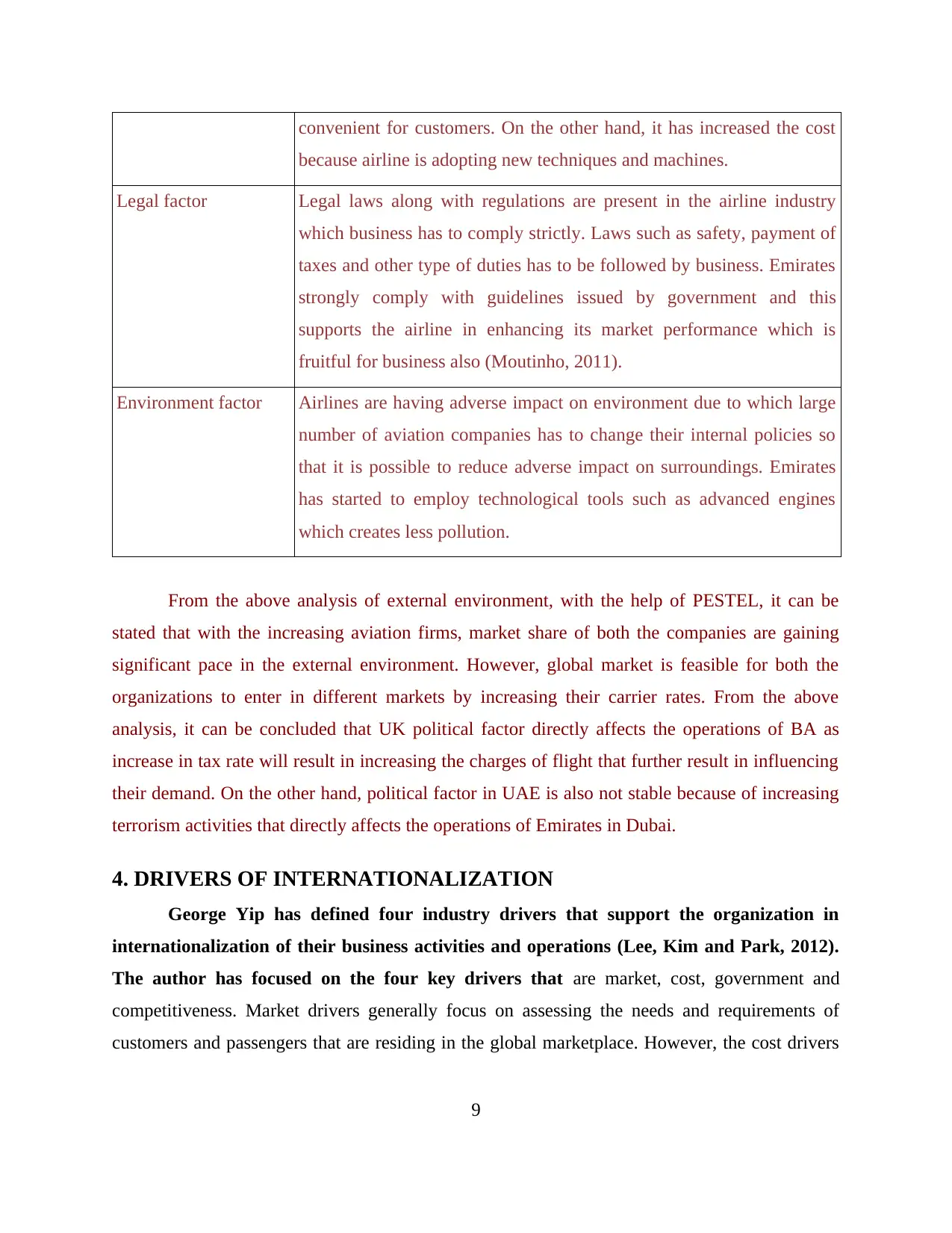

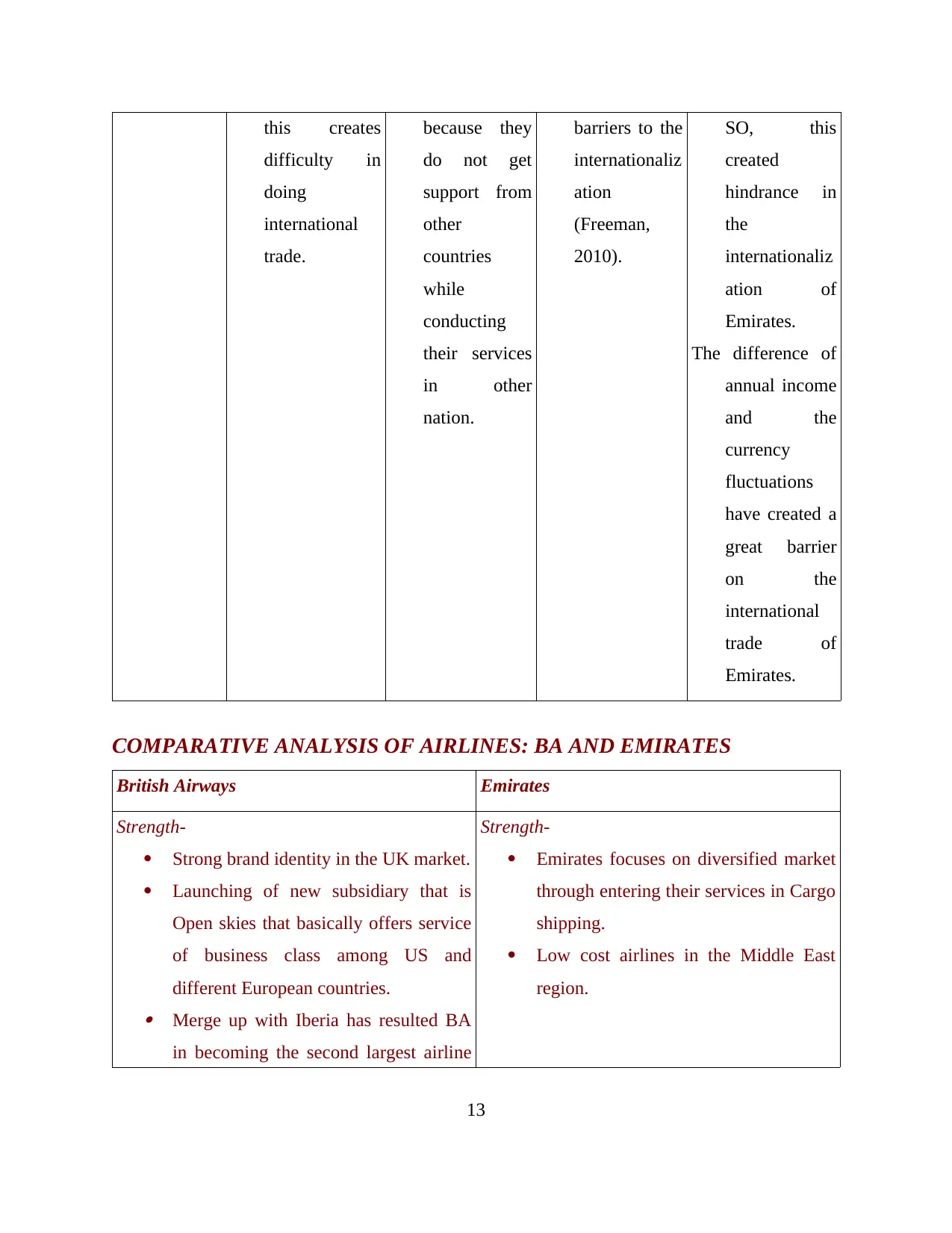

Porter's five forces of BA

Five Forces Characteristics

Bargaining power of

buyers

Buyers are highly sensitive towards the pricing strategy of BA as they

require quality services with affordable prices. In such situation,

bargaining power of buyers is strong within the low-cost market.

Bargaining power of

suppliers

Suppliers within UK airline industry possess high bargaining power

as BP is the single fuel supplier at the airports (Freeman, 2010).

Threat of new entrants With the requirement of huge capital investment as well as

competitive environment, the threat of new entrants is relatively low

in airline industry.

Competitive rivalries British Airways focuses on both long and short haul flights to

5

Illustration 1: Porter's five forces model

(Source: Porter's five Forces of competitive position analysis, 2011)

Five Forces Characteristics

Bargaining power of

buyers

Buyers are highly sensitive towards the pricing strategy of BA as they

require quality services with affordable prices. In such situation,

bargaining power of buyers is strong within the low-cost market.

Bargaining power of

suppliers

Suppliers within UK airline industry possess high bargaining power

as BP is the single fuel supplier at the airports (Freeman, 2010).

Threat of new entrants With the requirement of huge capital investment as well as

competitive environment, the threat of new entrants is relatively low

in airline industry.

Competitive rivalries British Airways focuses on both long and short haul flights to

5

Illustration 1: Porter's five forces model

(Source: Porter's five Forces of competitive position analysis, 2011)

different destination. Therefore, there is a little distinction in the price

and services that are offered to the long haul flight customers. Thus, it

can be said that competitive rivalry within UK airline industry is high.

Threat of substitutes However, threat of substitution within the airline industry is low as

replacement for the short haul flight is available in the market. While

the alternative of long haul flight and destination is not available.

Thus, threat of substitution is low (Janczak, 2005).

Porter's five forces of Emirates

Five Forces Characteristics

Bargaining power of

buyers

The bargaining power of buyers and customers of airline in the middle

east region is relatively low as the demand of customers keep on

increasing.

Bargaining power of

suppliers

Bargaining power of suppliers within the industry is high as there are

two key suppliers in the industry that is Boeing and Airbus. Thus, they

are in the condition to change trends within the market and also control

the prices of their services (Brush, Edelman and Manolova, 2015).

Threat of new entrants The threat of new entrants within the airline industry of UAE is

relatively low due to different barriers. The foremost barrier that results

in a threat of new entrant is finance, as resources in middle east region

are purchasable.

Competitive rivalries However, the rivalry against the existing firms in UAE is high because

large airline are existing in the market that offer different services

according to the needs and requirements of the travellers.

Threat of substitutes However, the threat of substitution is high in the middle east country as

the alternative of airline is available within the market. For instance; in

middle east area, passengers often use their vehicles to travel from one

6

and services that are offered to the long haul flight customers. Thus, it

can be said that competitive rivalry within UK airline industry is high.

Threat of substitutes However, threat of substitution within the airline industry is low as

replacement for the short haul flight is available in the market. While

the alternative of long haul flight and destination is not available.

Thus, threat of substitution is low (Janczak, 2005).

Porter's five forces of Emirates

Five Forces Characteristics

Bargaining power of

buyers

The bargaining power of buyers and customers of airline in the middle

east region is relatively low as the demand of customers keep on

increasing.

Bargaining power of

suppliers

Bargaining power of suppliers within the industry is high as there are

two key suppliers in the industry that is Boeing and Airbus. Thus, they

are in the condition to change trends within the market and also control

the prices of their services (Brush, Edelman and Manolova, 2015).

Threat of new entrants The threat of new entrants within the airline industry of UAE is

relatively low due to different barriers. The foremost barrier that results

in a threat of new entrant is finance, as resources in middle east region

are purchasable.

Competitive rivalries However, the rivalry against the existing firms in UAE is high because

large airline are existing in the market that offer different services

according to the needs and requirements of the travellers.

Threat of substitutes However, the threat of substitution is high in the middle east country as

the alternative of airline is available within the market. For instance; in

middle east area, passengers often use their vehicles to travel from one

6

place to another within the country (De Wit, 2015).

3. INTERNATIONALIZATION

PESTLE analysis of British Airways:

Factors Characteristic

Political factor The political environment is generally concerned with interference of

function of UK government within the operation of BA that directly

affects their working. For instance; with the increase in flight tax rates,

business travelers will also result in paying higher tax that might affect the

customer’s budget.

Economical factor Another factor that affects the operation of BA is economic activity of UK.

For instance; with the inflation rate in UK, customers will not purchase

higher price tickets of flight to travel from one place to another (Forsgren,

2015).

Social factor Another factor is social factor that affect the operations of BA in UK

market that are customers and passengers who are preferring to continue

the long haul flights as compare to the short one. However, now a days for

having quality experience customers are preferring to opt the budgeted

flights according to their changing needs and requirements.

Technological

factor

Technological factor also plays a significant role in the operations of BA.

With the self-service check-in machines available at the airport lounge that

assists passenger to overcome the queuing system. However, with the

increase in airline website, they support BA customers in grabbing the

opportunities to avail the additional discount on their flight fare.

Legal factor However, legal factor also affect BA’s business environment within UK.

There are different legal regulations and norms that are proposed by the

UK government so that they can easily carry out their services and

operation within their region. With the help of safety and regulation act,

7

3. INTERNATIONALIZATION

PESTLE analysis of British Airways:

Factors Characteristic

Political factor The political environment is generally concerned with interference of

function of UK government within the operation of BA that directly

affects their working. For instance; with the increase in flight tax rates,

business travelers will also result in paying higher tax that might affect the

customer’s budget.

Economical factor Another factor that affects the operation of BA is economic activity of UK.

For instance; with the inflation rate in UK, customers will not purchase

higher price tickets of flight to travel from one place to another (Forsgren,

2015).

Social factor Another factor is social factor that affect the operations of BA in UK

market that are customers and passengers who are preferring to continue

the long haul flights as compare to the short one. However, now a days for

having quality experience customers are preferring to opt the budgeted

flights according to their changing needs and requirements.

Technological

factor

Technological factor also plays a significant role in the operations of BA.

With the self-service check-in machines available at the airport lounge that

assists passenger to overcome the queuing system. However, with the

increase in airline website, they support BA customers in grabbing the

opportunities to avail the additional discount on their flight fare.

Legal factor However, legal factor also affect BA’s business environment within UK.

There are different legal regulations and norms that are proposed by the

UK government so that they can easily carry out their services and

operation within their region. With the help of safety and regulation act,

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EU has limited the air carriers to avoid any future conflict (Knight, 2015).

Environment factor The environmental factor also affects the operations of BA, with the

intervention of environmental regulation by UK and EU. British Airways

has incorporated the strategies so that they can easily overcome the carbon

emission and waste that affects the environment.

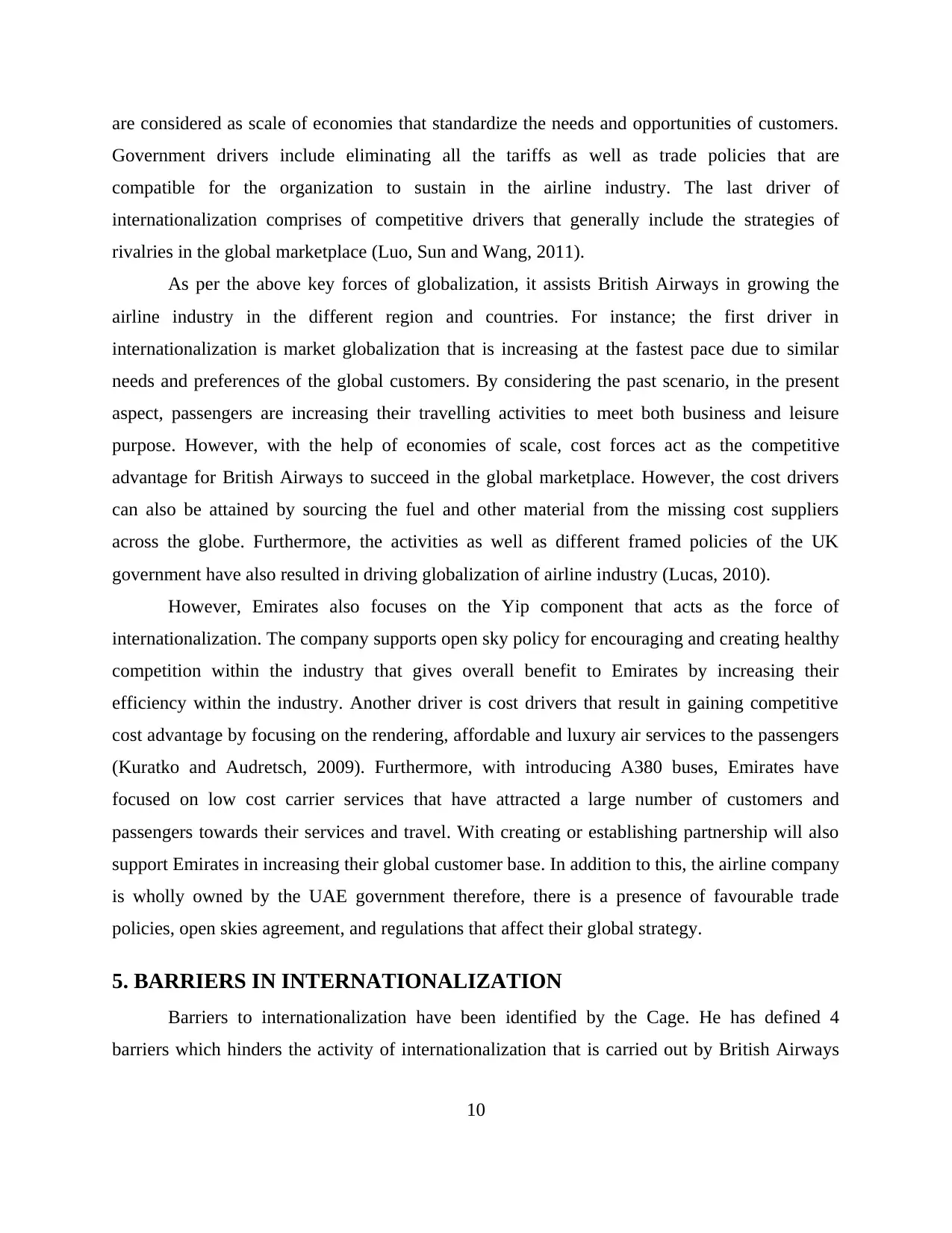

PESTLE analysis of Emirates

Factors Characteristics

Political factor The political factor within the middle east region is unstable that

directly affect the operation of Emirates as well as international

alliances. However, the airline industry within UAE is generally

affected by political situation as it results in increasing the rate of wars

and terrorism activities (Spencer, Buhalis and Moital, 2012).

Economical factor Another factor that affects the activities of Emirates is the economic

condition of the country. Further, modern airports have to employ

advanced technology, so that overall operations can be carried out

easily and in turn customer’s requirement can be met. Apart from this,

market of UAE is developed due to which strong economic condition

allows firm to operate efficiently which has positively impacted on the

brand image of the business.

Social factor Social factors also affect the activities and operations of business to a

great extent. The rapid growth in population resulted in increasing

demand of airline services. Along with this, the rising income level and

standard of living of people within the country also developed the

necessity of services such as airlines (Shapiro and Varian, 2013).

Technological factor Technology has also affected the sales, profitability and operations of

Emirates in both negative as well as positive aspects. Advancement

such as online booking has resulted in making services more

8

Environment factor The environmental factor also affects the operations of BA, with the

intervention of environmental regulation by UK and EU. British Airways

has incorporated the strategies so that they can easily overcome the carbon

emission and waste that affects the environment.

PESTLE analysis of Emirates

Factors Characteristics

Political factor The political factor within the middle east region is unstable that

directly affect the operation of Emirates as well as international

alliances. However, the airline industry within UAE is generally

affected by political situation as it results in increasing the rate of wars

and terrorism activities (Spencer, Buhalis and Moital, 2012).

Economical factor Another factor that affects the activities of Emirates is the economic

condition of the country. Further, modern airports have to employ

advanced technology, so that overall operations can be carried out

easily and in turn customer’s requirement can be met. Apart from this,

market of UAE is developed due to which strong economic condition

allows firm to operate efficiently which has positively impacted on the

brand image of the business.

Social factor Social factors also affect the activities and operations of business to a

great extent. The rapid growth in population resulted in increasing

demand of airline services. Along with this, the rising income level and

standard of living of people within the country also developed the

necessity of services such as airlines (Shapiro and Varian, 2013).

Technological factor Technology has also affected the sales, profitability and operations of

Emirates in both negative as well as positive aspects. Advancement

such as online booking has resulted in making services more

8

convenient for customers. On the other hand, it has increased the cost

because airline is adopting new techniques and machines.

Legal factor Legal laws along with regulations are present in the airline industry

which business has to comply strictly. Laws such as safety, payment of

taxes and other type of duties has to be followed by business. Emirates

strongly comply with guidelines issued by government and this

supports the airline in enhancing its market performance which is

fruitful for business also (Moutinho, 2011).

Environment factor Airlines are having adverse impact on environment due to which large

number of aviation companies has to change their internal policies so

that it is possible to reduce adverse impact on surroundings. Emirates

has started to employ technological tools such as advanced engines

which creates less pollution.

From the above analysis of external environment, with the help of PESTEL, it can be

stated that with the increasing aviation firms, market share of both the companies are gaining

significant pace in the external environment. However, global market is feasible for both the

organizations to enter in different markets by increasing their carrier rates. From the above

analysis, it can be concluded that UK political factor directly affects the operations of BA as

increase in tax rate will result in increasing the charges of flight that further result in influencing

their demand. On the other hand, political factor in UAE is also not stable because of increasing

terrorism activities that directly affects the operations of Emirates in Dubai.

4. DRIVERS OF INTERNATIONALIZATION

George Yip has defined four industry drivers that support the organization in

internationalization of their business activities and operations (Lee, Kim and Park, 2012).

The author has focused on the four key drivers that are market, cost, government and

competitiveness. Market drivers generally focus on assessing the needs and requirements of

customers and passengers that are residing in the global marketplace. However, the cost drivers

9

because airline is adopting new techniques and machines.

Legal factor Legal laws along with regulations are present in the airline industry

which business has to comply strictly. Laws such as safety, payment of

taxes and other type of duties has to be followed by business. Emirates

strongly comply with guidelines issued by government and this

supports the airline in enhancing its market performance which is

fruitful for business also (Moutinho, 2011).

Environment factor Airlines are having adverse impact on environment due to which large

number of aviation companies has to change their internal policies so

that it is possible to reduce adverse impact on surroundings. Emirates

has started to employ technological tools such as advanced engines

which creates less pollution.

From the above analysis of external environment, with the help of PESTEL, it can be

stated that with the increasing aviation firms, market share of both the companies are gaining

significant pace in the external environment. However, global market is feasible for both the

organizations to enter in different markets by increasing their carrier rates. From the above

analysis, it can be concluded that UK political factor directly affects the operations of BA as

increase in tax rate will result in increasing the charges of flight that further result in influencing

their demand. On the other hand, political factor in UAE is also not stable because of increasing

terrorism activities that directly affects the operations of Emirates in Dubai.

4. DRIVERS OF INTERNATIONALIZATION

George Yip has defined four industry drivers that support the organization in

internationalization of their business activities and operations (Lee, Kim and Park, 2012).

The author has focused on the four key drivers that are market, cost, government and

competitiveness. Market drivers generally focus on assessing the needs and requirements of

customers and passengers that are residing in the global marketplace. However, the cost drivers

9

are considered as scale of economies that standardize the needs and opportunities of customers.

Government drivers include eliminating all the tariffs as well as trade policies that are

compatible for the organization to sustain in the airline industry. The last driver of

internationalization comprises of competitive drivers that generally include the strategies of

rivalries in the global marketplace (Luo, Sun and Wang, 2011).

As per the above key forces of globalization, it assists British Airways in growing the

airline industry in the different region and countries. For instance; the first driver in

internationalization is market globalization that is increasing at the fastest pace due to similar

needs and preferences of the global customers. By considering the past scenario, in the present

aspect, passengers are increasing their travelling activities to meet both business and leisure

purpose. However, with the help of economies of scale, cost forces act as the competitive

advantage for British Airways to succeed in the global marketplace. However, the cost drivers

can also be attained by sourcing the fuel and other material from the missing cost suppliers

across the globe. Furthermore, the activities as well as different framed policies of the UK

government have also resulted in driving globalization of airline industry (Lucas, 2010).

However, Emirates also focuses on the Yip component that acts as the force of

internationalization. The company supports open sky policy for encouraging and creating healthy

competition within the industry that gives overall benefit to Emirates by increasing their

efficiency within the industry. Another driver is cost drivers that result in gaining competitive

cost advantage by focusing on the rendering, affordable and luxury air services to the passengers

(Kuratko and Audretsch, 2009). Furthermore, with introducing A380 buses, Emirates have

focused on low cost carrier services that have attracted a large number of customers and

passengers towards their services and travel. With creating or establishing partnership will also

support Emirates in increasing their global customer base. In addition to this, the airline company

is wholly owned by the UAE government therefore, there is a presence of favourable trade

policies, open skies agreement, and regulations that affect their global strategy.

5. BARRIERS IN INTERNATIONALIZATION

Barriers to internationalization have been identified by the Cage. He has defined 4

barriers which hinders the activity of internationalization that is carried out by British Airways

10

Government drivers include eliminating all the tariffs as well as trade policies that are

compatible for the organization to sustain in the airline industry. The last driver of

internationalization comprises of competitive drivers that generally include the strategies of

rivalries in the global marketplace (Luo, Sun and Wang, 2011).

As per the above key forces of globalization, it assists British Airways in growing the

airline industry in the different region and countries. For instance; the first driver in

internationalization is market globalization that is increasing at the fastest pace due to similar

needs and preferences of the global customers. By considering the past scenario, in the present

aspect, passengers are increasing their travelling activities to meet both business and leisure

purpose. However, with the help of economies of scale, cost forces act as the competitive

advantage for British Airways to succeed in the global marketplace. However, the cost drivers

can also be attained by sourcing the fuel and other material from the missing cost suppliers

across the globe. Furthermore, the activities as well as different framed policies of the UK

government have also resulted in driving globalization of airline industry (Lucas, 2010).

However, Emirates also focuses on the Yip component that acts as the force of

internationalization. The company supports open sky policy for encouraging and creating healthy

competition within the industry that gives overall benefit to Emirates by increasing their

efficiency within the industry. Another driver is cost drivers that result in gaining competitive

cost advantage by focusing on the rendering, affordable and luxury air services to the passengers

(Kuratko and Audretsch, 2009). Furthermore, with introducing A380 buses, Emirates have

focused on low cost carrier services that have attracted a large number of customers and

passengers towards their services and travel. With creating or establishing partnership will also

support Emirates in increasing their global customer base. In addition to this, the airline company

is wholly owned by the UAE government therefore, there is a presence of favourable trade

policies, open skies agreement, and regulations that affect their global strategy.

5. BARRIERS IN INTERNATIONALIZATION

Barriers to internationalization have been identified by the Cage. He has defined 4

barriers which hinders the activity of internationalization that is carried out by British Airways

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

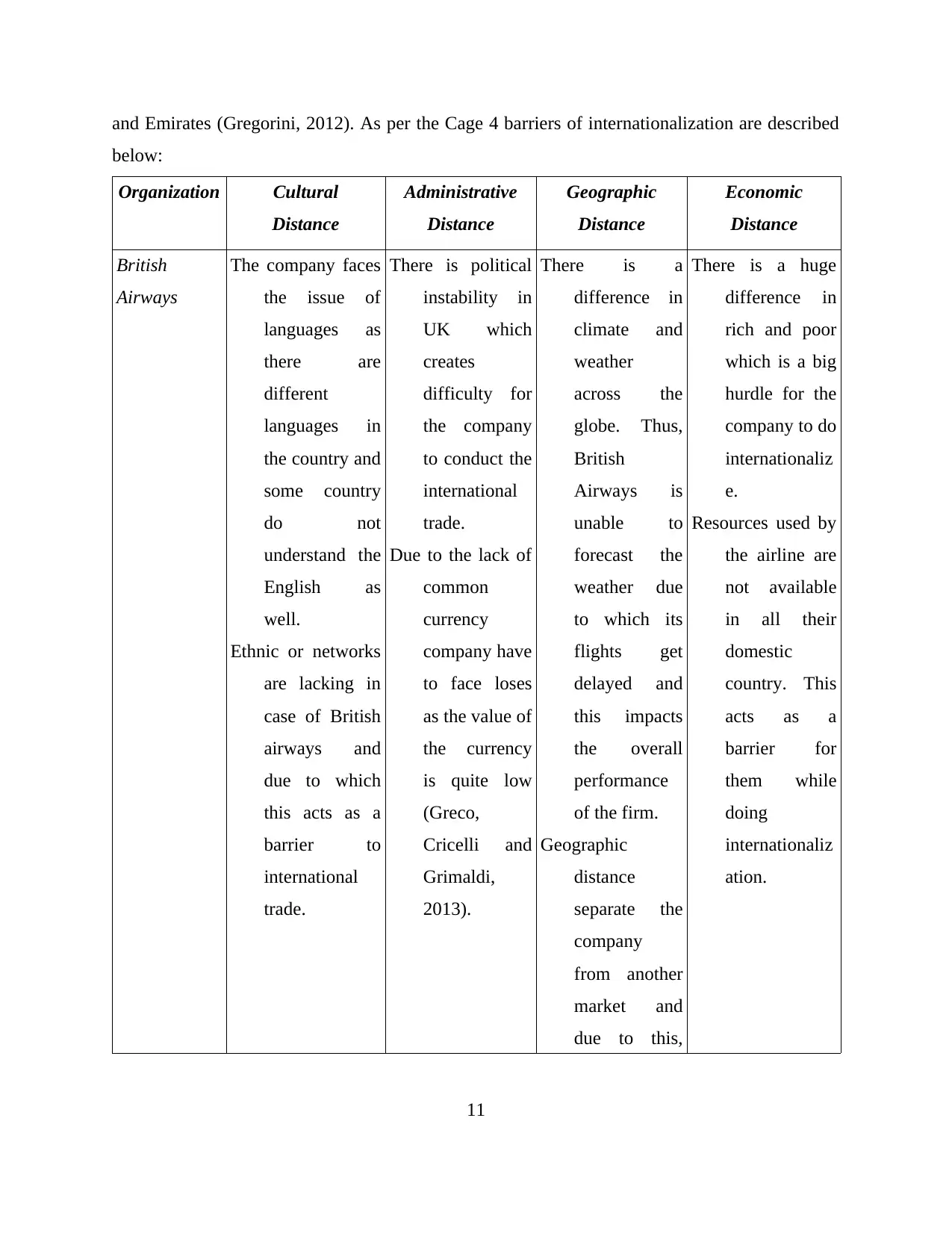

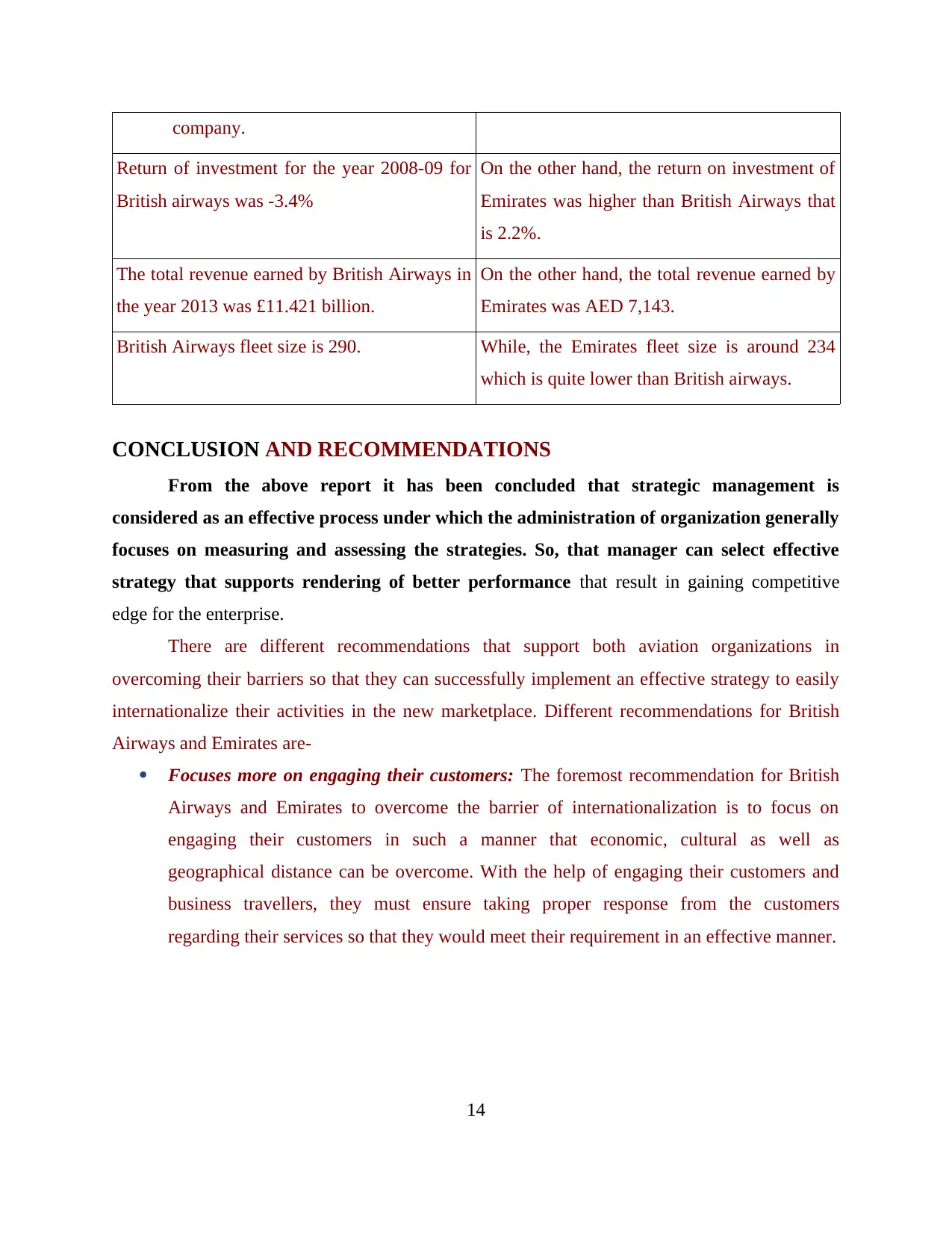

and Emirates (Gregorini, 2012). As per the Cage 4 barriers of internationalization are described

below:

Organization Cultural

Distance

Administrative

Distance

Geographic

Distance

Economic

Distance

British

Airways

The company faces

the issue of

languages as

there are

different

languages in

the country and

some country

do not

understand the

English as

well.

Ethnic or networks

are lacking in

case of British

airways and

due to which

this acts as a

barrier to

international

trade.

There is political

instability in

UK which

creates

difficulty for

the company

to conduct the

international

trade.

Due to the lack of

common

currency

company have

to face loses

as the value of

the currency

is quite low

(Greco,

Cricelli and

Grimaldi,

2013).

There is a

difference in

climate and

weather

across the

globe. Thus,

British

Airways is

unable to

forecast the

weather due

to which its

flights get

delayed and

this impacts

the overall

performance

of the firm.

Geographic

distance

separate the

company

from another

market and

due to this,

There is a huge

difference in

rich and poor

which is a big

hurdle for the

company to do

internationaliz

e.

Resources used by

the airline are

not available

in all their

domestic

country. This

acts as a

barrier for

them while

doing

internationaliz

ation.

11

below:

Organization Cultural

Distance

Administrative

Distance

Geographic

Distance

Economic

Distance

British

Airways

The company faces

the issue of

languages as

there are

different

languages in

the country and

some country

do not

understand the

English as

well.

Ethnic or networks

are lacking in

case of British

airways and

due to which

this acts as a

barrier to

international

trade.

There is political

instability in

UK which

creates

difficulty for

the company

to conduct the

international

trade.

Due to the lack of

common

currency

company have

to face loses

as the value of

the currency

is quite low

(Greco,

Cricelli and

Grimaldi,

2013).

There is a

difference in

climate and

weather

across the

globe. Thus,

British

Airways is

unable to

forecast the

weather due

to which its

flights get

delayed and

this impacts

the overall

performance

of the firm.

Geographic

distance

separate the

company

from another

market and

due to this,

There is a huge

difference in

rich and poor

which is a big

hurdle for the

company to do

internationaliz

e.

Resources used by

the airline are

not available

in all their

domestic

country. This

acts as a

barrier for

them while

doing

internationaliz

ation.

11

enterprise

could not

analyze the

actual

changes

prevailing in

other

country’s

market which

hinders the

growth of the

firm

(Thomson and

Fuller, 2010).

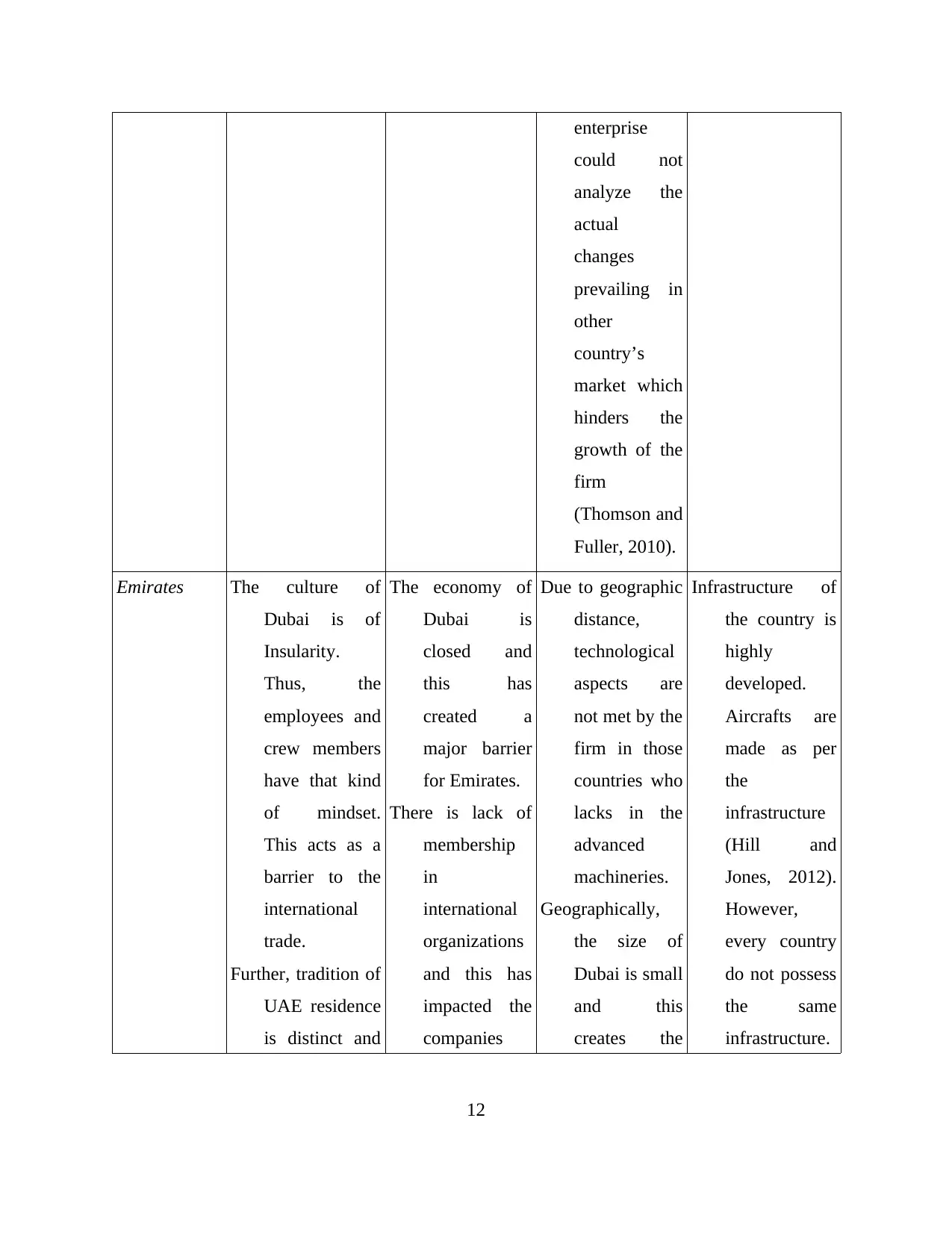

Emirates The culture of

Dubai is of

Insularity.

Thus, the

employees and

crew members

have that kind

of mindset.

This acts as a

barrier to the

international

trade.

Further, tradition of

UAE residence

is distinct and

The economy of

Dubai is

closed and

this has

created a

major barrier

for Emirates.

There is lack of

membership

in

international

organizations

and this has

impacted the

companies

Due to geographic

distance,

technological

aspects are

not met by the

firm in those

countries who

lacks in the

advanced

machineries.

Geographically,

the size of

Dubai is small

and this

creates the

Infrastructure of

the country is

highly

developed.

Aircrafts are

made as per

the

infrastructure

(Hill and

Jones, 2012).

However,

every country

do not possess

the same

infrastructure.

12

could not

analyze the

actual

changes

prevailing in

other

country’s

market which

hinders the

growth of the

firm

(Thomson and

Fuller, 2010).

Emirates The culture of

Dubai is of

Insularity.

Thus, the

employees and

crew members

have that kind

of mindset.

This acts as a

barrier to the

international

trade.

Further, tradition of

UAE residence

is distinct and

The economy of

Dubai is

closed and

this has

created a

major barrier

for Emirates.

There is lack of

membership

in

international

organizations

and this has

impacted the

companies

Due to geographic

distance,

technological

aspects are

not met by the

firm in those

countries who

lacks in the

advanced

machineries.

Geographically,

the size of

Dubai is small

and this

creates the

Infrastructure of

the country is

highly

developed.

Aircrafts are

made as per

the

infrastructure

(Hill and

Jones, 2012).

However,

every country

do not possess

the same

infrastructure.

12

this creates

difficulty in

doing

international

trade.

because they

do not get

support from

other

countries

while

conducting

their services

in other

nation.

barriers to the

internationaliz

ation

(Freeman,

2010).

SO, this

created

hindrance in

the

internationaliz

ation of

Emirates.

The difference of

annual income

and the

currency

fluctuations

have created a

great barrier

on the

international

trade of

Emirates.

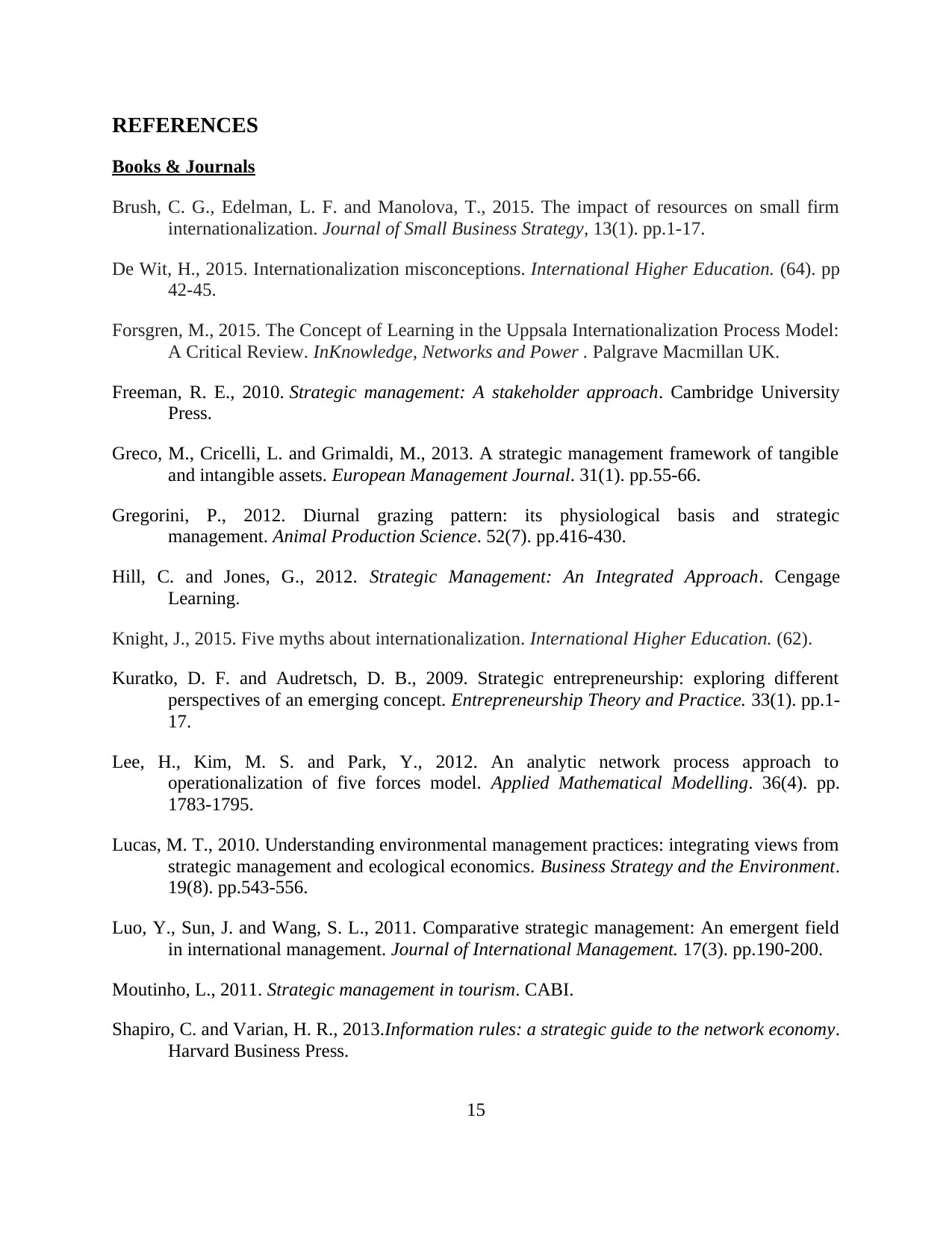

COMPARATIVE ANALYSIS OF AIRLINES: BA AND EMIRATES

British Airways Emirates

Strength-

Strong brand identity in the UK market.

Launching of new subsidiary that is

Open skies that basically offers service

of business class among US and

different European countries. Merge up with Iberia has resulted BA

in becoming the second largest airline

Strength-

Emirates focuses on diversified market

through entering their services in Cargo

shipping.

Low cost airlines in the Middle East

region.

13

difficulty in

doing

international

trade.

because they

do not get

support from

other

countries

while

conducting

their services

in other

nation.

barriers to the

internationaliz

ation

(Freeman,

2010).

SO, this

created

hindrance in

the

internationaliz

ation of

Emirates.

The difference of

annual income

and the

currency

fluctuations

have created a

great barrier

on the

international

trade of

Emirates.

COMPARATIVE ANALYSIS OF AIRLINES: BA AND EMIRATES

British Airways Emirates

Strength-

Strong brand identity in the UK market.

Launching of new subsidiary that is

Open skies that basically offers service

of business class among US and

different European countries. Merge up with Iberia has resulted BA

in becoming the second largest airline

Strength-

Emirates focuses on diversified market

through entering their services in Cargo

shipping.

Low cost airlines in the Middle East

region.

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

company.

Return of investment for the year 2008-09 for

British airways was -3.4%

On the other hand, the return on investment of

Emirates was higher than British Airways that

is 2.2%.

The total revenue earned by British Airways in

the year 2013 was £11.421 billion.

On the other hand, the total revenue earned by

Emirates was AED 7,143.

British Airways fleet size is 290. While, the Emirates fleet size is around 234

which is quite lower than British airways.

CONCLUSION AND RECOMMENDATIONS

From the above report it has been concluded that strategic management is

considered as an effective process under which the administration of organization generally

focuses on measuring and assessing the strategies. So, that manager can select effective

strategy that supports rendering of better performance that result in gaining competitive

edge for the enterprise.

There are different recommendations that support both aviation organizations in

overcoming their barriers so that they can successfully implement an effective strategy to easily

internationalize their activities in the new marketplace. Different recommendations for British

Airways and Emirates are-

Focuses more on engaging their customers: The foremost recommendation for British

Airways and Emirates to overcome the barrier of internationalization is to focus on

engaging their customers in such a manner that economic, cultural as well as

geographical distance can be overcome. With the help of engaging their customers and

business travellers, they must ensure taking proper response from the customers

regarding their services so that they would meet their requirement in an effective manner.

14

Return of investment for the year 2008-09 for

British airways was -3.4%

On the other hand, the return on investment of

Emirates was higher than British Airways that

is 2.2%.

The total revenue earned by British Airways in

the year 2013 was £11.421 billion.

On the other hand, the total revenue earned by

Emirates was AED 7,143.

British Airways fleet size is 290. While, the Emirates fleet size is around 234

which is quite lower than British airways.

CONCLUSION AND RECOMMENDATIONS

From the above report it has been concluded that strategic management is

considered as an effective process under which the administration of organization generally

focuses on measuring and assessing the strategies. So, that manager can select effective

strategy that supports rendering of better performance that result in gaining competitive

edge for the enterprise.

There are different recommendations that support both aviation organizations in

overcoming their barriers so that they can successfully implement an effective strategy to easily

internationalize their activities in the new marketplace. Different recommendations for British

Airways and Emirates are-

Focuses more on engaging their customers: The foremost recommendation for British

Airways and Emirates to overcome the barrier of internationalization is to focus on

engaging their customers in such a manner that economic, cultural as well as

geographical distance can be overcome. With the help of engaging their customers and

business travellers, they must ensure taking proper response from the customers

regarding their services so that they would meet their requirement in an effective manner.

14

REFERENCES

Books & Journals

Brush, C. G., Edelman, L. F. and Manolova, T., 2015. The impact of resources on small firm

internationalization. Journal of Small Business Strategy, 13(1). pp.1-17.

De Wit, H., 2015. Internationalization misconceptions. International Higher Education. (64). pp

42-45.

Forsgren, M., 2015. The Concept of Learning in the Uppsala Internationalization Process Model:

A Critical Review. InKnowledge, Networks and Power . Palgrave Macmillan UK.

Freeman, R. E., 2010. Strategic management: A stakeholder approach. Cambridge University

Press.

Greco, M., Cricelli, L. and Grimaldi, M., 2013. A strategic management framework of tangible

and intangible assets. European Management Journal. 31(1). pp.55-66.

Gregorini, P., 2012. Diurnal grazing pattern: its physiological basis and strategic

management. Animal Production Science. 52(7). pp.416-430.

Hill, C. and Jones, G., 2012. Strategic Management: An Integrated Approach. Cengage

Learning.

Knight, J., 2015. Five myths about internationalization. International Higher Education. (62).

Kuratko, D. F. and Audretsch, D. B., 2009. Strategic entrepreneurship: exploring different

perspectives of an emerging concept. Entrepreneurship Theory and Practice. 33(1). pp.1-

17.

Lee, H., Kim, M. S. and Park, Y., 2012. An analytic network process approach to

operationalization of five forces model. Applied Mathematical Modelling. 36(4). pp.

1783-1795.

Lucas, M. T., 2010. Understanding environmental management practices: integrating views from

strategic management and ecological economics. Business Strategy and the Environment.

19(8). pp.543-556.

Luo, Y., Sun, J. and Wang, S. L., 2011. Comparative strategic management: An emergent field

in international management. Journal of International Management. 17(3). pp.190-200.

Moutinho, L., 2011. Strategic management in tourism. CABI.

Shapiro, C. and Varian, H. R., 2013.Information rules: a strategic guide to the network economy.

Harvard Business Press.

15

Books & Journals

Brush, C. G., Edelman, L. F. and Manolova, T., 2015. The impact of resources on small firm

internationalization. Journal of Small Business Strategy, 13(1). pp.1-17.

De Wit, H., 2015. Internationalization misconceptions. International Higher Education. (64). pp

42-45.

Forsgren, M., 2015. The Concept of Learning in the Uppsala Internationalization Process Model:

A Critical Review. InKnowledge, Networks and Power . Palgrave Macmillan UK.

Freeman, R. E., 2010. Strategic management: A stakeholder approach. Cambridge University

Press.

Greco, M., Cricelli, L. and Grimaldi, M., 2013. A strategic management framework of tangible

and intangible assets. European Management Journal. 31(1). pp.55-66.

Gregorini, P., 2012. Diurnal grazing pattern: its physiological basis and strategic

management. Animal Production Science. 52(7). pp.416-430.

Hill, C. and Jones, G., 2012. Strategic Management: An Integrated Approach. Cengage

Learning.

Knight, J., 2015. Five myths about internationalization. International Higher Education. (62).

Kuratko, D. F. and Audretsch, D. B., 2009. Strategic entrepreneurship: exploring different

perspectives of an emerging concept. Entrepreneurship Theory and Practice. 33(1). pp.1-

17.

Lee, H., Kim, M. S. and Park, Y., 2012. An analytic network process approach to

operationalization of five forces model. Applied Mathematical Modelling. 36(4). pp.

1783-1795.

Lucas, M. T., 2010. Understanding environmental management practices: integrating views from

strategic management and ecological economics. Business Strategy and the Environment.

19(8). pp.543-556.

Luo, Y., Sun, J. and Wang, S. L., 2011. Comparative strategic management: An emergent field

in international management. Journal of International Management. 17(3). pp.190-200.

Moutinho, L., 2011. Strategic management in tourism. CABI.

Shapiro, C. and Varian, H. R., 2013.Information rules: a strategic guide to the network economy.

Harvard Business Press.

15

Spencer, A. J., Buhalis, D. and Moital, M., 2012. A hierarchical model of technology adoption

for small owner-managed travel firms: An organizational decision-making and leadership

perspective. Tourism Management. 33(5). pp. 1195-1208.

Thomson, N. and Fuller, B. C., 2010. Basic Strategy in Context: European text and cases. John

Wiley & Sons.

Online

Janczak, S., 2005. The Strategic Decision-Making Process in Organizations. [Pdf]. Available

through:

<http://businessperspectives.org/journals_free/ppm/2005/PPM_EN_2005_03_Janczak.pd

f>. [Accessed on 6th February 2016].

Porter's Five Forces of competitive position analysis. 2011. [Online]. Available through:

<http://www.cgma.org/Resources/Tools/essential-tools/Pages/porters-five-forces.aspx?

TestCookiesEnabled=redirect>. [Accessed on 29th February 2016].

16

for small owner-managed travel firms: An organizational decision-making and leadership

perspective. Tourism Management. 33(5). pp. 1195-1208.

Thomson, N. and Fuller, B. C., 2010. Basic Strategy in Context: European text and cases. John

Wiley & Sons.

Online

Janczak, S., 2005. The Strategic Decision-Making Process in Organizations. [Pdf]. Available

through:

<http://businessperspectives.org/journals_free/ppm/2005/PPM_EN_2005_03_Janczak.pd

f>. [Accessed on 6th February 2016].

Porter's Five Forces of competitive position analysis. 2011. [Online]. Available through:

<http://www.cgma.org/Resources/Tools/essential-tools/Pages/porters-five-forces.aspx?

TestCookiesEnabled=redirect>. [Accessed on 29th February 2016].

16

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.