A Critical Analysis of Teslas Business and Financial Performance With Ford Motors 2019 to 2021

VerifiedAdded on 2023/06/14

|25

|7861

|480

AI Summary

This report analyzes the business and financial performance of Tesla and Ford Motors from 2019 to 2021 using established models such as SWOT, PESTLE, Ansoff Matrix, and ratio analysis. It evaluates the macro environment, current position, marketing strategies, and strategic options followed by Tesla. The report also includes a comparative analysis of the monetary performance of both companies based on fiscal ratios.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

A Critical Analysis of

Teslas Business and

Financial Performance

with Ford Motors 2019

to 2021

Teslas Business and

Financial Performance

with Ford Motors 2019

to 2021

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Contents

INTRODUCTION...........................................................................................................................3

RESEARCH OBJECTIVES............................................................................................................4

CURRENT STRATEGIES FOLLOWED BY THE ORGANISATION........................................4

LITERATURE REVIEW USING ESTABLISHED MODELS......................................................5

RESEARCH METHODOLOGY.....................................................................................................9

ANALYSIS....................................................................................................................................10

SWOT..................................................................................................................................10

PESTLE...............................................................................................................................11

FOUR Ps MARKETING MIX..........................................................................................13

ANSOFF MATRIX............................................................................................................14

RATIO ANALYSIS............................................................................................................15

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

INTRODUCTION...........................................................................................................................3

RESEARCH OBJECTIVES............................................................................................................4

CURRENT STRATEGIES FOLLOWED BY THE ORGANISATION........................................4

LITERATURE REVIEW USING ESTABLISHED MODELS......................................................5

RESEARCH METHODOLOGY.....................................................................................................9

ANALYSIS....................................................................................................................................10

SWOT..................................................................................................................................10

PESTLE...............................................................................................................................11

FOUR Ps MARKETING MIX..........................................................................................13

ANSOFF MATRIX............................................................................................................14

RATIO ANALYSIS............................................................................................................15

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

INTRODUCTION

The business and the monetary performance of any organisation can be determined by the

help of the financial statement that are prepared by every listed and non – listed company. It

helps in measuring the quantifiable information and the standing of the firm in the industry.

Tesla is an American multinational company with headquarters in Austin Texas. It is an electric

vehicle and clean energy organisation. The company mainly creates and produces electric cars,

solar panels, battery energy storage from home to grid-scale, solar roof tiles and many other

products related to it. The company regards as the most valuable company throughout the world

and remains the most valuable automaker in the entire world. The company founded in July,

2003 as Tesla Motors (About Tesla, 2022).

Ford Motor Company is commonly names as Ford. It is also an American brand in car

manufacturing industry. It has its headquarter in Dearborn, Michigan, United States. The founder

Henry Ford announced the company in the year 1903. This automobile company specialises in

selling automobile and commercial goods under the name of Ford. The company owns several

other brands such as Brazilian SUV and Jangling Motors. It has created joint ventures in various

countries such as Chine, Turkey, Thailand and Russia. Ford is known as the second-largest US

based automobile company and fifth in the entire world, behind Volkswagen, Toyota, Hyundai

and more (Ford History, 2020).

The comparative analysis of the two companies is done to identify the monetary

performance and the operating results of in the financial year. It can be judged by evaluating the

annual report and the data information of the company which is utilised for making the

significant differences. The several choices are to be made by the company to ensure that the

decision making process in effectively completed.

The report prepared from collected information gives an idea about the research

objectives and questions which are useful for company’s long life cycle. It helps to have an

explanatory research and design which would be helpful to understand working of company with

a better view. It also serves as a guide to understand analysis and describe the reason behind

events taking place in carrying out operations related to company. It gives a better understanding

to people who are connected with company both internal as well as external users which

contribute to growth and expansion of business. It helps to evaluate that the data provided by the

company is accurate, reliable, reasonable or not. The report is helpful for choosing from best

The business and the monetary performance of any organisation can be determined by the

help of the financial statement that are prepared by every listed and non – listed company. It

helps in measuring the quantifiable information and the standing of the firm in the industry.

Tesla is an American multinational company with headquarters in Austin Texas. It is an electric

vehicle and clean energy organisation. The company mainly creates and produces electric cars,

solar panels, battery energy storage from home to grid-scale, solar roof tiles and many other

products related to it. The company regards as the most valuable company throughout the world

and remains the most valuable automaker in the entire world. The company founded in July,

2003 as Tesla Motors (About Tesla, 2022).

Ford Motor Company is commonly names as Ford. It is also an American brand in car

manufacturing industry. It has its headquarter in Dearborn, Michigan, United States. The founder

Henry Ford announced the company in the year 1903. This automobile company specialises in

selling automobile and commercial goods under the name of Ford. The company owns several

other brands such as Brazilian SUV and Jangling Motors. It has created joint ventures in various

countries such as Chine, Turkey, Thailand and Russia. Ford is known as the second-largest US

based automobile company and fifth in the entire world, behind Volkswagen, Toyota, Hyundai

and more (Ford History, 2020).

The comparative analysis of the two companies is done to identify the monetary

performance and the operating results of in the financial year. It can be judged by evaluating the

annual report and the data information of the company which is utilised for making the

significant differences. The several choices are to be made by the company to ensure that the

decision making process in effectively completed.

The report prepared from collected information gives an idea about the research

objectives and questions which are useful for company’s long life cycle. It helps to have an

explanatory research and design which would be helpful to understand working of company with

a better view. It also serves as a guide to understand analysis and describe the reason behind

events taking place in carrying out operations related to company. It gives a better understanding

to people who are connected with company both internal as well as external users which

contribute to growth and expansion of business. It helps to evaluate that the data provided by the

company is accurate, reliable, reasonable or not. The report is helpful for choosing from best

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

alternatives available in case of methods applicable I.e. which must be helpful and will serve best

results. It helps to evaluate best hypothesis which would be helpful for the company to be

applied. These are of two types Null and alternate which helps to choose which would be more

effective and efficient policy which can be implemented. This reports helps to build a

competitive advantage in market against other companies as well (Conlon and Ford, 2022). It

helps to find out what could be done, when could be done and which would be the best path for

reaching goals and fulfilling aims wished for. This report gives an idea where the company is

lacking and where it lagging behind which would not only increase its speed towards success but

help to utilise its resources in other areas which would result more beneficial. It can also be

considered as a guide providing solutions for unnecessary issues and problems which can be

easily dealt with in no time.

RESEARCH OBJECTIVES

The main of the research is to gives the summative information and the gap which can be

addressed for fulfilling the performance of Tesla. It will involve the strategic analysis and

evaluation that will involve the skills that need to be displayed by the relevant models and

theory’s in the paper (Gautam, Verma, and Srivastava, 2019). For this the comparative analysis

of the performance of the firm is done.

The objectives of the paper are:

1. To assess the macro environment by undertaking a Pestle analysis.

2. To assess the current position of Tesla in the market by undertaking the SWOT.

3. To analyse the strategy and the models of marketing that are used by Tesla in the

comparison of Ford Motors.

4. To analyse the strategic options followed by Tesla by undertaking a Ansoff Matrix

analysis of Tesla.

5. The evaluate the monetary performance of the Tesla against Ford Motors from the 2

years from 2019 to 2021 analysis on the basis of the fiscal ratios.

CURRENT STRATEGIES FOLLOWED BY THE ORGANISATION

The research about the company suggests that the large emphasis of the organisation is

on the market penetration strategy by developing the aim of gaining sustainability in the market

for increasing the customer satisfaction. Its main aim is to apply the strategy of intensive growth

results. It helps to evaluate best hypothesis which would be helpful for the company to be

applied. These are of two types Null and alternate which helps to choose which would be more

effective and efficient policy which can be implemented. This reports helps to build a

competitive advantage in market against other companies as well (Conlon and Ford, 2022). It

helps to find out what could be done, when could be done and which would be the best path for

reaching goals and fulfilling aims wished for. This report gives an idea where the company is

lacking and where it lagging behind which would not only increase its speed towards success but

help to utilise its resources in other areas which would result more beneficial. It can also be

considered as a guide providing solutions for unnecessary issues and problems which can be

easily dealt with in no time.

RESEARCH OBJECTIVES

The main of the research is to gives the summative information and the gap which can be

addressed for fulfilling the performance of Tesla. It will involve the strategic analysis and

evaluation that will involve the skills that need to be displayed by the relevant models and

theory’s in the paper (Gautam, Verma, and Srivastava, 2019). For this the comparative analysis

of the performance of the firm is done.

The objectives of the paper are:

1. To assess the macro environment by undertaking a Pestle analysis.

2. To assess the current position of Tesla in the market by undertaking the SWOT.

3. To analyse the strategy and the models of marketing that are used by Tesla in the

comparison of Ford Motors.

4. To analyse the strategic options followed by Tesla by undertaking a Ansoff Matrix

analysis of Tesla.

5. The evaluate the monetary performance of the Tesla against Ford Motors from the 2

years from 2019 to 2021 analysis on the basis of the fiscal ratios.

CURRENT STRATEGIES FOLLOWED BY THE ORGANISATION

The research about the company suggests that the large emphasis of the organisation is

on the market penetration strategy by developing the aim of gaining sustainability in the market

for increasing the customer satisfaction. Its main aim is to apply the strategy of intensive growth

which can enable the firm to elevate the revenue in the current market of the company. The Tesla

owns the market share of around 18 % in the industry which signifies in leadership position in

the market (Ogunbameru, Adeloye, and Oyebode, 2019). It gives a brief understanding about the

consumers’ needs and encourages the executive of the organisation to create some innovation in

its products and also aims at increasing the supply distribution channel.

The company Ford Motors Uses the generic strategy it’s in marketing models which emphasises

ion the competitive advantage of the firm. It helps the company to maintain the costs leadership

in the market which attracts more customers. It enables the company to enforce the international

growth of the company and helps in gaining the distinctive competencies in the market.

LITERATURE REVIEW USING ESTABLISHED MODELS

Assess the macro environment by undertaking a Pestle analysis:

According to Daniel Kissinger, Pestle analysis is the tool used in analysing macro

environment factors that affects organisations performance. Tesla Plc. needs to overcome

challenges which are connected to external factors explained in Pestle. Their case involved

macro environment of Automobile sector, energy generation industry as these factors directly

influence other business determinants such as Tesla customer base directly depends upon the

cost effectiveness they got in technology and logistic sector. In order to maintain growth and

success they need to formulate their strategic decisions considering Pestle Analysis. Political

factors by way of government incentives to Electric vehicle, International global trade

agreements with other countries, Political stability in maximum market etc. reflects the

opportunity they got to strengthen their business. Decrease in cost of Battery, Renewable energy

cost etc. are the opportunity they got as economic factor, however stability issues in economy

created a threat for them. Preferences towards low carbon lifestyle, usage of renewable energy

product etc. are opportunities they must encash in social factors (Boldrini, and et.al., 2021).

There is a rapid technological change that creates threat for them. However, Tesla gets an

opportunity of increased automation in business with awareness towards online mobile system.

Ecological factors with respect to change in climate, program relating to expanding environment

etc. are certain opportunity that exist for Tesla. Dealership regulations in Unites States create

threat and Opportunity whereas rules and regulation towards energy consumption, global

protection of intangibles safeguard Tesla so that they lead the market. Tesla Pestle Analysis,

(2019)

owns the market share of around 18 % in the industry which signifies in leadership position in

the market (Ogunbameru, Adeloye, and Oyebode, 2019). It gives a brief understanding about the

consumers’ needs and encourages the executive of the organisation to create some innovation in

its products and also aims at increasing the supply distribution channel.

The company Ford Motors Uses the generic strategy it’s in marketing models which emphasises

ion the competitive advantage of the firm. It helps the company to maintain the costs leadership

in the market which attracts more customers. It enables the company to enforce the international

growth of the company and helps in gaining the distinctive competencies in the market.

LITERATURE REVIEW USING ESTABLISHED MODELS

Assess the macro environment by undertaking a Pestle analysis:

According to Daniel Kissinger, Pestle analysis is the tool used in analysing macro

environment factors that affects organisations performance. Tesla Plc. needs to overcome

challenges which are connected to external factors explained in Pestle. Their case involved

macro environment of Automobile sector, energy generation industry as these factors directly

influence other business determinants such as Tesla customer base directly depends upon the

cost effectiveness they got in technology and logistic sector. In order to maintain growth and

success they need to formulate their strategic decisions considering Pestle Analysis. Political

factors by way of government incentives to Electric vehicle, International global trade

agreements with other countries, Political stability in maximum market etc. reflects the

opportunity they got to strengthen their business. Decrease in cost of Battery, Renewable energy

cost etc. are the opportunity they got as economic factor, however stability issues in economy

created a threat for them. Preferences towards low carbon lifestyle, usage of renewable energy

product etc. are opportunities they must encash in social factors (Boldrini, and et.al., 2021).

There is a rapid technological change that creates threat for them. However, Tesla gets an

opportunity of increased automation in business with awareness towards online mobile system.

Ecological factors with respect to change in climate, program relating to expanding environment

etc. are certain opportunity that exist for Tesla. Dealership regulations in Unites States create

threat and Opportunity whereas rules and regulation towards energy consumption, global

protection of intangibles safeguard Tesla so that they lead the market. Tesla Pestle Analysis,

(2019)

Assess the current position of Tesla in the market by undertaking the SWOT:

As per the view of Rakesh Naga Naidu Chinta, Tesla manufactures fully

automatic electric vehicle and products relating to energy storage. They have established

their own ecosystem by developing their service centre with respect to sales and service.

Along with this tesla also establish charging station around the world so that people will

easily adopt electric vehicles as compare to those runs on Petrol, Diesel or Gas. They

have developed their unique position in Automotive industry with innovation and

technology with achieving higher growth rate in sales that showcase their strength as

market leader. They have made large amount of investment in Research and development

in terms of innovation in cars they produced and major investment in construction of

Gifafactory in Nevada that produce battery packs and lithium cell. Due to this heavy

investments their operating cash flows become negative and they have to raise funds

from debt to inject the same in operating activities (Sanchez-Siles and et.al., 2020). These

cash outflows and increase the burden of debt in them capital structure is regarded as

their weakness. Tesla recently launched Model 3 whose price is lower at $35000 as

compare to same range of products offered by Mercedes and Audi. Further they working

on reducing cost of Batteries they plant into their car that creates an opportunity for Tesla

to lead the segment. The only threat they have is the increased competition with respect

to electric vehicle as other player have started to ship into that segment. Tesla Swot

Analysis, (2018)

Analyse the strategy and the models of marketing that are used by Tesla in the

comparison of Ford Motors:

As shown by Fahmina Ahmed Papia, when an organisation started a business their

intension is to offer something to their customer by way of goods or services that’s called

a product. Tesla is best known for cars they make in electric segment and they surprise

their high end consumer with technological development made in their product

(Muhammad, Putro, and Siallagan, 2019). The price of tesla product is higher as compare

to ford motors since battery they are using in their cars are high capacity kilowatt powers.

However, the demand equally matches higher price as they are building eco-friendly

As per the view of Rakesh Naga Naidu Chinta, Tesla manufactures fully

automatic electric vehicle and products relating to energy storage. They have established

their own ecosystem by developing their service centre with respect to sales and service.

Along with this tesla also establish charging station around the world so that people will

easily adopt electric vehicles as compare to those runs on Petrol, Diesel or Gas. They

have developed their unique position in Automotive industry with innovation and

technology with achieving higher growth rate in sales that showcase their strength as

market leader. They have made large amount of investment in Research and development

in terms of innovation in cars they produced and major investment in construction of

Gifafactory in Nevada that produce battery packs and lithium cell. Due to this heavy

investments their operating cash flows become negative and they have to raise funds

from debt to inject the same in operating activities (Sanchez-Siles and et.al., 2020). These

cash outflows and increase the burden of debt in them capital structure is regarded as

their weakness. Tesla recently launched Model 3 whose price is lower at $35000 as

compare to same range of products offered by Mercedes and Audi. Further they working

on reducing cost of Batteries they plant into their car that creates an opportunity for Tesla

to lead the segment. The only threat they have is the increased competition with respect

to electric vehicle as other player have started to ship into that segment. Tesla Swot

Analysis, (2018)

Analyse the strategy and the models of marketing that are used by Tesla in the

comparison of Ford Motors:

As shown by Fahmina Ahmed Papia, when an organisation started a business their

intension is to offer something to their customer by way of goods or services that’s called

a product. Tesla is best known for cars they make in electric segment and they surprise

their high end consumer with technological development made in their product

(Muhammad, Putro, and Siallagan, 2019). The price of tesla product is higher as compare

to ford motors since battery they are using in their cars are high capacity kilowatt powers.

However, the demand equally matches higher price as they are building eco-friendly

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

products with performance and comfort. Their place strategy is targeting the higher end

audience who can pay premium for comfort and features. That’s why their distribution

channel is also premium. Tesla does not invest much amount of investment in promotion

of product as they generate revolutionary product whose revenue over the period cross

the margins they needed. Marketing Mix of Tesla (2022).

On the contrary, as per Edward Fertguson the product that Ford motors offers varies in

different segment such as Automobiles, trucks, buses, tractors, automotive components

etc. that concludes that they have a diversified product mix for targeting multiple

customers. Ford uses typical places for distribution of their product as part of their

marketing strategy. Their main distribution network is their dealership from where they

sales their product and it contributes maximum revenue to them as compare to auto part

stores (McNally, 2018). Ford uses conventional tactics to promote their product

especially advertisement on televisions which is their main tactics to generate revenue as

compare to personal selling, public relations, sales promotions and so on. Ford pricing

strategy directly depends upon product. However, they use market oriented strategy and

premium pricing strategy in target the both types of customer. Ford Motors Marketing

Mix (2022)

Analyse the strategic options followed by Tesla by undertaking a Ansoff Matrix

analysis of Tesla:

Tesla Ansoff Matrix is set as model which are used by other automobile

manufacturer so that they can make better strategic decisions in their business model.

Ansoff Matrix is divided into four parts that is Market Penetration, Product Development,

Market Development and Diversification (Peterlin, 2019). Tesla is using market

penetration strategy aggressively as they are selling its electric vehicle and other energy

products in 35 countries including US. Tesla does not engage in product development on

a regular basis as it required high cost to develop a new product in electric vehicles and

power sectors. They are regularly entering into new markets with their existing products

as their market development strategy. For e.g. they entered in Indian market with their

electric vehicle product. Tesla regularly use diversification strategy over the past years as

they started with electric vehicles in 2003 and after wards they changed the name to Solar

audience who can pay premium for comfort and features. That’s why their distribution

channel is also premium. Tesla does not invest much amount of investment in promotion

of product as they generate revolutionary product whose revenue over the period cross

the margins they needed. Marketing Mix of Tesla (2022).

On the contrary, as per Edward Fertguson the product that Ford motors offers varies in

different segment such as Automobiles, trucks, buses, tractors, automotive components

etc. that concludes that they have a diversified product mix for targeting multiple

customers. Ford uses typical places for distribution of their product as part of their

marketing strategy. Their main distribution network is their dealership from where they

sales their product and it contributes maximum revenue to them as compare to auto part

stores (McNally, 2018). Ford uses conventional tactics to promote their product

especially advertisement on televisions which is their main tactics to generate revenue as

compare to personal selling, public relations, sales promotions and so on. Ford pricing

strategy directly depends upon product. However, they use market oriented strategy and

premium pricing strategy in target the both types of customer. Ford Motors Marketing

Mix (2022)

Analyse the strategic options followed by Tesla by undertaking a Ansoff Matrix

analysis of Tesla:

Tesla Ansoff Matrix is set as model which are used by other automobile

manufacturer so that they can make better strategic decisions in their business model.

Ansoff Matrix is divided into four parts that is Market Penetration, Product Development,

Market Development and Diversification (Peterlin, 2019). Tesla is using market

penetration strategy aggressively as they are selling its electric vehicle and other energy

products in 35 countries including US. Tesla does not engage in product development on

a regular basis as it required high cost to develop a new product in electric vehicles and

power sectors. They are regularly entering into new markets with their existing products

as their market development strategy. For e.g. they entered in Indian market with their

electric vehicle product. Tesla regularly use diversification strategy over the past years as

they started with electric vehicles in 2003 and after wards they changed the name to Solar

city in place of Tesla motors so that they can inter into energy sector. Tesla Ansoff Matrix

(2021)

Evaluating the monetary performance of the Tesla against Ford Motors from the 2

years from 2018 to 2020 analysis on the basis of the fiscal ratios:

Fiscal ratios to evaluate the performance of the organisation can be judged by calculating

their liquidity ratio, efficiency ratio and profitability ratio.

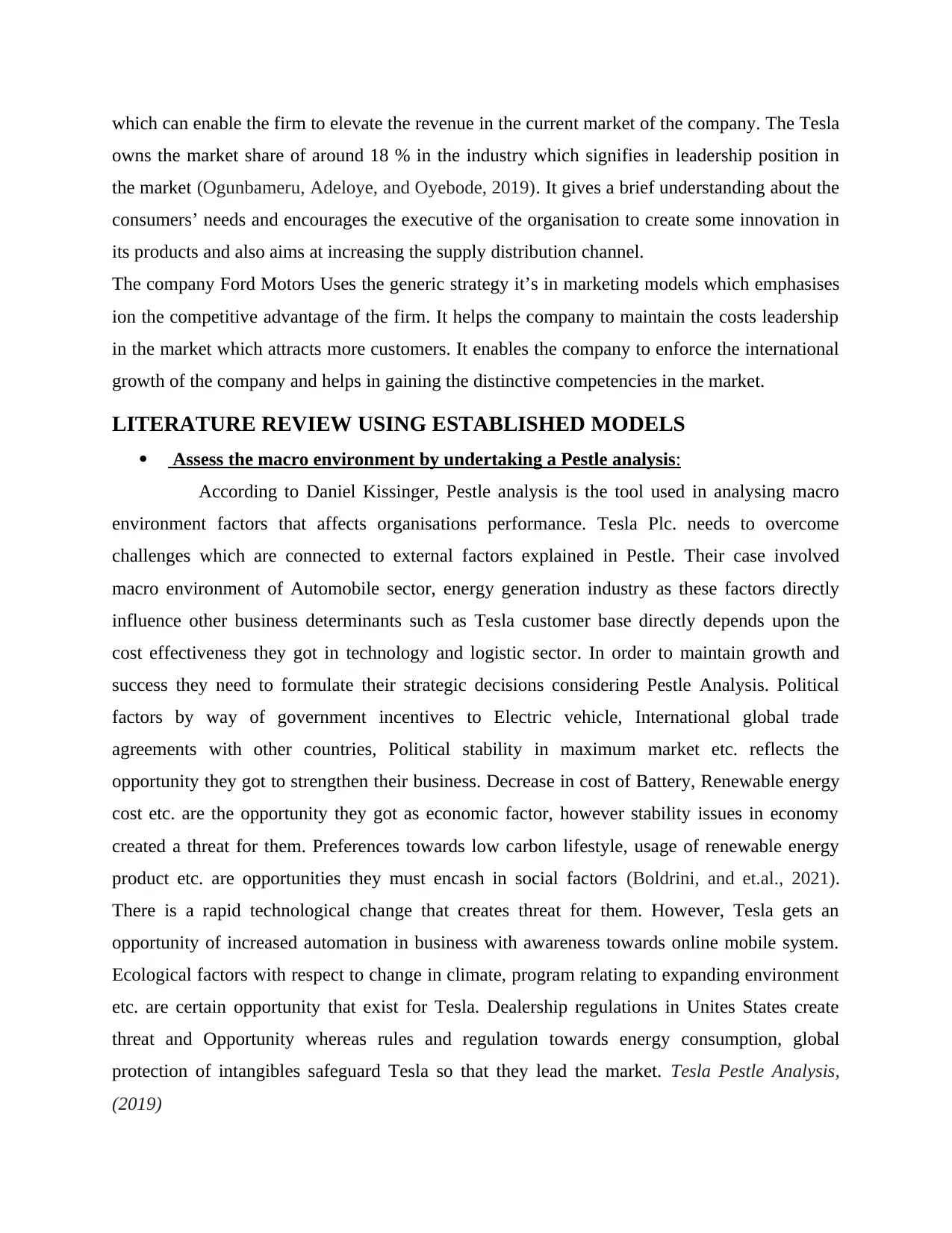

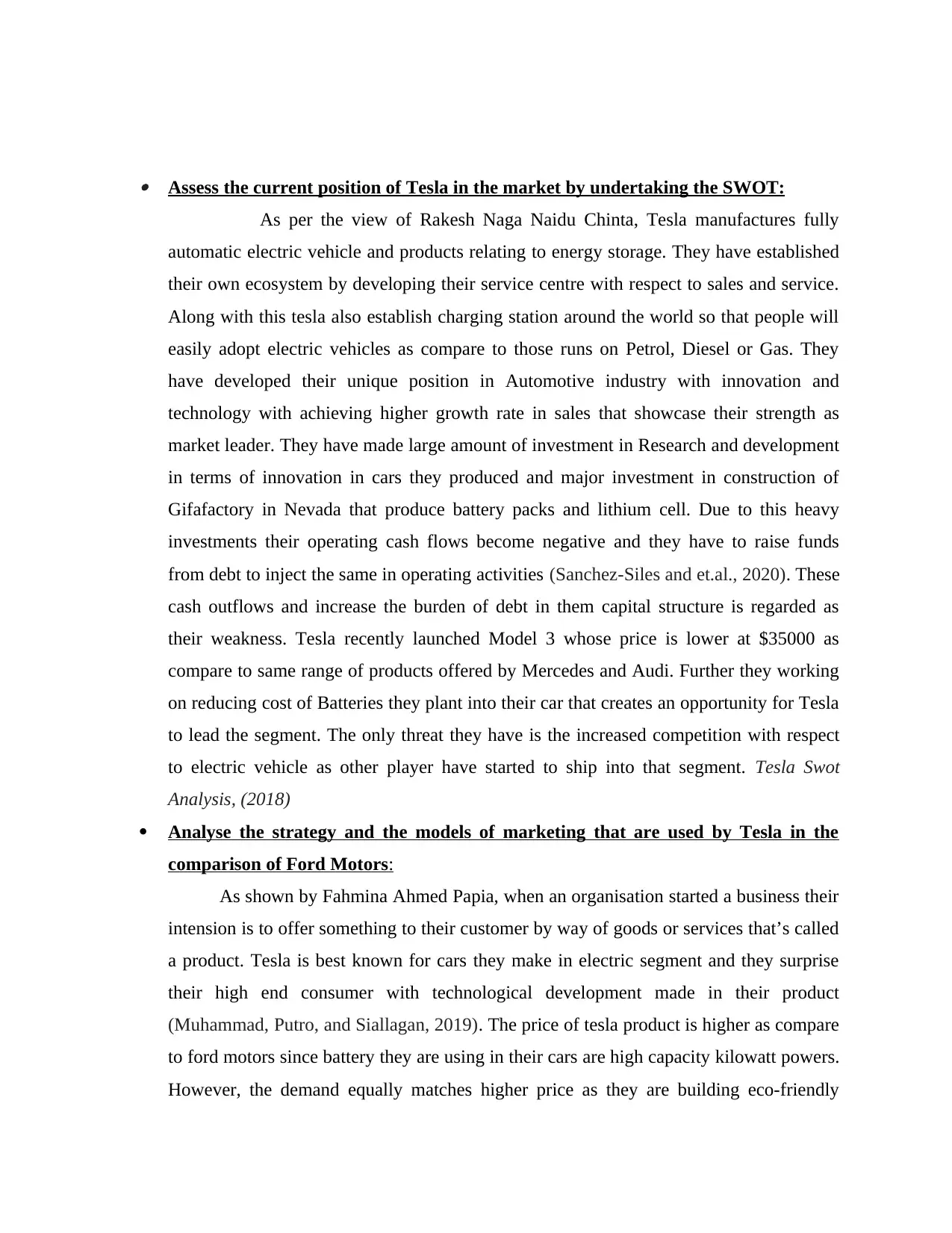

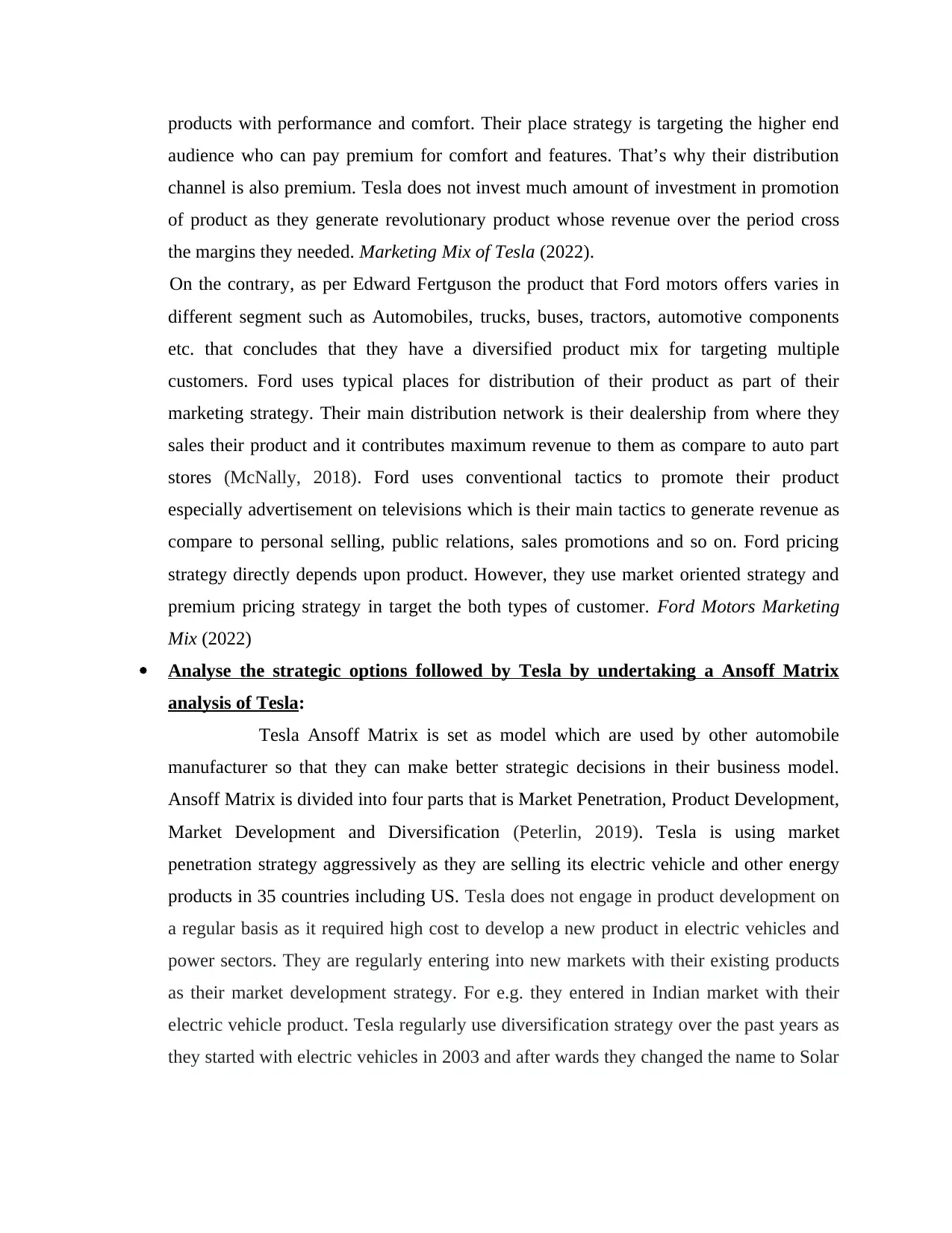

Tesla Inc. 2020 2019

Current Ratio 26717 / 14248 = 1.875 12103 /10667 = 1.135

Asset Turnover Ratio 31536 / 52148 = .605 24578 / 34309 = .716

Gross Profit Ratio 6630 / 31536 = 21.02% 4069 / 24578 = 16.56%

Annual Report tesla (2020)

Ford Motors 2020 2019

Current Ratio 116744 / 97192 = 1.201 114047 / 98132 = 1.162

Asset Turnover Ratio 127144 / 267261 = .476 155900 / 258537 = .603

Gross Profit Ratio (4408) / 127144 = - 3.47% 574 / 155900 = .368 %

Annual Report Ford Motors (2020)

The current ratio of tesla has improved in 2020 as compared to 2019. That shows that their

ability to repay their debts has been improved (Tepler, 2019). On the other hand, similar

results can be seen in Ford Motors performance. However, they both does not cross the idol

current ratio which is 2.

The turnover ratio of tesla has decreased by 11.17% compare to 2019 the reason cab be the

economic downfall they are facing during 2020 due to Covid 19 Pandemic. On the other

hand, Ford Motors asset turnover ratio declines by 12.73% that shows that tesla able to

sustain better from them.

The profit margin of Tesla has improved a lot in both the above years but ford is not

maintaining their profit margins (Damaj and et.al., 2021). As compare to tesla they are far

behind, the reason can be that they are much diversified in their business but tesla has limited

diversion.

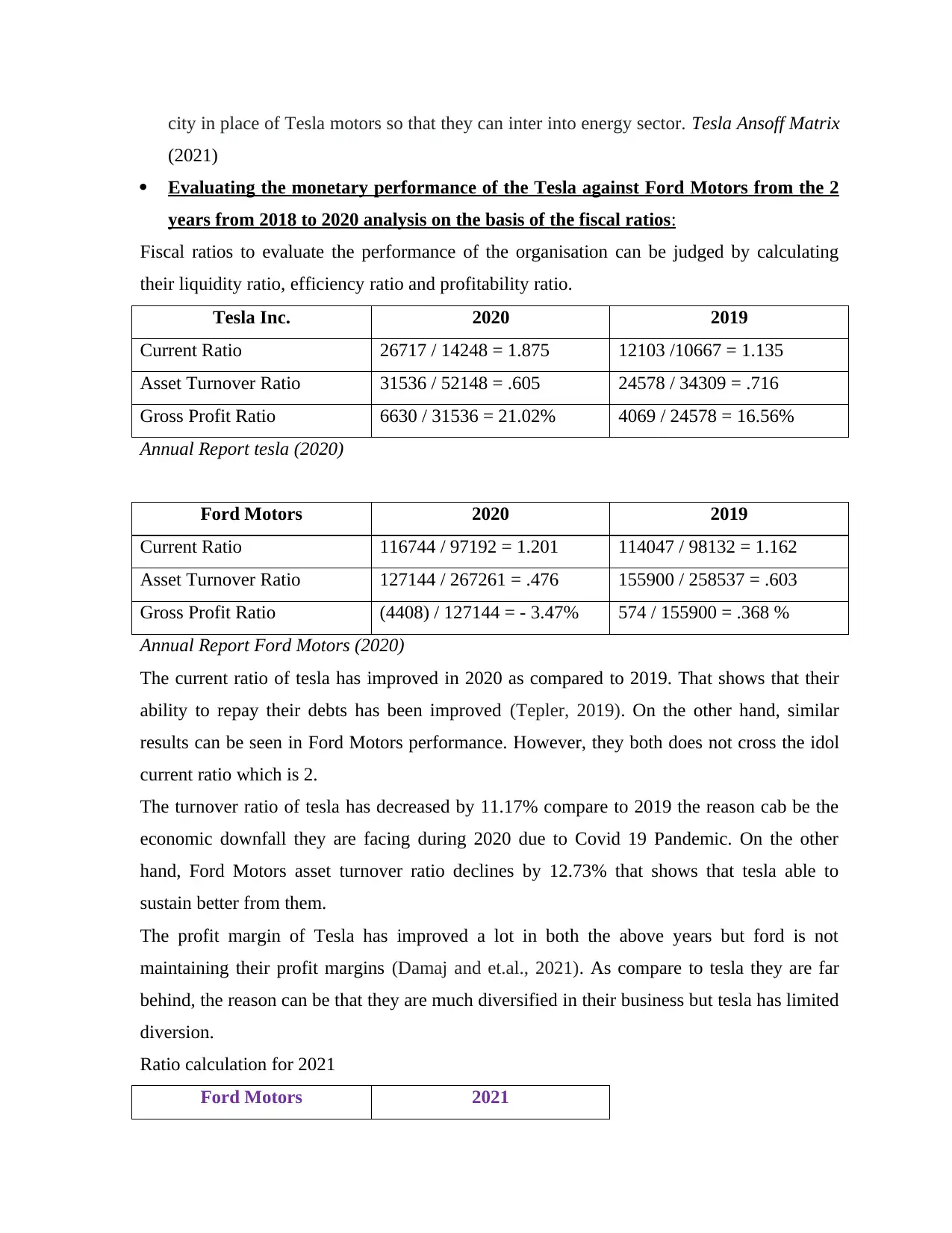

Ratio calculation for 2021

Ford Motors 2021

(2021)

Evaluating the monetary performance of the Tesla against Ford Motors from the 2

years from 2018 to 2020 analysis on the basis of the fiscal ratios:

Fiscal ratios to evaluate the performance of the organisation can be judged by calculating

their liquidity ratio, efficiency ratio and profitability ratio.

Tesla Inc. 2020 2019

Current Ratio 26717 / 14248 = 1.875 12103 /10667 = 1.135

Asset Turnover Ratio 31536 / 52148 = .605 24578 / 34309 = .716

Gross Profit Ratio 6630 / 31536 = 21.02% 4069 / 24578 = 16.56%

Annual Report tesla (2020)

Ford Motors 2020 2019

Current Ratio 116744 / 97192 = 1.201 114047 / 98132 = 1.162

Asset Turnover Ratio 127144 / 267261 = .476 155900 / 258537 = .603

Gross Profit Ratio (4408) / 127144 = - 3.47% 574 / 155900 = .368 %

Annual Report Ford Motors (2020)

The current ratio of tesla has improved in 2020 as compared to 2019. That shows that their

ability to repay their debts has been improved (Tepler, 2019). On the other hand, similar

results can be seen in Ford Motors performance. However, they both does not cross the idol

current ratio which is 2.

The turnover ratio of tesla has decreased by 11.17% compare to 2019 the reason cab be the

economic downfall they are facing during 2020 due to Covid 19 Pandemic. On the other

hand, Ford Motors asset turnover ratio declines by 12.73% that shows that tesla able to

sustain better from them.

The profit margin of Tesla has improved a lot in both the above years but ford is not

maintaining their profit margins (Damaj and et.al., 2021). As compare to tesla they are far

behind, the reason can be that they are much diversified in their business but tesla has limited

diversion.

Ratio calculation for 2021

Ford Motors 2021

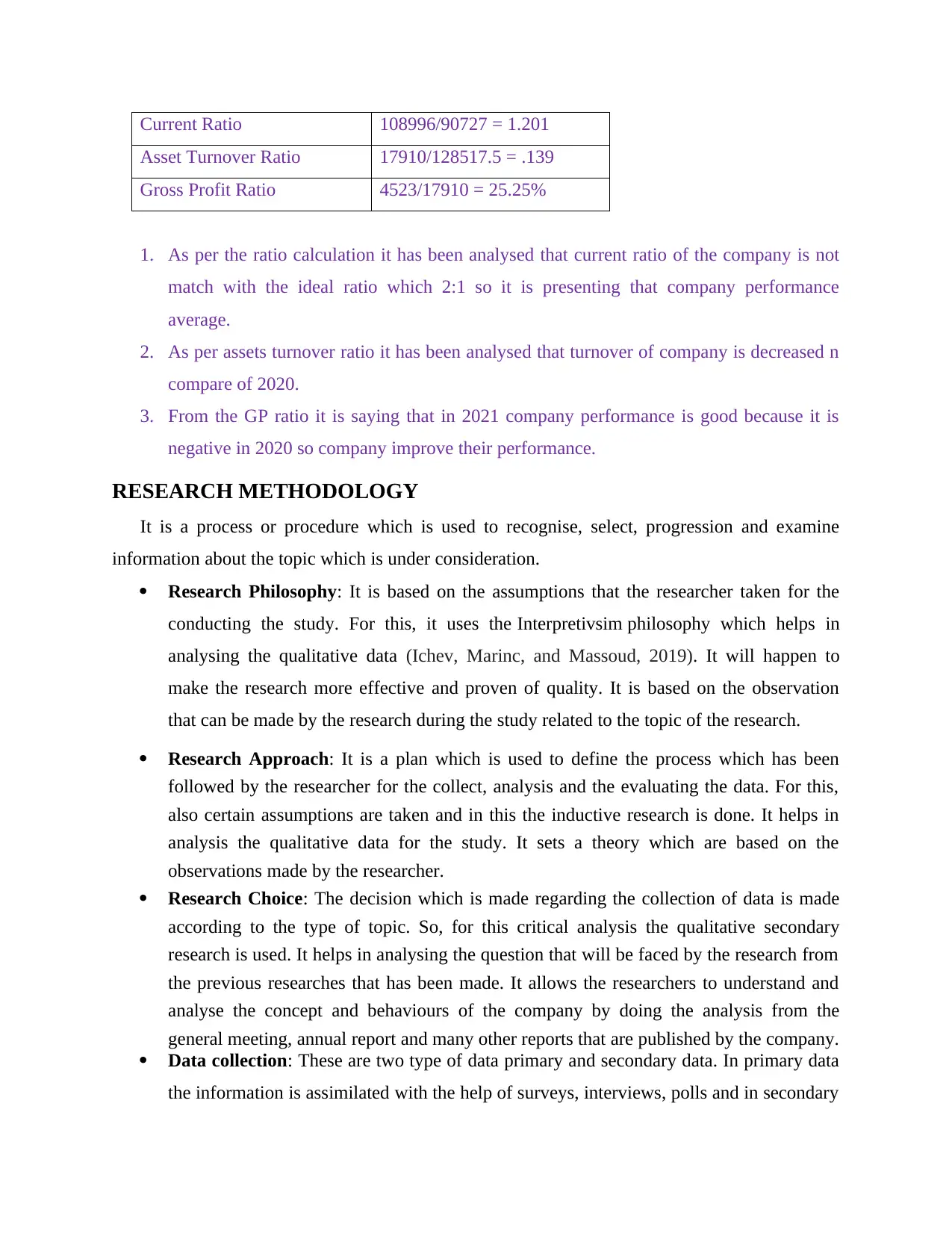

Current Ratio 108996/90727 = 1.201

Asset Turnover Ratio 17910/128517.5 = .139

Gross Profit Ratio 4523/17910 = 25.25%

1. As per the ratio calculation it has been analysed that current ratio of the company is not

match with the ideal ratio which 2:1 so it is presenting that company performance

average.

2. As per assets turnover ratio it has been analysed that turnover of company is decreased n

compare of 2020.

3. From the GP ratio it is saying that in 2021 company performance is good because it is

negative in 2020 so company improve their performance.

RESEARCH METHODOLOGY

It is a process or procedure which is used to recognise, select, progression and examine

information about the topic which is under consideration.

Research Philosophy: It is based on the assumptions that the researcher taken for the

conducting the study. For this, it uses the Interpretivsim philosophy which helps in

analysing the qualitative data (Ichev, Marinc, and Massoud, 2019). It will happen to

make the research more effective and proven of quality. It is based on the observation

that can be made by the research during the study related to the topic of the research.

Research Approach: It is a plan which is used to define the process which has been

followed by the researcher for the collect, analysis and the evaluating the data. For this,

also certain assumptions are taken and in this the inductive research is done. It helps in

analysis the qualitative data for the study. It sets a theory which are based on the

observations made by the researcher.

Research Choice: The decision which is made regarding the collection of data is made

according to the type of topic. So, for this critical analysis the qualitative secondary

research is used. It helps in analysing the question that will be faced by the research from

the previous researches that has been made. It allows the researchers to understand and

analyse the concept and behaviours of the company by doing the analysis from the

general meeting, annual report and many other reports that are published by the company.

Data collection: These are two type of data primary and secondary data. In primary data

the information is assimilated with the help of surveys, interviews, polls and in secondary

Asset Turnover Ratio 17910/128517.5 = .139

Gross Profit Ratio 4523/17910 = 25.25%

1. As per the ratio calculation it has been analysed that current ratio of the company is not

match with the ideal ratio which 2:1 so it is presenting that company performance

average.

2. As per assets turnover ratio it has been analysed that turnover of company is decreased n

compare of 2020.

3. From the GP ratio it is saying that in 2021 company performance is good because it is

negative in 2020 so company improve their performance.

RESEARCH METHODOLOGY

It is a process or procedure which is used to recognise, select, progression and examine

information about the topic which is under consideration.

Research Philosophy: It is based on the assumptions that the researcher taken for the

conducting the study. For this, it uses the Interpretivsim philosophy which helps in

analysing the qualitative data (Ichev, Marinc, and Massoud, 2019). It will happen to

make the research more effective and proven of quality. It is based on the observation

that can be made by the research during the study related to the topic of the research.

Research Approach: It is a plan which is used to define the process which has been

followed by the researcher for the collect, analysis and the evaluating the data. For this,

also certain assumptions are taken and in this the inductive research is done. It helps in

analysis the qualitative data for the study. It sets a theory which are based on the

observations made by the researcher.

Research Choice: The decision which is made regarding the collection of data is made

according to the type of topic. So, for this critical analysis the qualitative secondary

research is used. It helps in analysing the question that will be faced by the research from

the previous researches that has been made. It allows the researchers to understand and

analyse the concept and behaviours of the company by doing the analysis from the

general meeting, annual report and many other reports that are published by the company.

Data collection: These are two type of data primary and secondary data. In primary data

the information is assimilated with the help of surveys, interviews, polls and in secondary

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

data it is done through the internet information based on the topic, sales reports and many

more (Loist, 2020). In this overall procedure that has been followed by the researchers is

included. As in this researcher, secondary research is used, so for this the qualitative data

will be collected. It will help in accumulating the data through the help of journal,

articles, documents published by the company and newspapers and many other aspects.

Research Instrument: For getting the data which is needed for conducting the study, the

research has to first collect the data from various sources such as newspapers, article,

case study and many more. In the type of qualitative research, the instrument that will

used is the observations, case study and the document analysis of the organisation. On the

basis of this, the research analysis is formulated. It helps in performance evaluation

which is a tool to appraise the research project.

Primary data: For the sole aim of resolving the author's study topic, primary data is information

that was created for the initial time by the investigator via personal efforts and expertise. usually

defined as raw data or first-hand information. Since the company or agency doing the study must

spend in resources like money and labour, collecting primary data is extremely costly. The

researcher is directly in charge of and overseeing the data collecting.

Advantage:

Primary data advantages from its validity, particular presence, and up-to-date data, but

secondary data is relatively inexpensive and time-consuming.

Primary data is particularly reliable because it is basically impartial and collected from

the source directly. In comparison to secondary information, this also gives up-to-date

information on a certain study subject.

Secondary day, on the other hand, is not expensive, allowing secondary education more

accessible for people. This doesn't take too long, and practically all secondary sources of

information are easily accessible for nothing.

Disadvantage: The drawback of primary data is the cost and effort involved in data collection,

while secondary data may be unreliable or unimportant. Primary data are expensive and time-

consuming because of the evident steps involved in doing primary research.

Secondary data: The term "secondary data" refers to information that has previously been

collected and stored from someone other than the consumer for a reason unrelated to the present

study issue. It is the easily accessible format of data gathered from a variety of resources,

more (Loist, 2020). In this overall procedure that has been followed by the researchers is

included. As in this researcher, secondary research is used, so for this the qualitative data

will be collected. It will help in accumulating the data through the help of journal,

articles, documents published by the company and newspapers and many other aspects.

Research Instrument: For getting the data which is needed for conducting the study, the

research has to first collect the data from various sources such as newspapers, article,

case study and many more. In the type of qualitative research, the instrument that will

used is the observations, case study and the document analysis of the organisation. On the

basis of this, the research analysis is formulated. It helps in performance evaluation

which is a tool to appraise the research project.

Primary data: For the sole aim of resolving the author's study topic, primary data is information

that was created for the initial time by the investigator via personal efforts and expertise. usually

defined as raw data or first-hand information. Since the company or agency doing the study must

spend in resources like money and labour, collecting primary data is extremely costly. The

researcher is directly in charge of and overseeing the data collecting.

Advantage:

Primary data advantages from its validity, particular presence, and up-to-date data, but

secondary data is relatively inexpensive and time-consuming.

Primary data is particularly reliable because it is basically impartial and collected from

the source directly. In comparison to secondary information, this also gives up-to-date

information on a certain study subject.

Secondary day, on the other hand, is not expensive, allowing secondary education more

accessible for people. This doesn't take too long, and practically all secondary sources of

information are easily accessible for nothing.

Disadvantage: The drawback of primary data is the cost and effort involved in data collection,

while secondary data may be unreliable or unimportant. Primary data are expensive and time-

consuming because of the evident steps involved in doing primary research.

Secondary data: The term "secondary data" refers to information that has previously been

collected and stored from someone other than the consumer for a reason unrelated to the present

study issue. It is the easily accessible format of data gathered from a variety of resources,

including censuses, published material, firm ’s internal documents, reports, books, scientific

journals, blogs, and more.

Advantage:

In comparison to actual information, secondary data is more freely available. Secondary

data is readily available on several sites that the investigator can access.

Secondary data is fairly inexpensive. It costs almost nothing to obtain them since they are

occasionally handed free of charge.

Secondary data collection often takes far less time than initial data collection.

Disadvantage:

Secondary data might not be trustworthy and genuine. The information gathered from the

promote public may have to be additionally verified by the investigator.

When discovering the necessary data, investigators might have to handle with irrelevant

information.

Because of the information source's own bias, a portion of the information is overstated.

There may not always be updated published data to update secondary data sources.

ANALYSIS

SWOT

After analysing the annual report of Tesla Plc for the period 2019 and 2020, the Author has

identified certain key factor as explained in each category that determine the strategy of tesla.

Strength: The automobile sector expands on regular basis due to technological changes

taken place over the period of time from petrol, diesel car to batter made cars. Tesla has

recognised the need to serve their consumers with premium and luxury comfort they

wanted in today’s world (Metsälä, and Fridell, 2018). This will make them different from

their rivals as they are first mover in technological advancement from day 1. Overall, the

Author has viewed that targeting premium customer with premium electric cars are their

strength in the long run as they invest heavy in research and development to generate

different product.

Weakness: The Authors recognise that Tesla has invested hug amount of investment in

research and development due to which their operating cash flows has become negative.

On the other hand, ford motors develop their strategy according to need of market

journals, blogs, and more.

Advantage:

In comparison to actual information, secondary data is more freely available. Secondary

data is readily available on several sites that the investigator can access.

Secondary data is fairly inexpensive. It costs almost nothing to obtain them since they are

occasionally handed free of charge.

Secondary data collection often takes far less time than initial data collection.

Disadvantage:

Secondary data might not be trustworthy and genuine. The information gathered from the

promote public may have to be additionally verified by the investigator.

When discovering the necessary data, investigators might have to handle with irrelevant

information.

Because of the information source's own bias, a portion of the information is overstated.

There may not always be updated published data to update secondary data sources.

ANALYSIS

SWOT

After analysing the annual report of Tesla Plc for the period 2019 and 2020, the Author has

identified certain key factor as explained in each category that determine the strategy of tesla.

Strength: The automobile sector expands on regular basis due to technological changes

taken place over the period of time from petrol, diesel car to batter made cars. Tesla has

recognised the need to serve their consumers with premium and luxury comfort they

wanted in today’s world (Metsälä, and Fridell, 2018). This will make them different from

their rivals as they are first mover in technological advancement from day 1. Overall, the

Author has viewed that targeting premium customer with premium electric cars are their

strength in the long run as they invest heavy in research and development to generate

different product.

Weakness: The Authors recognise that Tesla has invested hug amount of investment in

research and development due to which their operating cash flows has become negative.

On the other hand, ford motors develop their strategy according to need of market

therefore they generate positive cash flows. Authors observed that due to highly complex

engineering in electric vehicle segment, their electric cars and other energy products they

produced exhibited higher cash outflows which needs to be monitor after regular

intervals. In order to remain in market tesla needs to avoid expenditure on new product

that creates burden on them (Keykha, 2018). They can adopt Ford marketing strategies by

diversifying themselves in different sector so that their weakness will become strength

that provides additional competitive advantage. In 2019 Ford spend around 8 billion

dollars on R&D while tesla only spent 1.50 billion but the difference that is created is

operating cost which $157.134 billion in Tesla where the ford spending restricted to

$21.849 billion. As per Author view an above operating cost needs to curtain to generate

positive cash flows for Tesla. For tesla as a whole diversification allows the company to

generate more revenue such as ford diversify in gas, hybrid, diesel, electric vehicle and

many more.

Opportunities: In order to satisfy the needs of shareholders and customer satisfaction,

tesla is working to reduce the cost of lithium battery their electric car segment as its play

a major role so that cost of final product is reduced to certain extent. Author has

determined that electric segment has tremendous growth but cost needs to be consider so

that other competitor does not overrule them as market is shifting towards electric car

segment in the global market (Herliana, Lawiyah, and Aina, 2018). Further there are

strategic growth opportunities that tesla holds as the consumer are shifting towards low

carbon lifestyle and they are preferring renewable energy products nowadays. However

as per Author’s view point their target audience is limited to premium consumers which

needs to be broader globally by targeting one level below the above class that to increase

the customer base they hold currently.

Threats: The growth in automobile sector which respect to shifting towards electric car

segment, renewable energy products etc. likely to impact tesla strategy due to consumer

and geographical access contributes towards growth in business transactions. Threat to

tesla with ford motors can be the other players such as Toyota, Nissan, BMW etc.

regularly creating new ideas and approaches for EVs as they are trying to establish their

name in EV market. As compare to tesla which has targeted audience, it is clearly audible

engineering in electric vehicle segment, their electric cars and other energy products they

produced exhibited higher cash outflows which needs to be monitor after regular

intervals. In order to remain in market tesla needs to avoid expenditure on new product

that creates burden on them (Keykha, 2018). They can adopt Ford marketing strategies by

diversifying themselves in different sector so that their weakness will become strength

that provides additional competitive advantage. In 2019 Ford spend around 8 billion

dollars on R&D while tesla only spent 1.50 billion but the difference that is created is

operating cost which $157.134 billion in Tesla where the ford spending restricted to

$21.849 billion. As per Author view an above operating cost needs to curtain to generate

positive cash flows for Tesla. For tesla as a whole diversification allows the company to

generate more revenue such as ford diversify in gas, hybrid, diesel, electric vehicle and

many more.

Opportunities: In order to satisfy the needs of shareholders and customer satisfaction,

tesla is working to reduce the cost of lithium battery their electric car segment as its play

a major role so that cost of final product is reduced to certain extent. Author has

determined that electric segment has tremendous growth but cost needs to be consider so

that other competitor does not overrule them as market is shifting towards electric car

segment in the global market (Herliana, Lawiyah, and Aina, 2018). Further there are

strategic growth opportunities that tesla holds as the consumer are shifting towards low

carbon lifestyle and they are preferring renewable energy products nowadays. However

as per Author’s view point their target audience is limited to premium consumers which

needs to be broader globally by targeting one level below the above class that to increase

the customer base they hold currently.

Threats: The growth in automobile sector which respect to shifting towards electric car

segment, renewable energy products etc. likely to impact tesla strategy due to consumer

and geographical access contributes towards growth in business transactions. Threat to

tesla with ford motors can be the other players such as Toyota, Nissan, BMW etc.

regularly creating new ideas and approaches for EVs as they are trying to establish their

name in EV market. As compare to tesla which has targeted audience, it is clearly audible

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

that ford motors have facing multiple issues with respect to finding customers who are

ready to invest their funds in their electric vehicle (Kurmanalina, and et.al., 2020).

The Author believes that SWOT Analysis is an important model in automobile industry as it

indicates the effect of external influences which would likely to impact the strategy of the

organisation and performance in future. A suggestion can be drawn that since model can be

adjusted with external factors and condition of market, therefore organisation must adjust their

business strategies accordingly which suits their market conditions.

PESTLE

Based on the assessment on external environment, automobile manufactures can adopt

specific strategies so that they can maintain their share in market. Therefore, it is important for

such manufacturers to develop and modify their business strategies that fulfils entity’s financial

return and customer satisfaction.

Political: Tesla has a political advantage in terms of government grant they receive from

the UK government. Further due to global trade agreement and political stability in major

markets tesla gets an opportunity to expand their business. On the other hand, ford motors

have un stability in European countries (Işık, and et.al., 2018). Their political stability

isn’t good except in Asian countries where they got much better success. Author is of the

view that Tesla should target Asian markets who considerably accepting the change by

way of EV in auto segment.

Economical: Tesla has an opportunity due to decrease in battery cost and renewable

energy product cost as their business get benefited from such reduction. However, they

face economic stability issues in countries like Europe and Asia as their vehicle cost is

high and only afforded by limited customers. On the other hand, Ford has government

support for technological innovation they carried out and infrastructure they built in

developing countries that makes them in front from tesla which is an opportunity for

them.

Social: Tesla is directly contributing to environment as they are working in electric

vehicle and renewable energy products that provides them competitive advantage as

compare to other players in auto segment (Liu and Xu, 2018). However, ford motors

need to work on their electric segment by implementing extensive marketing strategies.

ready to invest their funds in their electric vehicle (Kurmanalina, and et.al., 2020).

The Author believes that SWOT Analysis is an important model in automobile industry as it

indicates the effect of external influences which would likely to impact the strategy of the

organisation and performance in future. A suggestion can be drawn that since model can be

adjusted with external factors and condition of market, therefore organisation must adjust their

business strategies accordingly which suits their market conditions.

PESTLE

Based on the assessment on external environment, automobile manufactures can adopt

specific strategies so that they can maintain their share in market. Therefore, it is important for

such manufacturers to develop and modify their business strategies that fulfils entity’s financial

return and customer satisfaction.

Political: Tesla has a political advantage in terms of government grant they receive from

the UK government. Further due to global trade agreement and political stability in major

markets tesla gets an opportunity to expand their business. On the other hand, ford motors

have un stability in European countries (Işık, and et.al., 2018). Their political stability

isn’t good except in Asian countries where they got much better success. Author is of the

view that Tesla should target Asian markets who considerably accepting the change by

way of EV in auto segment.

Economical: Tesla has an opportunity due to decrease in battery cost and renewable

energy product cost as their business get benefited from such reduction. However, they

face economic stability issues in countries like Europe and Asia as their vehicle cost is

high and only afforded by limited customers. On the other hand, Ford has government

support for technological innovation they carried out and infrastructure they built in

developing countries that makes them in front from tesla which is an opportunity for

them.

Social: Tesla is directly contributing to environment as they are working in electric

vehicle and renewable energy products that provides them competitive advantage as

compare to other players in auto segment (Liu and Xu, 2018). However, ford motors

need to work on their electric segment by implementing extensive marketing strategies.

Author is of the opinion that social factors always support tesla initially but in long run

they need to diversify in order to maximise their profits.

Technological: The final product tesla produces directly depend on the available

technology’s Such as material engineering technology defines the cost of batteries they

input in EVs. Technological changes with higher rate creates an opportunity and threat to

them as they need to remain updated towards the product they offer. However, ford

market share in EV is not higher and they also have limited network in terms of alternate

fuel stations that needs to be improvise.

Legal: Laws and regulation are the surrounding body of a corporate and they need to

work around it as their managerial and business development decision depending upon

laws and regulation made for them. Tesla can expand their business overseas easily as

there is international patent protection. There is an opportunity exist for their EVs and

other energy products as their Client must follow energy consumption regulations. On

the other hand, ford macro environment is improving due to intellectual proper laws that

gives protection to their intellectual properties and rights.

Environmental: Tesla is a global leader in terms of safeguarding the environment as

their business model directly linked with them. Due to rising of standards with respect to

waste disposal, Extension of programs for environment etc. gives opportunity to them to

promote their vehicle.

Overall Author has identified that Pestle model is the key tool in order to analyse the impact

of external factor on entity’s business. Further the research gathered above highlights the

importance of external factors affecting the business that must be addressed for sustainable

returns in future. On the other hand, ford motors are far behind them and they to give more

emphasize on product innovation in improve their performance.

FOUR Ps MARKETING MIX

The marketing mix or 4Ps are marketing strategies used by the business concern to set out

their marketing plan. Tesla has maintained substantial control over its marketing mix. Such

control increases their effectiveness in order to reaching out their targeted audience.

Product: Product that tesla offer to their customer is automobiles, electric vehicle,

batteries, energy storage, and solar panels. However, they majorly focus on electric

they need to diversify in order to maximise their profits.

Technological: The final product tesla produces directly depend on the available

technology’s Such as material engineering technology defines the cost of batteries they

input in EVs. Technological changes with higher rate creates an opportunity and threat to

them as they need to remain updated towards the product they offer. However, ford

market share in EV is not higher and they also have limited network in terms of alternate

fuel stations that needs to be improvise.

Legal: Laws and regulation are the surrounding body of a corporate and they need to

work around it as their managerial and business development decision depending upon

laws and regulation made for them. Tesla can expand their business overseas easily as

there is international patent protection. There is an opportunity exist for their EVs and

other energy products as their Client must follow energy consumption regulations. On

the other hand, ford macro environment is improving due to intellectual proper laws that

gives protection to their intellectual properties and rights.

Environmental: Tesla is a global leader in terms of safeguarding the environment as

their business model directly linked with them. Due to rising of standards with respect to

waste disposal, Extension of programs for environment etc. gives opportunity to them to

promote their vehicle.

Overall Author has identified that Pestle model is the key tool in order to analyse the impact

of external factor on entity’s business. Further the research gathered above highlights the

importance of external factors affecting the business that must be addressed for sustainable

returns in future. On the other hand, ford motors are far behind them and they to give more

emphasize on product innovation in improve their performance.

FOUR Ps MARKETING MIX

The marketing mix or 4Ps are marketing strategies used by the business concern to set out

their marketing plan. Tesla has maintained substantial control over its marketing mix. Such

control increases their effectiveness in order to reaching out their targeted audience.

Product: Product that tesla offer to their customer is automobiles, electric vehicle,

batteries, energy storage, and solar panels. However, they majorly focus on electric

vehicles as they are growing and expanding its business globally. The company offers

battery and residential and industrial use and after acquiring Solar city corporation they

start selling solar penal as well (Deshmukh, Kadam, and Dhoble, 2022). On the other

hand, ford offer variety of products such as automobiles, trucks, buses, tractors and

related parts and components. They have a diversifies product mix that gives an

advantage to them to cover the loss of one segment against profit of others. Tesla need to

diversify their business so that they can compete their competitors in other segment also

that will enhance their profitability too.

Place: Tesla sells their product using the stores they owned, through their website etc.

The customer can check out their product through different galleries located in multiple

malls. On the other hand, ford motors have wide distribution network through its wide

dealership, auto parts store they hold in Asian and other markets. On overall basis the

author concludes that ford has wide distribution network therefore their reach to customer

is far away as compare to tesla.

Promotion: Tesla promote their product using marketing which get spread with fast rate.

However, their product is sold to customer through personal selling they take place or

sales promotional activities too. As far as ford is concerned they uses conventional tactics

to sell their products and services. They mainly focus on advertisement to target their

audience. In addition to that they have multiple sales agents who approach the customer

in order to persuade them to sales dealers.

Price: Since tesla is a premium brand therefore they charge higher price for the product

and services they sold to customer. They follow premium pricing strategy and market

oriented approach to target their audience. Customer are ready to pay relatively higher

price for tesla automobiles as their product are advanced in terms of technology and

innovation. Ford pricing strategy differs on the basis of demand of market and they have

their products for premium customers also. The overall strategy for both the companies

varies as per their requirement and wide selected customer base.

ANSOFF MATRIX

Market Penetration: Tesla uses market penetration strategy extensively that can be

reflected from the product they sold such as in car segment Model S, Model X and Model

3 electric vehicle are best in class in their segment. Similarly, they are market leader in

battery and residential and industrial use and after acquiring Solar city corporation they

start selling solar penal as well (Deshmukh, Kadam, and Dhoble, 2022). On the other

hand, ford offer variety of products such as automobiles, trucks, buses, tractors and

related parts and components. They have a diversifies product mix that gives an

advantage to them to cover the loss of one segment against profit of others. Tesla need to

diversify their business so that they can compete their competitors in other segment also

that will enhance their profitability too.

Place: Tesla sells their product using the stores they owned, through their website etc.

The customer can check out their product through different galleries located in multiple

malls. On the other hand, ford motors have wide distribution network through its wide

dealership, auto parts store they hold in Asian and other markets. On overall basis the

author concludes that ford has wide distribution network therefore their reach to customer

is far away as compare to tesla.

Promotion: Tesla promote their product using marketing which get spread with fast rate.

However, their product is sold to customer through personal selling they take place or

sales promotional activities too. As far as ford is concerned they uses conventional tactics

to sell their products and services. They mainly focus on advertisement to target their

audience. In addition to that they have multiple sales agents who approach the customer

in order to persuade them to sales dealers.

Price: Since tesla is a premium brand therefore they charge higher price for the product

and services they sold to customer. They follow premium pricing strategy and market

oriented approach to target their audience. Customer are ready to pay relatively higher

price for tesla automobiles as their product are advanced in terms of technology and

innovation. Ford pricing strategy differs on the basis of demand of market and they have

their products for premium customers also. The overall strategy for both the companies

varies as per their requirement and wide selected customer base.

ANSOFF MATRIX

Market Penetration: Tesla uses market penetration strategy extensively that can be

reflected from the product they sold such as in car segment Model S, Model X and Model

3 electric vehicle are best in class in their segment. Similarly, they are market leader in

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

their energy storage products too. However, ford penetrate the market with aggressive

promotional tools such as social media, television, print media etc.

Market Development: Tesla starts diversifying their business in different sector as they

invested in 10000-acre plot in Nevada where they extract metal that is used by them

lithium refinery. They are diversifying as the need suggest whereas in product

development ford is far better from them as they already diversify in various sector in

different nations (Candelo, 2019).

Market Development: Tesla is evaluating the new markets for their existing products as

they enter into Indian market which is strategically an appropriate decision as India is

shifting towards electrical vehicle segment day by day. On the other hand, ford need to

work hard in EV segment as they do not hold sufficient customer base worldwide which

make them behind Tesla.

Diversification: Tesla from the beginning diversify their business starting from electric

vehicle manufactures in 2003 to acquiring solar company solar city in 2016 so that they

can enter into energy storage sector too. Whereas ford diversify their business in single

segment only and there is room for them to diversify such as consumer electronics

segment, equipment, hospitality where they earn their margins effectively. The overall

conclusion can be made that tesla positioning with respect to diversion is better as

compared to ford motors.

RATIO ANALYSIS

In this section the Author decided to analyse the financial statement of both the

automobile companies. The profit margins, current ratio, asset turnover ratio is analysed as they

are inter related to each other and compared on same parameters.

Initially the Author is intended to analyse the gearing ratio of both the automobile manufactures

but due to limitation in comparison of financial statements only certain amount of ratios have

been analysed and concluded accordingly (Tepler, 2019). Due to limitation, the Author chooses

to analyse current ratio, asset turnover ratio and gross profit ratio of tesla and ford motors. As a

result, the Author provides comparative analysis of above-mentioned ratio in following three

different categories depicted below:

promotional tools such as social media, television, print media etc.

Market Development: Tesla starts diversifying their business in different sector as they

invested in 10000-acre plot in Nevada where they extract metal that is used by them

lithium refinery. They are diversifying as the need suggest whereas in product

development ford is far better from them as they already diversify in various sector in

different nations (Candelo, 2019).

Market Development: Tesla is evaluating the new markets for their existing products as

they enter into Indian market which is strategically an appropriate decision as India is

shifting towards electrical vehicle segment day by day. On the other hand, ford need to

work hard in EV segment as they do not hold sufficient customer base worldwide which

make them behind Tesla.

Diversification: Tesla from the beginning diversify their business starting from electric

vehicle manufactures in 2003 to acquiring solar company solar city in 2016 so that they

can enter into energy storage sector too. Whereas ford diversify their business in single

segment only and there is room for them to diversify such as consumer electronics

segment, equipment, hospitality where they earn their margins effectively. The overall

conclusion can be made that tesla positioning with respect to diversion is better as

compared to ford motors.

RATIO ANALYSIS

In this section the Author decided to analyse the financial statement of both the

automobile companies. The profit margins, current ratio, asset turnover ratio is analysed as they

are inter related to each other and compared on same parameters.

Initially the Author is intended to analyse the gearing ratio of both the automobile manufactures

but due to limitation in comparison of financial statements only certain amount of ratios have

been analysed and concluded accordingly (Tepler, 2019). Due to limitation, the Author chooses

to analyse current ratio, asset turnover ratio and gross profit ratio of tesla and ford motors. As a

result, the Author provides comparative analysis of above-mentioned ratio in following three

different categories depicted below:

Profitability Ratio: These ratios assess the ability of the organisation to earn operating

profits from their sales, business operations, different items of balance sheet such as

equity, non-current assets, noncurrent liabilities etc. (Ashkezari, 2022). The gross profit

ratio of Tesla in the year 2020 and 2019 is 21.02% and 16.56% respectively. From the

view point of author there is an increase that shows their profit earning ability thought

they invest heavy in research but capable enough to cover that from sales they made.

They even maintain such high share in 2020 when global business giant suffering from

pandemic. On the other hand, ford margins are in negative in both the years which shoes

their inability to control their cost that simply means production cost is higher as compare

to revenue. Tesla is maintaining its position as the market leader by greater cost of sales

and less operational expenses in the year 2020. Overall the author has concluded that

Tesla has maintained steady positon in terms of margin both the years.

Liquidity Ratio: These are the financial ratio which helps in determining to ability of the

business enterprise to repay its debts in short as well as long term (Soyeh and Wiley,

2019). Current ratio has been calculated for both tesla and ford motors for the year 2020

and 2019. However as per author view Tesla has improved a bit as compare to year 2019

and reach to idol ratio in industry which is 1.50 which shows that they have good short

term capability to repay their obligation. Ford current ratio is below 1.50 in both 2020

and 2019 that indicates that they are investing in capital projects more that must be

delayed. Further they are re amortized their business loan and must sell the idol assets

they hold in business so that ratio can be improved. The conclusion drawn the author that

that tesla positioning is better in terms of liquidity as current ratio is an essential ratio in

automobile sector and tesla has maintained superior performance across this measure as

sales and growth are impressive.

Efficiency Ratio: These ratio highlights the income generation ability of the business

concern from the assets whether physical or intangible they have invested in business

(Mayer and et.al., 2020). The assets turnover ratio of Tesla in year 2020 and 2019 is .605

and .716 times which is considerably better as compare to ford which is .476 and .603

respectively as they simply showcase that they are utilising their assets more effectively

and efficiently. The author is of the view that both the companies are not utilising their

assets sufficiently since the ratio is less than 1 in Tesla and Ford also. Further the reason

profits from their sales, business operations, different items of balance sheet such as

equity, non-current assets, noncurrent liabilities etc. (Ashkezari, 2022). The gross profit

ratio of Tesla in the year 2020 and 2019 is 21.02% and 16.56% respectively. From the

view point of author there is an increase that shows their profit earning ability thought

they invest heavy in research but capable enough to cover that from sales they made.

They even maintain such high share in 2020 when global business giant suffering from

pandemic. On the other hand, ford margins are in negative in both the years which shoes

their inability to control their cost that simply means production cost is higher as compare

to revenue. Tesla is maintaining its position as the market leader by greater cost of sales

and less operational expenses in the year 2020. Overall the author has concluded that

Tesla has maintained steady positon in terms of margin both the years.

Liquidity Ratio: These are the financial ratio which helps in determining to ability of the

business enterprise to repay its debts in short as well as long term (Soyeh and Wiley,

2019). Current ratio has been calculated for both tesla and ford motors for the year 2020

and 2019. However as per author view Tesla has improved a bit as compare to year 2019

and reach to idol ratio in industry which is 1.50 which shows that they have good short

term capability to repay their obligation. Ford current ratio is below 1.50 in both 2020

and 2019 that indicates that they are investing in capital projects more that must be

delayed. Further they are re amortized their business loan and must sell the idol assets

they hold in business so that ratio can be improved. The conclusion drawn the author that

that tesla positioning is better in terms of liquidity as current ratio is an essential ratio in

automobile sector and tesla has maintained superior performance across this measure as

sales and growth are impressive.

Efficiency Ratio: These ratio highlights the income generation ability of the business

concern from the assets whether physical or intangible they have invested in business