Café Paradiso: Employee Induction Process

VerifiedAdded on 2023/04/07

|18

|5682

|211

AI Summary

This document provides information about the employee induction process at Café Paradiso, including the procedures followed to ensure employees are properly inducted into the organization.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Assessment Coversheet

Student Name CIT Number

Competency Title, Code and

Banner Code

CRN

MANAGE OPERATIONAL PLAN BSBMGT517

CRN

Assessment Type ☒ Written ☐ Case Study ☐ Project ☐ Presentation ☐ Other

Assessment Name ASSESSMENT TASK 3: WRITTEN TASK

Assessment Date

Student Statement: This assessment is my own work. Any ideas and comments made by other people have been

acknowledged. I understand that by emailing or submitting this assessment electronically, I agree to this statement.

Student Signature Date

PRIVACY DISCLAIMER: CIT is collecting your personal information for assessment purposes. The information will only be used in

accordance with the CIT Privacy Policy.

Assessor Feedback

Student provided with feedback

Attempt 1 ☐ Satisfactory ☐ Not Yet Satisfactory Date / /

Attempt 2 ☐ Satisfactory ☐ Not Yet Satisfactory Date / /

Assessor Name Assessor Signature

Note to Assessor: Please record any reasonable adjustment that has occurred for this assessment.

Instructions to Assessor

Work, Health and Safety: A work health and safety check of the assessment environment is to be conducted prior to the assessment and

any hazards addressed appropriately.

© Canberra Institute of Technology RTO Code 0101 Page 1 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

Student Name CIT Number

Competency Title, Code and

Banner Code

CRN

MANAGE OPERATIONAL PLAN BSBMGT517

CRN

Assessment Type ☒ Written ☐ Case Study ☐ Project ☐ Presentation ☐ Other

Assessment Name ASSESSMENT TASK 3: WRITTEN TASK

Assessment Date

Student Statement: This assessment is my own work. Any ideas and comments made by other people have been

acknowledged. I understand that by emailing or submitting this assessment electronically, I agree to this statement.

Student Signature Date

PRIVACY DISCLAIMER: CIT is collecting your personal information for assessment purposes. The information will only be used in

accordance with the CIT Privacy Policy.

Assessor Feedback

Student provided with feedback

Attempt 1 ☐ Satisfactory ☐ Not Yet Satisfactory Date / /

Attempt 2 ☐ Satisfactory ☐ Not Yet Satisfactory Date / /

Assessor Name Assessor Signature

Note to Assessor: Please record any reasonable adjustment that has occurred for this assessment.

Instructions to Assessor

Work, Health and Safety: A work health and safety check of the assessment environment is to be conducted prior to the assessment and

any hazards addressed appropriately.

© Canberra Institute of Technology RTO Code 0101 Page 1 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Information for Students: You may have two (2) attempts for this assessment.

If your first attempt is not successful, your teacher will discuss your results with you and

will arrange a second attempt.

If your second attempt is not successful, you will be required to re-enrol in this unit.

Only one re-assessment attempt will be granted for each assessment item.

Time Allowed: 3 weeks

Materials Provided:

Business plan and case study notes for Café Paradiso and Kingfisher Garden Centre

Templates for operational plan

Computer and internet access both in the class room and at the CIT Library on all

campuses

Assessment Range and Conditions:

This is an open book assessment, you can use the resources on elearn and the Didasko

learner guide.

This assessment will be made available after week 6 of this unit once the operational plan

has been written. The assessment must be saved as a pdf file and uploaded to elearn in the

appropriate dropbox by the due date.

Assessment Criteria: To achieve a Satisfactory result, your assessor will be looking for your

ability to demonstrate the key skills/tasks/knowledge detailed in the Assessment Task to

industry standard.

Key performance indicators

Contingency planning

Induction of staff according to HR policies

Organisational policies, practices and procedures relating to HR, procurement and

record management

Intellectual property requirements

Budget results

Improvements to budget performance

Mentoring and coaching

Variations to the operational plan

Legislative and regulatory requirements

Assessment Task Instructions for Students

This is a short answer task, reference your operational plan, read the case study and

business information given and answer the questions. You are expected to analyse the

information and explain your answers in detail. You can ask the CIT Restaurant staff and

teachers any questions to assist you with this assignment.

Type your answers into this document, save it as a pdf file on your desktop or usb, then

upload into elearn.

© Canberra Institute of Technology RTO Code 0101 Page 2 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

If your first attempt is not successful, your teacher will discuss your results with you and

will arrange a second attempt.

If your second attempt is not successful, you will be required to re-enrol in this unit.

Only one re-assessment attempt will be granted for each assessment item.

Time Allowed: 3 weeks

Materials Provided:

Business plan and case study notes for Café Paradiso and Kingfisher Garden Centre

Templates for operational plan

Computer and internet access both in the class room and at the CIT Library on all

campuses

Assessment Range and Conditions:

This is an open book assessment, you can use the resources on elearn and the Didasko

learner guide.

This assessment will be made available after week 6 of this unit once the operational plan

has been written. The assessment must be saved as a pdf file and uploaded to elearn in the

appropriate dropbox by the due date.

Assessment Criteria: To achieve a Satisfactory result, your assessor will be looking for your

ability to demonstrate the key skills/tasks/knowledge detailed in the Assessment Task to

industry standard.

Key performance indicators

Contingency planning

Induction of staff according to HR policies

Organisational policies, practices and procedures relating to HR, procurement and

record management

Intellectual property requirements

Budget results

Improvements to budget performance

Mentoring and coaching

Variations to the operational plan

Legislative and regulatory requirements

Assessment Task Instructions for Students

This is a short answer task, reference your operational plan, read the case study and

business information given and answer the questions. You are expected to analyse the

information and explain your answers in detail. You can ask the CIT Restaurant staff and

teachers any questions to assist you with this assignment.

Type your answers into this document, save it as a pdf file on your desktop or usb, then

upload into elearn.

© Canberra Institute of Technology RTO Code 0101 Page 2 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

Assessment Task 3: Written task

Q1. According to the original brief the restaurant re-style was to be completed by 7th

February. Looking at the timelines in your project, What you would do if the following

occurred:

1. The menus are not printed by February 6th and will be held up in printing until

February 10.

Answer – If the menus are not being printed by 6th of February, and the re-styling of the

restaurant is completed by 7th of February, it is likely that the restaurant would be opened

but there would be count of menu hand-out’s to serve them to the customers. However, an

alternative way could be taken to solve the problem. The owners could shorten the menu of

the restaurabt for a while by serving only the specials from 7th of February till 10th of

February. The special would be easy for the waiters to remember. It would aslo eliminate the

risk of not having a menu for the restaurant and serving the food not accordingly to the

customers’ as speials would have their own styles and essence while would allow the

customers’ to tase something out of the blue, thus making both the work easy.

2. The new tables have not been delivered on time, and won’t be installed until after

February 8.

Answer - After the re-styling of the restaurant, it is likely to be reopend. Although, the tables

that were ordered in place of the old once have not be delivered yet and likely to be

installed after 8th of February. In this case the restaurant could only serve take outs of the

special’s that they would be taking order from the restaurants. This is would solve the their

problem till the new tables are installed and set for the restaurant to be operational again.

This would be hard for the regular customers or for the new ones but adding additional

offers the specials would be helpful in comforting the customers for a while.

Q2. Look back at your operational plan. What are your KPI’s for the chef to produce the new

menu?

Answer – In a restaurant, it is important to track the key performance indicator for

enhancing the daily business. It is alos the key process for the accelareting the success of the

restaurant. There are different key performance indicator to measure and analyse in a

restaurant. The key performance indicator for that would be kept in mind for assessing the

chef in making the new menu. The following KPI’s are –

a. Menu item profit and popularity – It is to be monitored as hig-profit menu is

considered as great but sometimes it is independent of the sales and are insignificant

ot the statistical percentage. Popularity of the foods are also necessary as if the food

is not popular, customers’ are not ordering it and thus it is unnecessary to keep in the

menu then.

© Canberra Institute of Technology RTO Code 0101 Page 3 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

Q1. According to the original brief the restaurant re-style was to be completed by 7th

February. Looking at the timelines in your project, What you would do if the following

occurred:

1. The menus are not printed by February 6th and will be held up in printing until

February 10.

Answer – If the menus are not being printed by 6th of February, and the re-styling of the

restaurant is completed by 7th of February, it is likely that the restaurant would be opened

but there would be count of menu hand-out’s to serve them to the customers. However, an

alternative way could be taken to solve the problem. The owners could shorten the menu of

the restaurabt for a while by serving only the specials from 7th of February till 10th of

February. The special would be easy for the waiters to remember. It would aslo eliminate the

risk of not having a menu for the restaurant and serving the food not accordingly to the

customers’ as speials would have their own styles and essence while would allow the

customers’ to tase something out of the blue, thus making both the work easy.

2. The new tables have not been delivered on time, and won’t be installed until after

February 8.

Answer - After the re-styling of the restaurant, it is likely to be reopend. Although, the tables

that were ordered in place of the old once have not be delivered yet and likely to be

installed after 8th of February. In this case the restaurant could only serve take outs of the

special’s that they would be taking order from the restaurants. This is would solve the their

problem till the new tables are installed and set for the restaurant to be operational again.

This would be hard for the regular customers or for the new ones but adding additional

offers the specials would be helpful in comforting the customers for a while.

Q2. Look back at your operational plan. What are your KPI’s for the chef to produce the new

menu?

Answer – In a restaurant, it is important to track the key performance indicator for

enhancing the daily business. It is alos the key process for the accelareting the success of the

restaurant. There are different key performance indicator to measure and analyse in a

restaurant. The key performance indicator for that would be kept in mind for assessing the

chef in making the new menu. The following KPI’s are –

a. Menu item profit and popularity – It is to be monitored as hig-profit menu is

considered as great but sometimes it is independent of the sales and are insignificant

ot the statistical percentage. Popularity of the foods are also necessary as if the food

is not popular, customers’ are not ordering it and thus it is unnecessary to keep in the

menu then.

© Canberra Institute of Technology RTO Code 0101 Page 3 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

b. Production time per dish – It is also necessary to know the preparation time for the

dishes in the menu to know. It would be helpful to know the if some dishes are

taking more time in making or less time as according to the preparation time, the

new menu should be created. However, if some food is taken immense amount of

time in production then it is not wise to keep that dish in the menu as it would be

foolish to make the customers wait, it would create a bad image and impression

among the customers.

c. Best and worst selling items – According to the popularity, the menu is categorized as

the best and worst selling items. It is necessary to know the what are the best and

wort selling items of the restaurant. With the help of this data, it would be necessary

for the chef to analze the make the menu accordingly ot that.

d. Food wasted per food purchased – It is also considered as an important factor for the

chef to measure as the key performance indicator. Accordingly to the new laws,

wasted on off is highly prohibited and it is the responsibility of the restaurant to

monitor the wastage of food. Thus, the chef should keep in mind the

How will you measure the KPI’s?

Answer – The above mentioned key performance idicators are necessary for the chef in

creating the new menu of the restaurant. There sould be methods and modes of measuring

the key performance indicators too.

The primary step for measuring the key performance indicator are

a. Establishing the goals and objectives

b. For the goals and the objectives, critical success factirs are also needed to be

established.

c. The measures for the respestive charectors is needed to be collected.

d. Calculation of the metrics for the measures is needed.

What will you do if the Chef does not meet the expected KPI’s?

Answers – Before taking any rash decisions that would harm the restaurant, it should be

analysed the reason behind why the chef is not meeting the expected key performance

indicators. It should be monitored that why the chef is not able to meet the expected KPI’s,

is is due to internal factors or it is due to personal ddrawbacks. After realising the reasons, it

should be solved taking in account the concrens of the chelf too.

The following documents are an excerpt from the business plan for a new venture proposed

by Brendan and Margaret Elliott called Café Paradiso. Read through the following and then

answer the questions.

© Canberra Institute of Technology RTO Code 0101 Page 4 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

dishes in the menu to know. It would be helpful to know the if some dishes are

taking more time in making or less time as according to the preparation time, the

new menu should be created. However, if some food is taken immense amount of

time in production then it is not wise to keep that dish in the menu as it would be

foolish to make the customers wait, it would create a bad image and impression

among the customers.

c. Best and worst selling items – According to the popularity, the menu is categorized as

the best and worst selling items. It is necessary to know the what are the best and

wort selling items of the restaurant. With the help of this data, it would be necessary

for the chef to analze the make the menu accordingly ot that.

d. Food wasted per food purchased – It is also considered as an important factor for the

chef to measure as the key performance indicator. Accordingly to the new laws,

wasted on off is highly prohibited and it is the responsibility of the restaurant to

monitor the wastage of food. Thus, the chef should keep in mind the

How will you measure the KPI’s?

Answer – The above mentioned key performance idicators are necessary for the chef in

creating the new menu of the restaurant. There sould be methods and modes of measuring

the key performance indicators too.

The primary step for measuring the key performance indicator are

a. Establishing the goals and objectives

b. For the goals and the objectives, critical success factirs are also needed to be

established.

c. The measures for the respestive charectors is needed to be collected.

d. Calculation of the metrics for the measures is needed.

What will you do if the Chef does not meet the expected KPI’s?

Answers – Before taking any rash decisions that would harm the restaurant, it should be

analysed the reason behind why the chef is not meeting the expected key performance

indicators. It should be monitored that why the chef is not able to meet the expected KPI’s,

is is due to internal factors or it is due to personal ddrawbacks. After realising the reasons, it

should be solved taking in account the concrens of the chelf too.

The following documents are an excerpt from the business plan for a new venture proposed

by Brendan and Margaret Elliott called Café Paradiso. Read through the following and then

answer the questions.

© Canberra Institute of Technology RTO Code 0101 Page 4 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

7.0 Human Resource Management

The management of the business comprises Brendan and Margaret Elliott who between them

have significant experience in the hospitality industry. Brendan is a qualified chef and has

successfully managed a number of restaurants both here and overseas. Margaret has

experience in the ‘front’ and ‘back’ offices of resort hotels and is highly respected in the

industry for her management skills.

The maximum staff requirement (including the owners) is estimated at 6 employees. Two of

the employees will be employed on a part-time basis. The main skill sets required are food

preparation, sales, customer service, front counter, stock control and management. It is

planned to retain two staff members from the previous ownership and recruit two more

appropriately qualified staff. We will be taking them through our in-house induction program

prior to opening.

Salaries and wages in the first year are estimated at $182,000 and $200,000 in the second

year of operation.

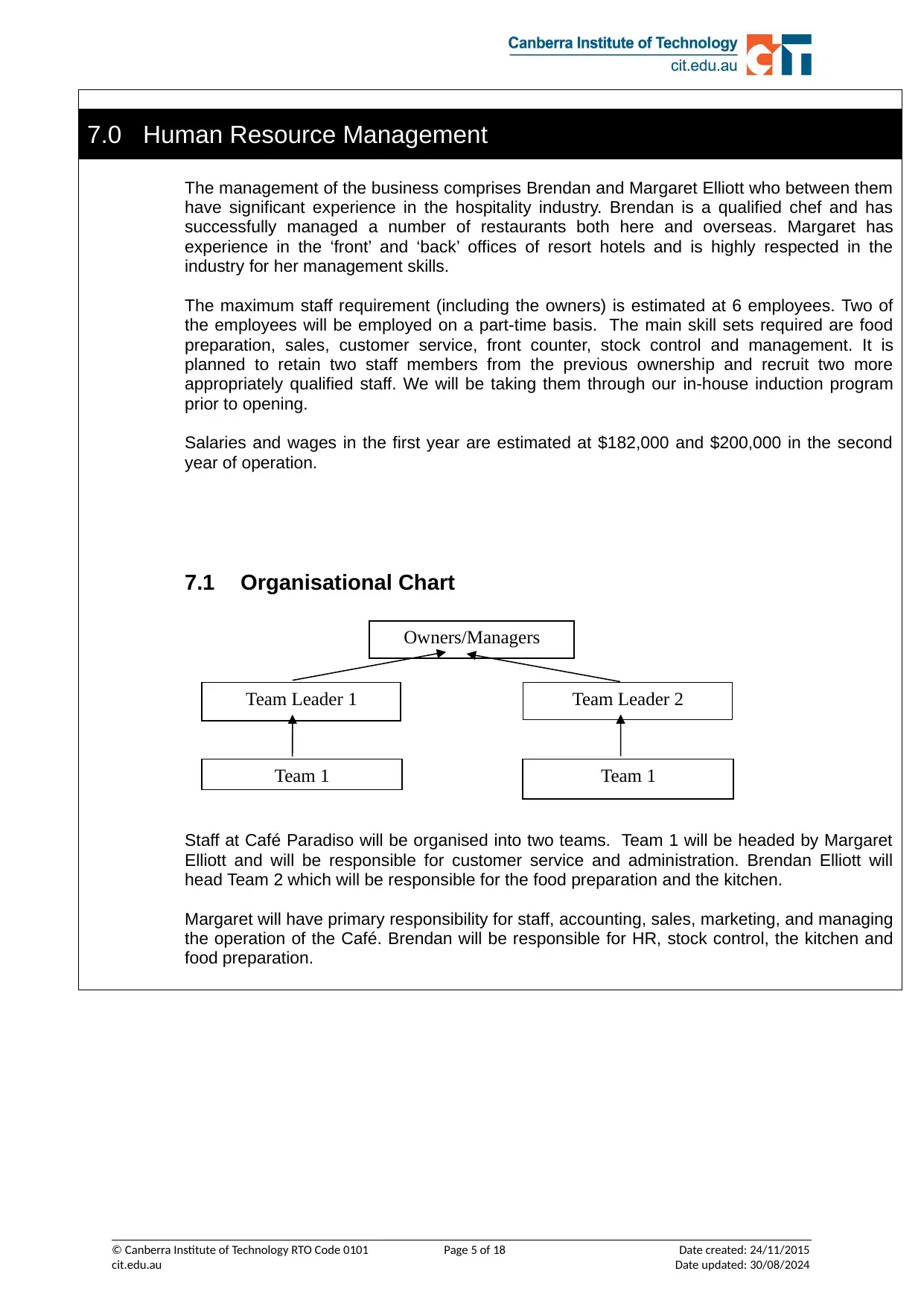

7.1 Organisational Chart

Staff at Café Paradiso will be organised into two teams. Team 1 will be headed by Margaret

Elliott and will be responsible for customer service and administration. Brendan Elliott will

head Team 2 which will be responsible for the food preparation and the kitchen.

Margaret will have primary responsibility for staff, accounting, sales, marketing, and managing

the operation of the Café. Brendan will be responsible for HR, stock control, the kitchen and

food preparation.

© Canberra Institute of Technology RTO Code 0101 Page 5 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

Owners/Managers

Team Leader 1 Team Leader 2

Team 1Team 1

The management of the business comprises Brendan and Margaret Elliott who between them

have significant experience in the hospitality industry. Brendan is a qualified chef and has

successfully managed a number of restaurants both here and overseas. Margaret has

experience in the ‘front’ and ‘back’ offices of resort hotels and is highly respected in the

industry for her management skills.

The maximum staff requirement (including the owners) is estimated at 6 employees. Two of

the employees will be employed on a part-time basis. The main skill sets required are food

preparation, sales, customer service, front counter, stock control and management. It is

planned to retain two staff members from the previous ownership and recruit two more

appropriately qualified staff. We will be taking them through our in-house induction program

prior to opening.

Salaries and wages in the first year are estimated at $182,000 and $200,000 in the second

year of operation.

7.1 Organisational Chart

Staff at Café Paradiso will be organised into two teams. Team 1 will be headed by Margaret

Elliott and will be responsible for customer service and administration. Brendan Elliott will

head Team 2 which will be responsible for the food preparation and the kitchen.

Margaret will have primary responsibility for staff, accounting, sales, marketing, and managing

the operation of the Café. Brendan will be responsible for HR, stock control, the kitchen and

food preparation.

© Canberra Institute of Technology RTO Code 0101 Page 5 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

Owners/Managers

Team Leader 1 Team Leader 2

Team 1Team 1

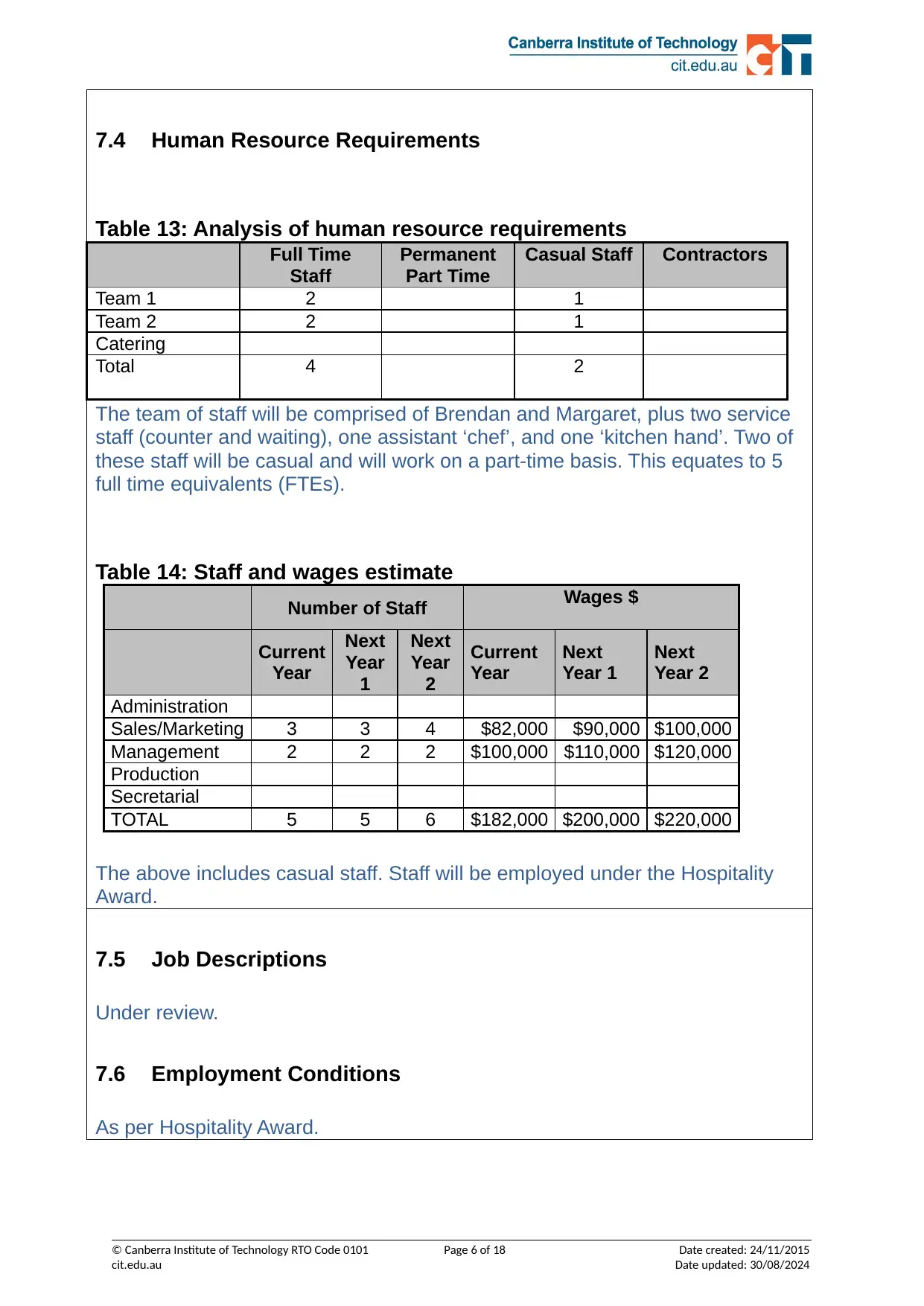

7.4 Human Resource Requirements

Table 13: Analysis of human resource requirements

The team of staff will be comprised of Brendan and Margaret, plus two service

staff (counter and waiting), one assistant ‘chef’, and one ‘kitchen hand’. Two of

these staff will be casual and will work on a part-time basis. This equates to 5

full time equivalents (FTEs).

Table 14: Staff and wages estimate

Number of Staff Wages $

Current

Year

Next

Year

1

Next

Year

2

Current

Year

Next

Year 1

Next

Year 2

Administration

Sales/Marketing 3 3 4 $82,000 $90,000 $100,000

Management 2 2 2 $100,000 $110,000 $120,000

Production

Secretarial

TOTAL 5 5 6 $182,000 $200,000 $220,000

The above includes casual staff. Staff will be employed under the Hospitality

Award.

7.5 Job Descriptions

Under review.

7.6 Employment Conditions

As per Hospitality Award.

© Canberra Institute of Technology RTO Code 0101 Page 6 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

Full Time

Staff

Permanent

Part Time

Casual Staff Contractors

Team 1 2 1

Team 2 2 1

Catering

Total 4 2

Table 13: Analysis of human resource requirements

The team of staff will be comprised of Brendan and Margaret, plus two service

staff (counter and waiting), one assistant ‘chef’, and one ‘kitchen hand’. Two of

these staff will be casual and will work on a part-time basis. This equates to 5

full time equivalents (FTEs).

Table 14: Staff and wages estimate

Number of Staff Wages $

Current

Year

Next

Year

1

Next

Year

2

Current

Year

Next

Year 1

Next

Year 2

Administration

Sales/Marketing 3 3 4 $82,000 $90,000 $100,000

Management 2 2 2 $100,000 $110,000 $120,000

Production

Secretarial

TOTAL 5 5 6 $182,000 $200,000 $220,000

The above includes casual staff. Staff will be employed under the Hospitality

Award.

7.5 Job Descriptions

Under review.

7.6 Employment Conditions

As per Hospitality Award.

© Canberra Institute of Technology RTO Code 0101 Page 6 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

Full Time

Staff

Permanent

Part Time

Casual Staff Contractors

Team 1 2 1

Team 2 2 1

Catering

Total 4 2

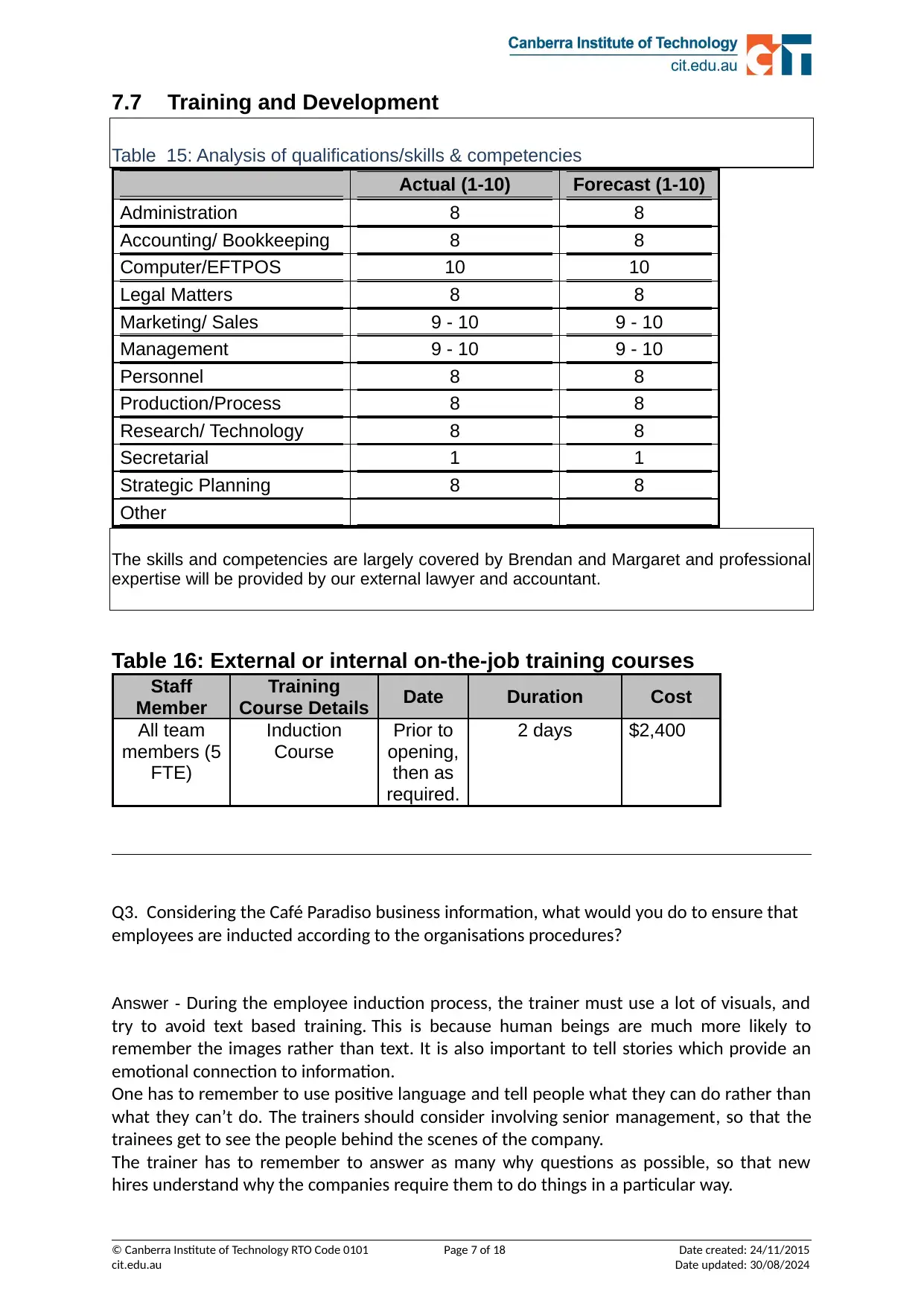

7.7 Training and Development

Table 15: Analysis of qualifications/skills & competencies

Actual (1-10) Forecast (1-10)

Administration 8 8

Accounting/ Bookkeeping 8 8

Computer/EFTPOS 10 10

Legal Matters 8 8

Marketing/ Sales 9 - 10 9 - 10

Management 9 - 10 9 - 10

Personnel 8 8

Production/Process 8 8

Research/ Technology 8 8

Secretarial 1 1

Strategic Planning 8 8

Other

The skills and competencies are largely covered by Brendan and Margaret and professional

expertise will be provided by our external lawyer and accountant.

Table 16: External or internal on-the-job training courses

Staff

Member

Training

Course Details Date Duration Cost

All team

members (5

FTE)

Induction

Course

Prior to

opening,

then as

required.

2 days $2,400

Q3. Considering the Café Paradiso business information, what would you do to ensure that

employees are inducted according to the organisations procedures?

Answer - During the employee induction process, the trainer must use a lot of visuals, and

try to avoid text based training. This is because human beings are much more likely to

remember the images rather than text. It is also important to tell stories which provide an

emotional connection to information.

One has to remember to use positive language and tell people what they can do rather than

what they can’t do. The trainers should consider involving senior management, so that the

trainees get to see the people behind the scenes of the company.

The trainer has to remember to answer as many why questions as possible, so that new

hires understand why the companies require them to do things in a particular way.

© Canberra Institute of Technology RTO Code 0101 Page 7 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

Table 15: Analysis of qualifications/skills & competencies

Actual (1-10) Forecast (1-10)

Administration 8 8

Accounting/ Bookkeeping 8 8

Computer/EFTPOS 10 10

Legal Matters 8 8

Marketing/ Sales 9 - 10 9 - 10

Management 9 - 10 9 - 10

Personnel 8 8

Production/Process 8 8

Research/ Technology 8 8

Secretarial 1 1

Strategic Planning 8 8

Other

The skills and competencies are largely covered by Brendan and Margaret and professional

expertise will be provided by our external lawyer and accountant.

Table 16: External or internal on-the-job training courses

Staff

Member

Training

Course Details Date Duration Cost

All team

members (5

FTE)

Induction

Course

Prior to

opening,

then as

required.

2 days $2,400

Q3. Considering the Café Paradiso business information, what would you do to ensure that

employees are inducted according to the organisations procedures?

Answer - During the employee induction process, the trainer must use a lot of visuals, and

try to avoid text based training. This is because human beings are much more likely to

remember the images rather than text. It is also important to tell stories which provide an

emotional connection to information.

One has to remember to use positive language and tell people what they can do rather than

what they can’t do. The trainers should consider involving senior management, so that the

trainees get to see the people behind the scenes of the company.

The trainer has to remember to answer as many why questions as possible, so that new

hires understand why the companies require them to do things in a particular way.

© Canberra Institute of Technology RTO Code 0101 Page 7 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

To make the training even better, one can include participative learning methods by asking

the questions and relating those questions to learners’ personal experiences. It is also a

good idea to use assessments to improve content recall and retention. Additionally, the

trainer must communicate the core values of the organization.

Q4. Write a procedure here to ensure that all new staff are inducted according to the

management’s practice.

Answer –

Prior to a new staff member arriving, plan out their first week and month.

On their first day, go through the schedule with them. The schedule should explain

when you will be having performance discussions and you will need to ensure that

they understand the key performance benchmarks they are expected to achieve.

Make sure your new staff member understands your business policies and

procedures and get their signature to demonstrate their understanding and

agreement.

Educate and train them on your key products, services and systems – then test their

knowledge.

Recognise and praise your new staff for each milestone and provide constructive

feedback to keep them on track.

Make sure the rest of your staff engage and help your new team member.

Go through an induction checklist to ensure you don’t forget any essential

information.

On their first day, the new employee should be given an employee handbook, or induction

manual. This will allow the employee to have ready access to all the necessary information

about the business, such as policies and procedures, company values and vision, key people,

etc.

Having a 3-month performance plan will ensure the new employee is clear about the key

direction of the role and what is expected of them from the start. It lays out the tools, skills

and tasks that they will need to learn. Your new employee will know exactly what’s

expected of them and they will immediately be able to envision a future with the company.

Don’t wait until the end of their probation period to have performance discussions. Use this

plan to structure your conversations. This will ensure the employee knows exactly what to

expect and what to do to be successful.

8.3 Purchasing and Supply

Brendan has contacted all existing suppliers and has negotiated supply arrangements on very

attractive terms. At this point there are no written contracts although three suppliers have

© Canberra Institute of Technology RTO Code 0101 Page 8 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

the questions and relating those questions to learners’ personal experiences. It is also a

good idea to use assessments to improve content recall and retention. Additionally, the

trainer must communicate the core values of the organization.

Q4. Write a procedure here to ensure that all new staff are inducted according to the

management’s practice.

Answer –

Prior to a new staff member arriving, plan out their first week and month.

On their first day, go through the schedule with them. The schedule should explain

when you will be having performance discussions and you will need to ensure that

they understand the key performance benchmarks they are expected to achieve.

Make sure your new staff member understands your business policies and

procedures and get their signature to demonstrate their understanding and

agreement.

Educate and train them on your key products, services and systems – then test their

knowledge.

Recognise and praise your new staff for each milestone and provide constructive

feedback to keep them on track.

Make sure the rest of your staff engage and help your new team member.

Go through an induction checklist to ensure you don’t forget any essential

information.

On their first day, the new employee should be given an employee handbook, or induction

manual. This will allow the employee to have ready access to all the necessary information

about the business, such as policies and procedures, company values and vision, key people,

etc.

Having a 3-month performance plan will ensure the new employee is clear about the key

direction of the role and what is expected of them from the start. It lays out the tools, skills

and tasks that they will need to learn. Your new employee will know exactly what’s

expected of them and they will immediately be able to envision a future with the company.

Don’t wait until the end of their probation period to have performance discussions. Use this

plan to structure your conversations. This will ensure the employee knows exactly what to

expect and what to do to be successful.

8.3 Purchasing and Supply

Brendan has contacted all existing suppliers and has negotiated supply arrangements on very

attractive terms. At this point there are no written contracts although three suppliers have

© Canberra Institute of Technology RTO Code 0101 Page 8 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

indicated that they are currently preparing contracts for execution. Where suppliers do not

provide formal contracts we will be requesting an exchange of letters to confirm the basic

arrangements.

In most instances local alternative suppliers exist. Where local alternative suppliers do not

exist, we have identified alternative suppliers from nearby regions who have the capacity to

meet the café’s needs in a timely manner at a reasonable cost.

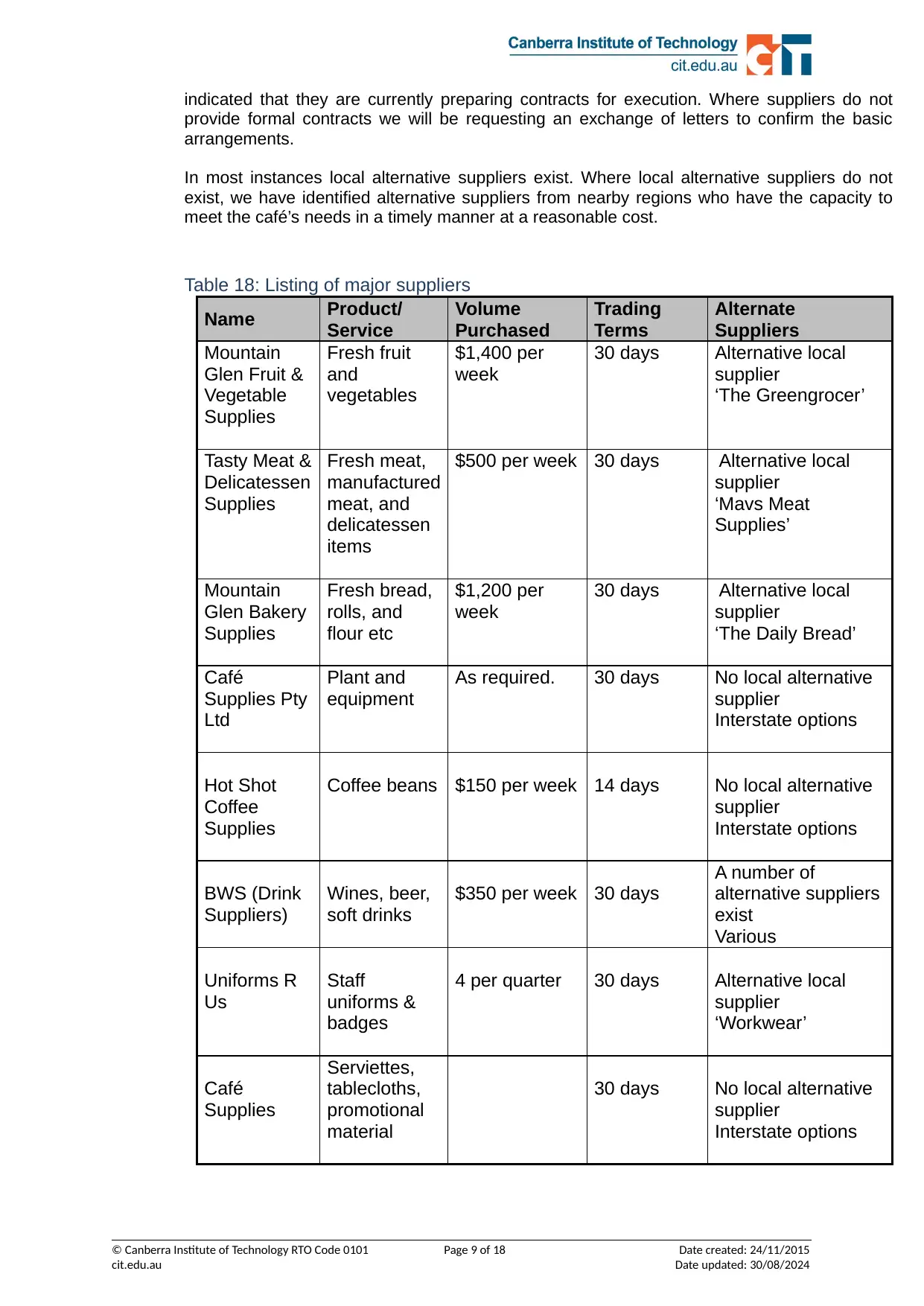

Table 18: Listing of major suppliers

Name Product/

Service

Volume

Purchased

Trading

Terms

Alternate

Suppliers

Mountain

Glen Fruit &

Vegetable

Supplies

Fresh fruit

and

vegetables

$1,400 per

week

30 days Alternative local

supplier

‘The Greengrocer’

Tasty Meat &

Delicatessen

Supplies

Fresh meat,

manufactured

meat, and

delicatessen

items

$500 per week 30 days Alternative local

supplier

‘Mavs Meat

Supplies’

Mountain

Glen Bakery

Supplies

Fresh bread,

rolls, and

flour etc

$1,200 per

week

30 days Alternative local

supplier

‘The Daily Bread’

Café

Supplies Pty

Ltd

Plant and

equipment

As required. 30 days No local alternative

supplier

Interstate options

Hot Shot

Coffee

Supplies

Coffee beans $150 per week 14 days No local alternative

supplier

Interstate options

BWS (Drink

Suppliers)

Wines, beer,

soft drinks

$350 per week 30 days

A number of

alternative suppliers

exist

Various

Uniforms R

Us

Staff

uniforms &

badges

4 per quarter 30 days Alternative local

supplier

‘Workwear’

Café

Supplies

Serviettes,

tablecloths,

promotional

material

30 days No local alternative

supplier

Interstate options

© Canberra Institute of Technology RTO Code 0101 Page 9 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

provide formal contracts we will be requesting an exchange of letters to confirm the basic

arrangements.

In most instances local alternative suppliers exist. Where local alternative suppliers do not

exist, we have identified alternative suppliers from nearby regions who have the capacity to

meet the café’s needs in a timely manner at a reasonable cost.

Table 18: Listing of major suppliers

Name Product/

Service

Volume

Purchased

Trading

Terms

Alternate

Suppliers

Mountain

Glen Fruit &

Vegetable

Supplies

Fresh fruit

and

vegetables

$1,400 per

week

30 days Alternative local

supplier

‘The Greengrocer’

Tasty Meat &

Delicatessen

Supplies

Fresh meat,

manufactured

meat, and

delicatessen

items

$500 per week 30 days Alternative local

supplier

‘Mavs Meat

Supplies’

Mountain

Glen Bakery

Supplies

Fresh bread,

rolls, and

flour etc

$1,200 per

week

30 days Alternative local

supplier

‘The Daily Bread’

Café

Supplies Pty

Ltd

Plant and

equipment

As required. 30 days No local alternative

supplier

Interstate options

Hot Shot

Coffee

Supplies

Coffee beans $150 per week 14 days No local alternative

supplier

Interstate options

BWS (Drink

Suppliers)

Wines, beer,

soft drinks

$350 per week 30 days

A number of

alternative suppliers

exist

Various

Uniforms R

Us

Staff

uniforms &

badges

4 per quarter 30 days Alternative local

supplier

‘Workwear’

Café

Supplies

Serviettes,

tablecloths,

promotional

material

30 days No local alternative

supplier

Interstate options

© Canberra Institute of Technology RTO Code 0101 Page 9 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

Q5. Read the purchasing and supply policy above, and then write a procedure here to

ensure that all resources are acquired according to the managements policies.

Answer - The four tips mentioned below on how to manage resources

Plan to Plan

Planning is important when it comes to being efficient. Time is money and it is best to plan

for effective resource management from the very beginning of projects.

Take a Systematic Approach

One of the most effective ways of using resources and minimising their use at work when

possible is by adopting a systematic approach

Use Technology Where Possible

The use of technology goes a long way in speeding and easing up processes significantly.

Any feature of the project that can be completed using technology should be automated.

Use Resource Management Software

Resource management software is a useful tool to significantly enhance the operations of

your business.

Q6. In what circumstances would you be using the “alternative suppliers”? Give an example.

Answer - Alternative supplier means, that a part will be supplied by a defined group of other

retail branches instead of the normal parameterised vendor or other external suppliers.

For example –

The delivering branch is member of the own dealer group

A dealer group is consisting of the main and its subsidiary branches

Alternatively supplied parts are valid for stock orders as well as emergency orders

Q7. If another Chef comes to work at Café Paradiso, explain what are this Chef’s and the

employers rights when it comes to intellectual property.

Answer – The rights that is shared by the previus chef or the existing chef, those rights would

be given to the new chef with the same amount of responsibility and the respect that is

enjoyed by the existing chef.

© Canberra Institute of Technology RTO Code 0101 Page 10 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

ensure that all resources are acquired according to the managements policies.

Answer - The four tips mentioned below on how to manage resources

Plan to Plan

Planning is important when it comes to being efficient. Time is money and it is best to plan

for effective resource management from the very beginning of projects.

Take a Systematic Approach

One of the most effective ways of using resources and minimising their use at work when

possible is by adopting a systematic approach

Use Technology Where Possible

The use of technology goes a long way in speeding and easing up processes significantly.

Any feature of the project that can be completed using technology should be automated.

Use Resource Management Software

Resource management software is a useful tool to significantly enhance the operations of

your business.

Q6. In what circumstances would you be using the “alternative suppliers”? Give an example.

Answer - Alternative supplier means, that a part will be supplied by a defined group of other

retail branches instead of the normal parameterised vendor or other external suppliers.

For example –

The delivering branch is member of the own dealer group

A dealer group is consisting of the main and its subsidiary branches

Alternatively supplied parts are valid for stock orders as well as emergency orders

Q7. If another Chef comes to work at Café Paradiso, explain what are this Chef’s and the

employers rights when it comes to intellectual property.

Answer – The rights that is shared by the previus chef or the existing chef, those rights would

be given to the new chef with the same amount of responsibility and the respect that is

enjoyed by the existing chef.

© Canberra Institute of Technology RTO Code 0101 Page 10 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Q8. If Chef writes a new menu along with accompanying recipes can they take it with them

when they leave? Who does it belong to?

Answer –

Recipes can be copyrighted, but copyrighting doesn’t keep someone else from using

the same formula or recreating the same food.

The chef may consider the recipes they create as their own intellectual property.

A chef you have fired or who quits may think it’s a good idea to go to work for one of

your competitors and make the same food you serve to hurt your business.

The chef takes their recipe book with them which are the only written copies of the

recipes to your food

Q9. What would you put in the contract of employment for a new Chef to acknowledge

these rights?

Answer – In the new contract, all the terms and conditions would be same as that of the old

contract in the restaurant but there would be an addition to the contract the previous mens

would be entitled to restaurant and the new modifications in the dishes cannot be shared

with anyone if the chef leaves or is fired.

1.5 Financial Plan

Our projected performance is summarised below:

Turnover: Year 1 $536,650 Year 2 $580,000

Gross margin $378,690 (71%)

Net profit (before tax) of $109,869 in the first year, growing to $131,175 in the second year of

operation.

The business is cash flow positive from the first month of operation

Break-Even is estimated at a monthly sales level of $30,869

Return on Total Assets: 37.3%

Return on Equity: 51.2%

The purchase price of the business is $170,000. Total start-up cost has been calculated at

$209,810 and is to be funded by way of a $104,905 bank loan and equity injection of

$104,905 from Brendan and Margaret. It is proposed that the loan be paid back over a two

year period from cash flow.

2.3 Goals and Objectives

Goal one: maintain continuity of customer relationships during the changeover by:

Retaining two key staff members of Café Paradiso

Maintaining the existing price levels

Goal two: maintain market share and sales through the change of ownership then grow

© Canberra Institute of Technology RTO Code 0101 Page 11 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

when they leave? Who does it belong to?

Answer –

Recipes can be copyrighted, but copyrighting doesn’t keep someone else from using

the same formula or recreating the same food.

The chef may consider the recipes they create as their own intellectual property.

A chef you have fired or who quits may think it’s a good idea to go to work for one of

your competitors and make the same food you serve to hurt your business.

The chef takes their recipe book with them which are the only written copies of the

recipes to your food

Q9. What would you put in the contract of employment for a new Chef to acknowledge

these rights?

Answer – In the new contract, all the terms and conditions would be same as that of the old

contract in the restaurant but there would be an addition to the contract the previous mens

would be entitled to restaurant and the new modifications in the dishes cannot be shared

with anyone if the chef leaves or is fired.

1.5 Financial Plan

Our projected performance is summarised below:

Turnover: Year 1 $536,650 Year 2 $580,000

Gross margin $378,690 (71%)

Net profit (before tax) of $109,869 in the first year, growing to $131,175 in the second year of

operation.

The business is cash flow positive from the first month of operation

Break-Even is estimated at a monthly sales level of $30,869

Return on Total Assets: 37.3%

Return on Equity: 51.2%

The purchase price of the business is $170,000. Total start-up cost has been calculated at

$209,810 and is to be funded by way of a $104,905 bank loan and equity injection of

$104,905 from Brendan and Margaret. It is proposed that the loan be paid back over a two

year period from cash flow.

2.3 Goals and Objectives

Goal one: maintain continuity of customer relationships during the changeover by:

Retaining two key staff members of Café Paradiso

Maintaining the existing price levels

Goal two: maintain market share and sales through the change of ownership then grow

© Canberra Institute of Technology RTO Code 0101 Page 11 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

market share to 40% in 18 months. The strategies to achieve this goal are:

Increase the number of customers

Increase the average sales size

Increase repeat trade from customers

Undertaking more aggressive marketing and promotion

Goal three: generate a before tax net margin of 20% for the next two financial years by:

Eliminating high cost purchases

Improving cost control

Improving stock control

Q10. Consider the financial plan above for the Café Pardiso.

How will you monitor the progress of this business to achieve the profit in year 1 and 2?

Answer -

By using financial ratios it can be assessed where the business is underperforming, and judge

the effects changes in one area will have elsewhere.

Monitoring figures closely will allow the owner to maximise efficiency and minimise waste,

which will help the business in the long run.

Q11. Consider the Goals and objectives of the business in the business plan above.

How will the business go about achieving Goal two?

Answer – The improvement in the cost control would be assessed by monitoring the cost

management of he business. The practical ways in doing it are –

1. First, perform a WBS with the team

2. Next, create a contingency reserve

3. Create a management reserve

4. Perform change control

5. Compare the actual expenses against the planned expenses regularly.

Q12. How will you monitor the progress of the business against goal two?

Answer –

1. Preparation of Key Financial Statements

2. Preparation of Aged Debtors Trial Balance

3. Preparation of Inventory Records

© Canberra Institute of Technology RTO Code 0101 Page 12 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

Increase the number of customers

Increase the average sales size

Increase repeat trade from customers

Undertaking more aggressive marketing and promotion

Goal three: generate a before tax net margin of 20% for the next two financial years by:

Eliminating high cost purchases

Improving cost control

Improving stock control

Q10. Consider the financial plan above for the Café Pardiso.

How will you monitor the progress of this business to achieve the profit in year 1 and 2?

Answer -

By using financial ratios it can be assessed where the business is underperforming, and judge

the effects changes in one area will have elsewhere.

Monitoring figures closely will allow the owner to maximise efficiency and minimise waste,

which will help the business in the long run.

Q11. Consider the Goals and objectives of the business in the business plan above.

How will the business go about achieving Goal two?

Answer – The improvement in the cost control would be assessed by monitoring the cost

management of he business. The practical ways in doing it are –

1. First, perform a WBS with the team

2. Next, create a contingency reserve

3. Create a management reserve

4. Perform change control

5. Compare the actual expenses against the planned expenses regularly.

Q12. How will you monitor the progress of the business against goal two?

Answer –

1. Preparation of Key Financial Statements

2. Preparation of Aged Debtors Trial Balance

3. Preparation of Inventory Records

© Canberra Institute of Technology RTO Code 0101 Page 12 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

4. Preparation of Working Capital Statements and Financial Ratios

5. Analysis of Overheads

Q13. After 6 months in business, only the number of customers have increased out of the 4

strategies in goal two. You will need to review your processes for achieving these goals.

What might you change?

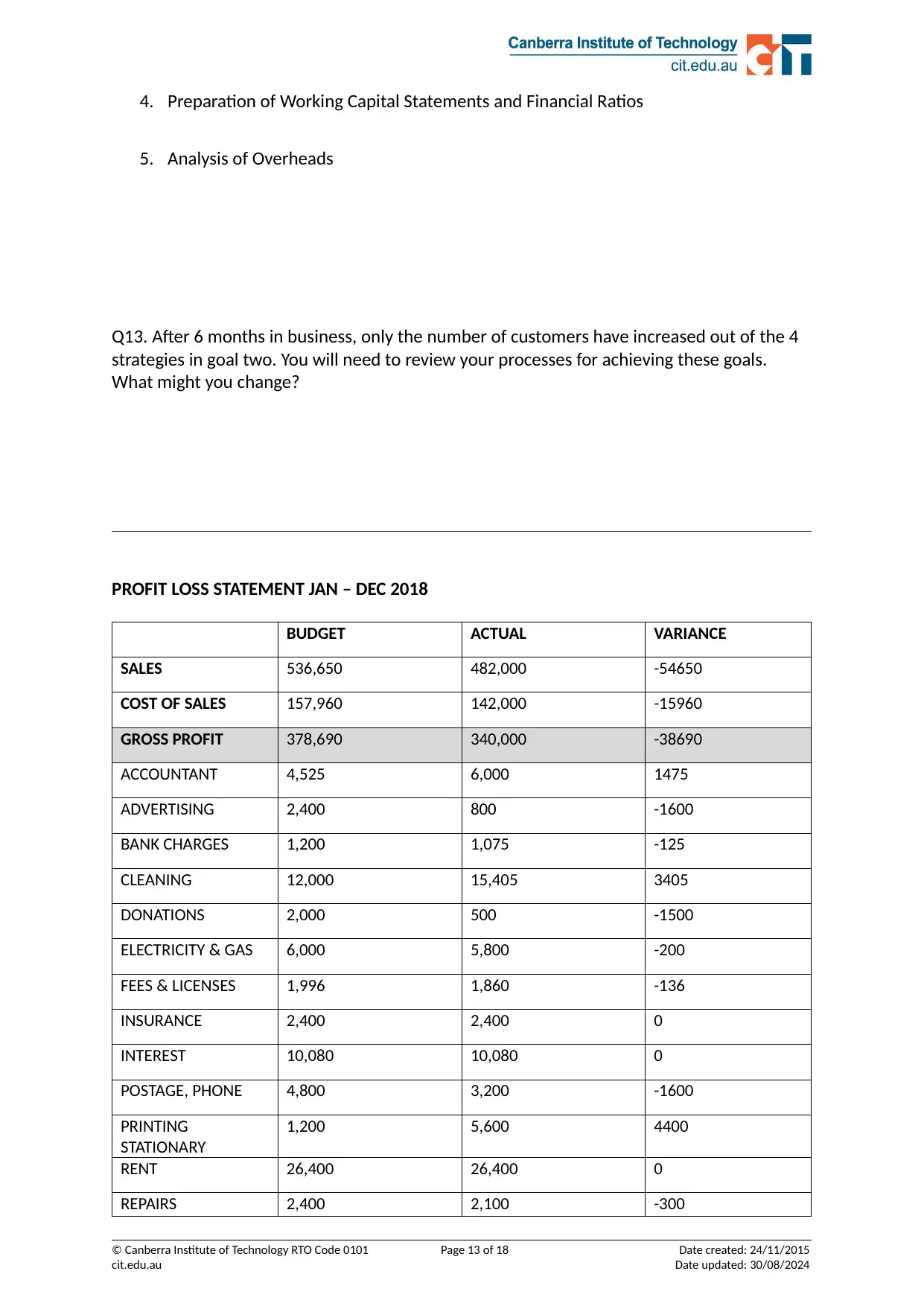

PROFIT LOSS STATEMENT JAN – DEC 2018

BUDGET ACTUAL VARIANCE

SALES 536,650 482,000 -54650

COST OF SALES 157,960 142,000 -15960

GROSS PROFIT 378,690 340,000 -38690

ACCOUNTANT 4,525 6,000 1475

ADVERTISING 2,400 800 -1600

BANK CHARGES 1,200 1,075 -125

CLEANING 12,000 15,405 3405

DONATIONS 2,000 500 -1500

ELECTRICITY & GAS 6,000 5,800 -200

FEES & LICENSES 1,996 1,860 -136

INSURANCE 2,400 2,400 0

INTEREST 10,080 10,080 0

POSTAGE, PHONE 4,800 3,200 -1600

PRINTING

STATIONARY

1,200 5,600 4400

RENT 26,400 26,400 0

REPAIRS 2,400 2,100 -300

© Canberra Institute of Technology RTO Code 0101 Page 13 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

5. Analysis of Overheads

Q13. After 6 months in business, only the number of customers have increased out of the 4

strategies in goal two. You will need to review your processes for achieving these goals.

What might you change?

PROFIT LOSS STATEMENT JAN – DEC 2018

BUDGET ACTUAL VARIANCE

SALES 536,650 482,000 -54650

COST OF SALES 157,960 142,000 -15960

GROSS PROFIT 378,690 340,000 -38690

ACCOUNTANT 4,525 6,000 1475

ADVERTISING 2,400 800 -1600

BANK CHARGES 1,200 1,075 -125

CLEANING 12,000 15,405 3405

DONATIONS 2,000 500 -1500

ELECTRICITY & GAS 6,000 5,800 -200

FEES & LICENSES 1,996 1,860 -136

INSURANCE 2,400 2,400 0

INTEREST 10,080 10,080 0

POSTAGE, PHONE 4,800 3,200 -1600

PRINTING

STATIONARY

1,200 5,600 4400

RENT 26,400 26,400 0

REPAIRS 2,400 2,100 -300

© Canberra Institute of Technology RTO Code 0101 Page 13 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

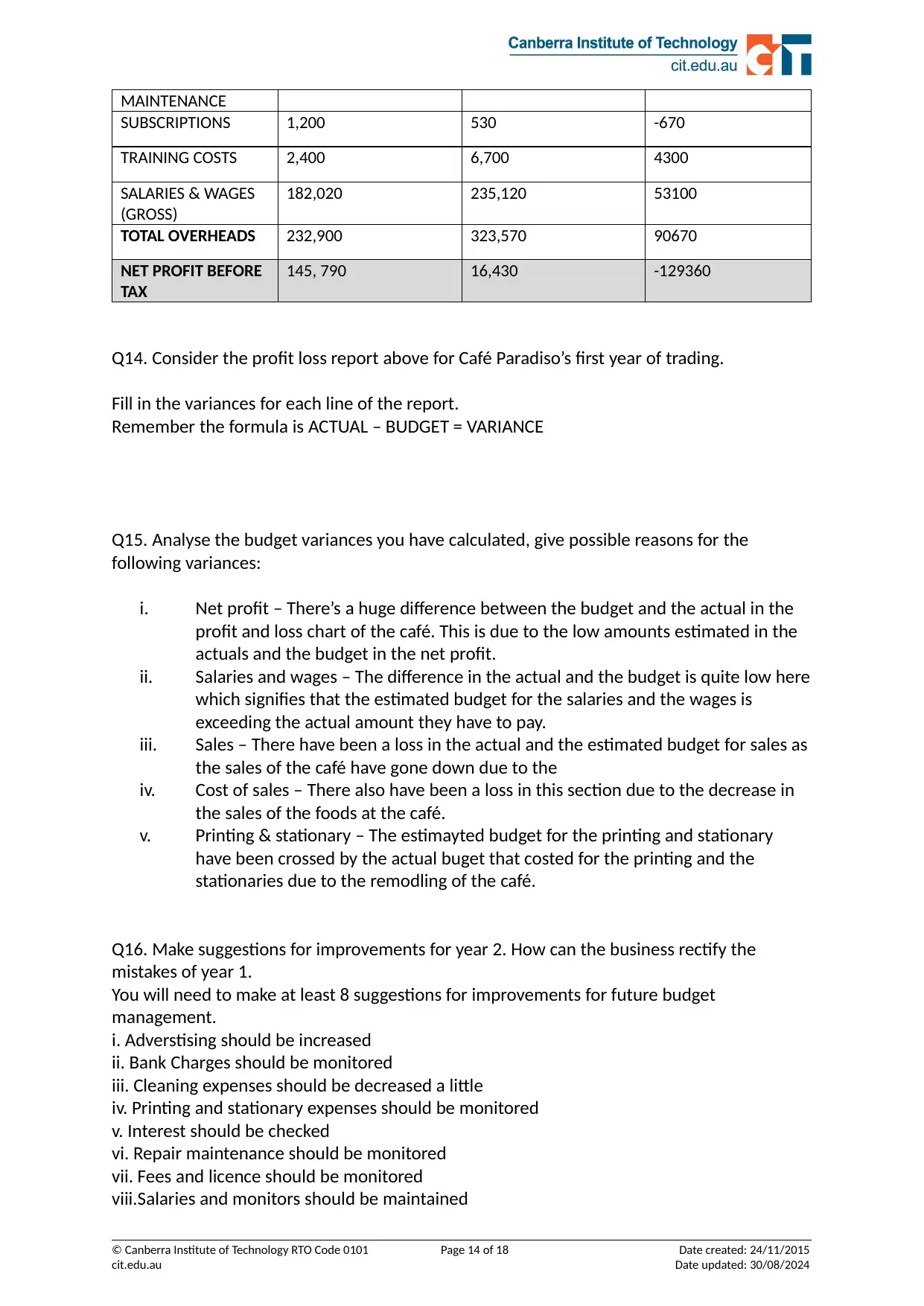

MAINTENANCE

SUBSCRIPTIONS 1,200 530 -670

TRAINING COSTS 2,400 6,700 4300

SALARIES & WAGES

(GROSS)

182,020 235,120 53100

TOTAL OVERHEADS 232,900 323,570 90670

NET PROFIT BEFORE

TAX

145, 790 16,430 -129360

Q14. Consider the profit loss report above for Café Paradiso’s first year of trading.

Fill in the variances for each line of the report.

Remember the formula is ACTUAL – BUDGET = VARIANCE

Q15. Analyse the budget variances you have calculated, give possible reasons for the

following variances:

i. Net profit – There’s a huge difference between the budget and the actual in the

profit and loss chart of the café. This is due to the low amounts estimated in the

actuals and the budget in the net profit.

ii. Salaries and wages – The difference in the actual and the budget is quite low here

which signifies that the estimated budget for the salaries and the wages is

exceeding the actual amount they have to pay.

iii. Sales – There have been a loss in the actual and the estimated budget for sales as

the sales of the café have gone down due to the

iv. Cost of sales – There also have been a loss in this section due to the decrease in

the sales of the foods at the café.

v. Printing & stationary – The estimayted budget for the printing and stationary

have been crossed by the actual buget that costed for the printing and the

stationaries due to the remodling of the café.

Q16. Make suggestions for improvements for year 2. How can the business rectify the

mistakes of year 1.

You will need to make at least 8 suggestions for improvements for future budget

management.

i. Adverstising should be increased

ii. Bank Charges should be monitored

iii. Cleaning expenses should be decreased a little

iv. Printing and stationary expenses should be monitored

v. Interest should be checked

vi. Repair maintenance should be monitored

vii. Fees and licence should be monitored

viii.Salaries and monitors should be maintained

© Canberra Institute of Technology RTO Code 0101 Page 14 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

SUBSCRIPTIONS 1,200 530 -670

TRAINING COSTS 2,400 6,700 4300

SALARIES & WAGES

(GROSS)

182,020 235,120 53100

TOTAL OVERHEADS 232,900 323,570 90670

NET PROFIT BEFORE

TAX

145, 790 16,430 -129360

Q14. Consider the profit loss report above for Café Paradiso’s first year of trading.

Fill in the variances for each line of the report.

Remember the formula is ACTUAL – BUDGET = VARIANCE

Q15. Analyse the budget variances you have calculated, give possible reasons for the

following variances:

i. Net profit – There’s a huge difference between the budget and the actual in the

profit and loss chart of the café. This is due to the low amounts estimated in the

actuals and the budget in the net profit.

ii. Salaries and wages – The difference in the actual and the budget is quite low here

which signifies that the estimated budget for the salaries and the wages is

exceeding the actual amount they have to pay.

iii. Sales – There have been a loss in the actual and the estimated budget for sales as

the sales of the café have gone down due to the

iv. Cost of sales – There also have been a loss in this section due to the decrease in

the sales of the foods at the café.

v. Printing & stationary – The estimayted budget for the printing and stationary

have been crossed by the actual buget that costed for the printing and the

stationaries due to the remodling of the café.

Q16. Make suggestions for improvements for year 2. How can the business rectify the

mistakes of year 1.

You will need to make at least 8 suggestions for improvements for future budget

management.

i. Adverstising should be increased

ii. Bank Charges should be monitored

iii. Cleaning expenses should be decreased a little

iv. Printing and stationary expenses should be monitored

v. Interest should be checked

vi. Repair maintenance should be monitored

vii. Fees and licence should be monitored

viii.Salaries and monitors should be maintained

© Canberra Institute of Technology RTO Code 0101 Page 14 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

Q17. You have employed two new staff members for front of house duties, they have had

basic training in the business processes. How could you make sure that they are familiar with

the policies and workplace procedures without a high cost to the business?

Answer – It would be wise to provide mentoring ot the new staff by a old and experienced

staff who are familiar with the policies and the procedures of the business.

Q18. a. Explain what mentoring is?

Answer - Mentoring in simple terms can be defined as a relationship or link established

between someone who is experienced and someone who is not.

b. How could you use mentoring in this situation?

Answer - The relationship is facilitated by a specific mentoring agenda comprising several

mentoring processes (initiated usually by the mentor) with the goal being that the mentee

achieves or at least moves toward achieving their personal goals and/or professional career

goals

Q19. You will need to monitor the kitchen food costs very closely as the cost of goods was a

lot over budget in year 1. How will you do this?

Answer – The cost could be monitored by keeping track of all the intakes and the goos that

are being bought for the production. The cost woukd also be monitored with the analysis of

the costof production of the food. This would help in estimating the budget.

Q20. You have 3 new staff members in the kitchen, how will you make sure that they are

using the equipment safely? Nominate 2 procedures you could introduce.

i.Keeping surveillance over them

ii. Keeping them in touch of experienced workers while using equipments.

Read the following information:

© Canberra Institute of Technology RTO Code 0101 Page 15 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

basic training in the business processes. How could you make sure that they are familiar with

the policies and workplace procedures without a high cost to the business?

Answer – It would be wise to provide mentoring ot the new staff by a old and experienced

staff who are familiar with the policies and the procedures of the business.

Q18. a. Explain what mentoring is?

Answer - Mentoring in simple terms can be defined as a relationship or link established

between someone who is experienced and someone who is not.

b. How could you use mentoring in this situation?

Answer - The relationship is facilitated by a specific mentoring agenda comprising several

mentoring processes (initiated usually by the mentor) with the goal being that the mentee

achieves or at least moves toward achieving their personal goals and/or professional career

goals

Q19. You will need to monitor the kitchen food costs very closely as the cost of goods was a

lot over budget in year 1. How will you do this?

Answer – The cost could be monitored by keeping track of all the intakes and the goos that

are being bought for the production. The cost woukd also be monitored with the analysis of

the costof production of the food. This would help in estimating the budget.

Q20. You have 3 new staff members in the kitchen, how will you make sure that they are

using the equipment safely? Nominate 2 procedures you could introduce.

i.Keeping surveillance over them

ii. Keeping them in touch of experienced workers while using equipments.

Read the following information:

© Canberra Institute of Technology RTO Code 0101 Page 15 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

Extracts from selected sections within Kingfisher Garden Centre

administrative policies and procedures

Document creation and capture

Staff should ensure they create official records of all decisions and actions made in the course

of their official business. For example, if business is transacted by telephone, file notes of the

key points in the conversation should be documented. Official meetings should include the

taking of minutes. Operational plans should be version controlled.

All records defined by the organisation as important to create should be captured into

designated record keeping systems (hard or electronic versions) so they can be managed

appropriately.

Records should be placed in an official file. Department-specific files should be kept and

maintained by the generating department. Operational plans, supporting documentation and

performance data for all areas of the organisation should be filed in the main administrative

hub. These files will be given a unique identifier code.

All official outgoing communications, including letters, faxes, emails, etc., should contain

reference to the file number, as prompted in the templates. Further information is available in

the Records Management Procedures.

Storage

Current hard copy records should be stored in designated storage areas (see ‘Document

creation and capture’) with access restrictions as outlined in the Records Management

Procedures.

Electronic records may either be retained online (on servers) or offline (on DVDs, USB stick,

portable hard drives or other removable media). Records of short-term value will be disposed

of at suitable intervals by the administrative assistant in each department. Records of long-

term or archival value should be retained online wherever possible and managed in

accordance with the Records Management Procedures.

Maintenance and monitoring

The location of each record needs to be recorded and updated at every movement of the

record when transferred between departments. Record keeping is not required within a

department. Staff members should update the file register or notify the relevant administrative

assistant when passing records on to another office, store or department.

The main administration office has implemented a number of security and counter disaster

measures as part of its Information Security Management System (ISMS) for safeguarding its

information assets. Staff should abide by these measures at all times. See Records

Management Procedures for more information.

Access

Records must be available to all authorised staff that require access to them for business

purposes. Reasons for restricting access are outlined in the Records Management Procedures.

Contractors and outsourced functions

All records created by contractors performing work on behalf of Kingfisher Garden Centre

belong to the organisation. This includes the records of contract staff working on the premises

as well as external service providers.

© Canberra Institute of Technology RTO Code 0101 Page 16 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

administrative policies and procedures

Document creation and capture

Staff should ensure they create official records of all decisions and actions made in the course

of their official business. For example, if business is transacted by telephone, file notes of the

key points in the conversation should be documented. Official meetings should include the

taking of minutes. Operational plans should be version controlled.

All records defined by the organisation as important to create should be captured into

designated record keeping systems (hard or electronic versions) so they can be managed

appropriately.

Records should be placed in an official file. Department-specific files should be kept and

maintained by the generating department. Operational plans, supporting documentation and

performance data for all areas of the organisation should be filed in the main administrative

hub. These files will be given a unique identifier code.

All official outgoing communications, including letters, faxes, emails, etc., should contain

reference to the file number, as prompted in the templates. Further information is available in

the Records Management Procedures.

Storage

Current hard copy records should be stored in designated storage areas (see ‘Document

creation and capture’) with access restrictions as outlined in the Records Management

Procedures.

Electronic records may either be retained online (on servers) or offline (on DVDs, USB stick,

portable hard drives or other removable media). Records of short-term value will be disposed

of at suitable intervals by the administrative assistant in each department. Records of long-

term or archival value should be retained online wherever possible and managed in

accordance with the Records Management Procedures.

Maintenance and monitoring

The location of each record needs to be recorded and updated at every movement of the

record when transferred between departments. Record keeping is not required within a

department. Staff members should update the file register or notify the relevant administrative

assistant when passing records on to another office, store or department.

The main administration office has implemented a number of security and counter disaster

measures as part of its Information Security Management System (ISMS) for safeguarding its

information assets. Staff should abide by these measures at all times. See Records

Management Procedures for more information.

Access

Records must be available to all authorised staff that require access to them for business

purposes. Reasons for restricting access are outlined in the Records Management Procedures.

Contractors and outsourced functions

All records created by contractors performing work on behalf of Kingfisher Garden Centre

belong to the organisation. This includes the records of contract staff working on the premises

as well as external service providers.

© Canberra Institute of Technology RTO Code 0101 Page 16 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Contracts should clearly state that ownership of records resides with Kingfisher Garden

Centre, and instructions regarding creation, management and access to the records created.

Disposal

Administrative records common to all or many public offices such as financial and personnel

records are covered under general retention and disposal authorities compiled by State

Records authorities and federal legislation.

Q21. Consider the Records management procedures in the Kingfisher Garden Centre

information.

Write a policy here for the records that you will need to keep for Café Paradiso, they are:

- Budgets and financial records

- Strategic plans, business plans and Operational plans

- Staff induction and performance management records

Answer –

1. Strategic planning is undertaken to provide direction and focus to the Governing Board

over their four year term.

2. Budget and business planning is undertaken to support strategic planning and decision-

making and to serve accountability by enabling the Superintendent to plan for the

resources needed to provide programs and services to students.

3. Draft budget preparation will follow a decentralized approach with each department of

the Board responsible for completing initial budget requirements based on

documentation standards established by the Director of Financial Services.

Q22. How would you implement this policy in your business. List out the steps you would

need to take to ensure all staff are aware of the new policy and trained in the processes.

Answer –

1. Obtain Stakeholder Support

All too often those who are expected to carry out the policies and ensure adherence to

the policies are not consulted prior to the implementation of the policy.

2. Communicate with Employees

Organizations should give employees background information (when possible) as to

why the policy is being implemented. Employees should be given enough details to

make the organization's position clear while keeping the communications process short

and simple

3. Update and Revise the Policy

© Canberra Institute of Technology RTO Code 0101 Page 17 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

Centre, and instructions regarding creation, management and access to the records created.

Disposal

Administrative records common to all or many public offices such as financial and personnel

records are covered under general retention and disposal authorities compiled by State

Records authorities and federal legislation.

Q21. Consider the Records management procedures in the Kingfisher Garden Centre

information.

Write a policy here for the records that you will need to keep for Café Paradiso, they are:

- Budgets and financial records

- Strategic plans, business plans and Operational plans

- Staff induction and performance management records

Answer –

1. Strategic planning is undertaken to provide direction and focus to the Governing Board

over their four year term.

2. Budget and business planning is undertaken to support strategic planning and decision-

making and to serve accountability by enabling the Superintendent to plan for the

resources needed to provide programs and services to students.

3. Draft budget preparation will follow a decentralized approach with each department of

the Board responsible for completing initial budget requirements based on

documentation standards established by the Director of Financial Services.

Q22. How would you implement this policy in your business. List out the steps you would

need to take to ensure all staff are aware of the new policy and trained in the processes.

Answer –

1. Obtain Stakeholder Support

All too often those who are expected to carry out the policies and ensure adherence to

the policies are not consulted prior to the implementation of the policy.

2. Communicate with Employees

Organizations should give employees background information (when possible) as to

why the policy is being implemented. Employees should be given enough details to

make the organization's position clear while keeping the communications process short

and simple

3. Update and Revise the Policy

© Canberra Institute of Technology RTO Code 0101 Page 17 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

Clear, well-written policies that are regularly reviewed can be effective employee

relations tools and communications devices. They illustrate the organization's

commitment to a positive work environment.

Q23. Considering the operational plan you have created for Restaurant@CIT.

i. What legislation and regulatory requirements do you have to work to in the

Restaurant? This includes front of house and back of house.

ii. What policies, practices and procedures will be affected by the operational plan

you have created? Think about what changes you have made to the way the

business operates.

Answer – Legislations and regulations are

Food Hygiene Certificate – This certificate proves that you are aware of, and operating

under, the appropriate food hygiene and health and safety regulations.

Food Premises Approval – If you restaurant handles any meat, fish, egg, or dairy products

Alcohol licence – If you plan to offer alcohol on your menu, you’ll need to obtain an Alcohol

On-License

Planning permission – In addition to gaining permission to make physical changes to a

building, you will also need to check permission to use the building as a restaurant.

The Policies, practices and the plans effected are –

The practices in the front houses and the back houses would be effected by the operational

plans. The procedurecs of the new policy conduction could be effected as the operational

plan might not fit with the new policy procedure.

© Canberra Institute of Technology RTO Code 0101 Page 18 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

relations tools and communications devices. They illustrate the organization's

commitment to a positive work environment.

Q23. Considering the operational plan you have created for Restaurant@CIT.

i. What legislation and regulatory requirements do you have to work to in the

Restaurant? This includes front of house and back of house.

ii. What policies, practices and procedures will be affected by the operational plan

you have created? Think about what changes you have made to the way the

business operates.

Answer – Legislations and regulations are

Food Hygiene Certificate – This certificate proves that you are aware of, and operating

under, the appropriate food hygiene and health and safety regulations.

Food Premises Approval – If you restaurant handles any meat, fish, egg, or dairy products

Alcohol licence – If you plan to offer alcohol on your menu, you’ll need to obtain an Alcohol

On-License

Planning permission – In addition to gaining permission to make physical changes to a

building, you will also need to check permission to use the building as a restaurant.

The Policies, practices and the plans effected are –

The practices in the front houses and the back houses would be effected by the operational

plans. The procedurecs of the new policy conduction could be effected as the operational

plan might not fit with the new policy procedure.

© Canberra Institute of Technology RTO Code 0101 Page 18 of 18 Date created: 24/11/2015

cit.edu.au Date updated: 30/08/2024

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.