Identifying Marketing Strategies for HSBC Bank Customer Satisfaction

VerifiedAdded on 2020/07/23

|24

|7250

|79

Report

AI Summary

This research project is a case study focusing on HSBC Bank's marketing strategies to achieve customer satisfaction. The report begins with an overview of the research, including its aims, objectives, and research questions, which center around identifying effective marketing strategies. It delves into the major factors influencing research project selection and provides a comprehensive literature review exploring marketing activities, green marketing strategies, and the banking sector's evolution. The study examines strategies such as free products, credit cards, and the incorporation of technologies, including online banking and green marketing initiatives. The research also covers the research methodology, data sampling, evaluation tools, data analysis, and recommendations for further study, culminating in a discussion of the findings and their implications for HSBC Bank's marketing practices. The project aims to understand the relationship between marketing strategies and customer satisfaction, emphasizing the importance of adapting to customer needs in a competitive market.

RESEARCH PROJECT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

TITLE .............................................................................................................................................1

TASK 1 ...........................................................................................................................................1

1.1 Overview of research........................................................................................................1

1.2 Major factors that contributes to the process of research project selection......................3

1.3 Literature Review ............................................................................................................3

1.4 Structure of the project ....................................................................................................9

1.5 Gantt Chart ......................................................................................................................9

TASK 2 .........................................................................................................................................10

2.1 Research Methodology ..................................................................................................10

2.2 Data Sampling ...............................................................................................................10

TASK 3 .........................................................................................................................................11

3.1 Evaluation tools and techniques ....................................................................................11

3.2 Data Analysis .................................................................................................................12

3.3 Recommendation and area of further study ...................................................................15

TASK 4 .........................................................................................................................................17

4.1 Covered in PPT ............................................................................................................17

REFERENCES .............................................................................................................................18

APPENDIX ...................................................................................................................................21

TITLE .............................................................................................................................................1

TASK 1 ...........................................................................................................................................1

1.1 Overview of research........................................................................................................1

1.2 Major factors that contributes to the process of research project selection......................3

1.3 Literature Review ............................................................................................................3

1.4 Structure of the project ....................................................................................................9

1.5 Gantt Chart ......................................................................................................................9

TASK 2 .........................................................................................................................................10

2.1 Research Methodology ..................................................................................................10

2.2 Data Sampling ...............................................................................................................10

TASK 3 .........................................................................................................................................11

3.1 Evaluation tools and techniques ....................................................................................11

3.2 Data Analysis .................................................................................................................12

3.3 Recommendation and area of further study ...................................................................15

TASK 4 .........................................................................................................................................17

4.1 Covered in PPT ............................................................................................................17

REFERENCES .............................................................................................................................18

APPENDIX ...................................................................................................................................21

TITLE

To identify various strategies of marketing that are beneficial in achieving customer’s

satisfaction - A case study on HSBC Bank.

TASK 1

1.1 Overview of research

In this modern era each business organisation is widely concern on providing high quality

products and services to their potential customer in order to satisfying their needs and wants.

Customer’s satisfaction is an essential term in this modern society as there is huge competition

available for a single product or business and buyers are having variety of choices in respect to

fulfilling their basic needs and wants (Baker and Saren, 2016). The preference of each customer

are different from each other as some are concern towards the price of product and some are goes

with the quality of goods and they are not concern about the high and low price of good.

Marketing activities plays an effective role in attaining high position at market place. The present

research is based on the marketing activities of HSBC bank in the United Kingdom., the

activities regarding to the marketing natures and aspects of the firm has to be discussed and

analysed in order to gain the essential information for the accomplishment of the project (Rundh,

2013). The nature of the project is to develop the data and information for the marketing

activities of the bank in the United Kingdom.

Research Aim

This is the most essential part of research as the whole research work is based on the title

of the research and each activities are implemented as per the requirement of project. The

research aims of the project consist of several marketing factors that occur during the marketing

activities of the HSBC Bank. Aim consist as an essential target which are effective in completion

of research work in appropriate manner (Ewing and Hendy Qc, 2012). This provide a significant

direction to the researcher for in respect to accomplishing research outcomes through moving

forwards towards right direction. For this present research project the aim is to identify the

various strategies of marketing that are beneficial in achieving customers satisfaction. A case

study on HSBC Bank.

Research objectives

1

To identify various strategies of marketing that are beneficial in achieving customer’s

satisfaction - A case study on HSBC Bank.

TASK 1

1.1 Overview of research

In this modern era each business organisation is widely concern on providing high quality

products and services to their potential customer in order to satisfying their needs and wants.

Customer’s satisfaction is an essential term in this modern society as there is huge competition

available for a single product or business and buyers are having variety of choices in respect to

fulfilling their basic needs and wants (Baker and Saren, 2016). The preference of each customer

are different from each other as some are concern towards the price of product and some are goes

with the quality of goods and they are not concern about the high and low price of good.

Marketing activities plays an effective role in attaining high position at market place. The present

research is based on the marketing activities of HSBC bank in the United Kingdom., the

activities regarding to the marketing natures and aspects of the firm has to be discussed and

analysed in order to gain the essential information for the accomplishment of the project (Rundh,

2013). The nature of the project is to develop the data and information for the marketing

activities of the bank in the United Kingdom.

Research Aim

This is the most essential part of research as the whole research work is based on the title

of the research and each activities are implemented as per the requirement of project. The

research aims of the project consist of several marketing factors that occur during the marketing

activities of the HSBC Bank. Aim consist as an essential target which are effective in completion

of research work in appropriate manner (Ewing and Hendy Qc, 2012). This provide a significant

direction to the researcher for in respect to accomplishing research outcomes through moving

forwards towards right direction. For this present research project the aim is to identify the

various strategies of marketing that are beneficial in achieving customers satisfaction. A case

study on HSBC Bank.

Research objectives

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

This section of research is directly depend on the aim of the study as objectives are

created in respect to carry out all research activities in well planned and systematic manner.

Objectives are interlinked with the research aim as it helps in providing a significant direction to

researcher for conducting an effective section of literature review (Siu, Zhang and Yau, 2013).

Some effective research objectives are describes as under:

To ascertain different strategies of marketing that are used by HSBC Bank in order to

attract customers.

To analyse the importance of customers satisfaction in enhancing performance of firm.

To determine the relationship between various marketing activities and consumer

satisfaction in HSBC Bank. To recommend various ways by which HSBC Bank can gain higher competitive edge at

market place.

Research Question

This considered as the most valuable part of research project as it helps in conducting the

whole research activities in well planned manner (Finn, 2011). These are directly connected with

the research objectives. The present research is based on the effectiveness of marketing strategies

that are beneficial for creating high customer satisfaction. Effective research questions are

evaluated as below:

What are the major strategies that are used by HSBC Bank in respect to gaining attention

of customers?

What are the importance of customer’s satisfaction in enhancing organisational

performance?

How to determine the relationship between various marketing activities and consumer

satisfaction in HSBC Bank? What are the essential ways by which HSBC Bank can attain higher competitive edge at

market place?

Rationale of the study

The research into consideration helps in determining the purpose of research work and

the manner in which research is going to provide a relevant outcome for completion of research

work. This is an important part of research to analyse the major issue on which researcher need

to conduct various research activities (Borland and Lindgreen, 2013). Customer’s satisfaction

2

created in respect to carry out all research activities in well planned and systematic manner.

Objectives are interlinked with the research aim as it helps in providing a significant direction to

researcher for conducting an effective section of literature review (Siu, Zhang and Yau, 2013).

Some effective research objectives are describes as under:

To ascertain different strategies of marketing that are used by HSBC Bank in order to

attract customers.

To analyse the importance of customers satisfaction in enhancing performance of firm.

To determine the relationship between various marketing activities and consumer

satisfaction in HSBC Bank. To recommend various ways by which HSBC Bank can gain higher competitive edge at

market place.

Research Question

This considered as the most valuable part of research project as it helps in conducting the

whole research activities in well planned manner (Finn, 2011). These are directly connected with

the research objectives. The present research is based on the effectiveness of marketing strategies

that are beneficial for creating high customer satisfaction. Effective research questions are

evaluated as below:

What are the major strategies that are used by HSBC Bank in respect to gaining attention

of customers?

What are the importance of customer’s satisfaction in enhancing organisational

performance?

How to determine the relationship between various marketing activities and consumer

satisfaction in HSBC Bank? What are the essential ways by which HSBC Bank can attain higher competitive edge at

market place?

Rationale of the study

The research into consideration helps in determining the purpose of research work and

the manner in which research is going to provide a relevant outcome for completion of research

work. This is an important part of research to analyse the major issue on which researcher need

to conduct various research activities (Borland and Lindgreen, 2013). Customer’s satisfaction

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

can be considered as the most essential issue at market place. In this competitive era each

business organisation is focused on offering variety of products and services to their significant

buyers in respect to sustain them for long time. HSBC is concern on satisfying the needs and

wants of customers in order to attaining high competitive edge at market place. HSBC bank

apply various marketing strategies in order to gaining attention of large number of people

towards the offered products and services of firm. The research into consideration helps in

measuring the relationship between marketing strategies and customer’s satisfaction. Each

business firm is focused on adopting various innovative tools and techniques at work place so

that their productivity and performance can be enhanced. This may create value in generating

high consumer satisfaction (Shankar, Carpenter and Farley, 2012).

1.2 Major factors that contributes to the process of research project selection

The marketing activities are to be observed and analysed just to gather the required

information and details in respect to develop the project on the bank. Marketing strategies plays a

vast role in executing various operations at market place. HSBC is a popular bank who is

focused on providing high quality and fast services and products to their potential customers in

terms of attaining high profit and revenue (Balmer, 2011). HSBC follow various marketing

strategies such as promotional campaign, effective offers, high interest accounts, loan on less

interest, conducting CSR activities at work place in respect to satisfying the needs and wants of

customers. Among all the marketing strategy green marketing activities is considered as the most

effective strategy which is significantly performed by HSBC bank in the country of United

Kingdom. The green marketing can demonstrated as the marketing activities that are to be done

according to the need for achieving the level where the marketing activities will be accomplished

without producing any wastage of the resources (Sarin, Challagalla and Kohli, 2012). There are

various sources that contributes to the process of selection of research project. Research aim can

be considered as the most essential element which plays a vast role in carry out the research issue

in specific direction as to gaining proper and relevant outcome for the research work. Research

collect data and information form various sources such as primary and sources as to moving

forward towards right manner.

1.3 Literature Review

Introduction

3

business organisation is focused on offering variety of products and services to their significant

buyers in respect to sustain them for long time. HSBC is concern on satisfying the needs and

wants of customers in order to attaining high competitive edge at market place. HSBC bank

apply various marketing strategies in order to gaining attention of large number of people

towards the offered products and services of firm. The research into consideration helps in

measuring the relationship between marketing strategies and customer’s satisfaction. Each

business firm is focused on adopting various innovative tools and techniques at work place so

that their productivity and performance can be enhanced. This may create value in generating

high consumer satisfaction (Shankar, Carpenter and Farley, 2012).

1.2 Major factors that contributes to the process of research project selection

The marketing activities are to be observed and analysed just to gather the required

information and details in respect to develop the project on the bank. Marketing strategies plays a

vast role in executing various operations at market place. HSBC is a popular bank who is

focused on providing high quality and fast services and products to their potential customers in

terms of attaining high profit and revenue (Balmer, 2011). HSBC follow various marketing

strategies such as promotional campaign, effective offers, high interest accounts, loan on less

interest, conducting CSR activities at work place in respect to satisfying the needs and wants of

customers. Among all the marketing strategy green marketing activities is considered as the most

effective strategy which is significantly performed by HSBC bank in the country of United

Kingdom. The green marketing can demonstrated as the marketing activities that are to be done

according to the need for achieving the level where the marketing activities will be accomplished

without producing any wastage of the resources (Sarin, Challagalla and Kohli, 2012). There are

various sources that contributes to the process of selection of research project. Research aim can

be considered as the most essential element which plays a vast role in carry out the research issue

in specific direction as to gaining proper and relevant outcome for the research work. Research

collect data and information form various sources such as primary and sources as to moving

forward towards right manner.

1.3 Literature Review

Introduction

3

This section of research plays a vast role in conducting an in depth research through

applying various resources in order to gathering appropriate data and information which are

required for the research work (Furedi, 2013). This is an effective part of research and helps in

providing appropriate discussion that are connected with the view point of various writers and

authors. The literature review section consists of several key references that is to be identified

and discussed. The aspects of the literature review section consist of the marketing activities,

green marketing strategies and plans. The banking sectors can be stated as the common financial

service providers in the market comparing to other organisations. The HSBC bank is known to

be one the most essential banking sector, which provides different services, and facilities to its

customers, thus it can be stated that the firm has developed its brand image to higher level

comparing to other banking sectors. The concept of green banking will be emphasised in this

literature review and linked with HSBC bank. This section generates a foundation for the

investigator through providing data and information that are based on various perspectives of

authors and writers (Walsh and Bartikowski, 2013). This part of research helps in generating an

effective and valuable outcome for the completion of research work.

The major marketing strategies that are used by HSBC Bank in respect to gaining attention of

customers.

As per the view point of Galbreath and Shum, 2012, banking sector has been going

through different changes from last few years due to merging of large banks and strategic

alliances. Apart from this, the enhancement of legislative deregulation of the market and

reducing amount of state intervention is also the reason for these changes. The banking sector

has introduced different new services that are helpful to capture the wide area of market. In the

United Kingdom, HSBC is one of the largest and popular banks with different service for its

customers. The 150 years old organisation implemented different marketing strategies to serve

its customers better and for this reason, it becomes one of the largest banks in the world.

Marketing is a wide term and plays an effective role in achieving high growth and profit at

market place. Small as well as large business organisations are concern on adopting most

suitable marketing strategies in respect to gaining attention of large number of people towards

their firm and offered products. There are various marketing strategies which are used by HSBC

Bank in respect to providing satisfactory services and products to their potential customers, in

which some are describes as under:

4

applying various resources in order to gathering appropriate data and information which are

required for the research work (Furedi, 2013). This is an effective part of research and helps in

providing appropriate discussion that are connected with the view point of various writers and

authors. The literature review section consists of several key references that is to be identified

and discussed. The aspects of the literature review section consist of the marketing activities,

green marketing strategies and plans. The banking sectors can be stated as the common financial

service providers in the market comparing to other organisations. The HSBC bank is known to

be one the most essential banking sector, which provides different services, and facilities to its

customers, thus it can be stated that the firm has developed its brand image to higher level

comparing to other banking sectors. The concept of green banking will be emphasised in this

literature review and linked with HSBC bank. This section generates a foundation for the

investigator through providing data and information that are based on various perspectives of

authors and writers (Walsh and Bartikowski, 2013). This part of research helps in generating an

effective and valuable outcome for the completion of research work.

The major marketing strategies that are used by HSBC Bank in respect to gaining attention of

customers.

As per the view point of Galbreath and Shum, 2012, banking sector has been going

through different changes from last few years due to merging of large banks and strategic

alliances. Apart from this, the enhancement of legislative deregulation of the market and

reducing amount of state intervention is also the reason for these changes. The banking sector

has introduced different new services that are helpful to capture the wide area of market. In the

United Kingdom, HSBC is one of the largest and popular banks with different service for its

customers. The 150 years old organisation implemented different marketing strategies to serve

its customers better and for this reason, it becomes one of the largest banks in the world.

Marketing is a wide term and plays an effective role in achieving high growth and profit at

market place. Small as well as large business organisations are concern on adopting most

suitable marketing strategies in respect to gaining attention of large number of people towards

their firm and offered products. There are various marketing strategies which are used by HSBC

Bank in respect to providing satisfactory services and products to their potential customers, in

which some are describes as under:

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Free products and offers: The customers can be attracted by providing free items from

the banks. Some banks offers gift coupons that helps to bring customers from different

other banks. Apart from this, some banks offer a small amount for opening up a new

account with them. In order to reduce the free items given away by the bank, it can

collaborate with different large retail chains or other brands and enter new customer’s

name for gift coupon or lucky draw (Gummesson, Kuusela and Närvänen, 2014).

However, the banks need to analyse its target customers to determine the types of free

items they can distribute. Credit Cards: HSBC design specialised credit card for different people such as for small

business directors, students and others. The credit card with lower interest rate and lesser

fees generally attracts more customers. Any cash back policy or rewards related to card

can be beneficial to get number of customers. Banks can encourage parents to create

accounts for their children to develop them as co-user of their parents’ credit cards. The

teen who already has a bank account are more likely to continue with that bank after

becomes adult or start earning. Incorporation of technologies: A lot of customers emphasised online banking by using

their smartphones or laptops because it saves time and energy. HSBC apply various

innovative tools and techniques at work place as this is effective in attracting large

number of customers. The online banking is helpful for the users to monitor their account

balance and transfer money from different locations. Apart from this, the banks can

provide information about its services to the accounts of the customers and also helps in

taking an effective decision regarding account management (Wu, 2011). Green Marketing: The green marketing is a new concept that refers to selling the

products or services an organisation based on the benefits of the environments. The

products or services developed by an organisation need to consume lesser energy and the

pricing, distribution and other related strategies need to contribute to this process. The

green marketing is a holistic process of management that identify, anticipate and satisfy

the demands of the consumers with a sustainable way (Hautsch, Schaumburg and

Schienle, 2014). The green marketing strategy in banking sector includes introducing

green services that reduces the use of natural resources. As example, the online service

5

the banks. Some banks offers gift coupons that helps to bring customers from different

other banks. Apart from this, some banks offer a small amount for opening up a new

account with them. In order to reduce the free items given away by the bank, it can

collaborate with different large retail chains or other brands and enter new customer’s

name for gift coupon or lucky draw (Gummesson, Kuusela and Närvänen, 2014).

However, the banks need to analyse its target customers to determine the types of free

items they can distribute. Credit Cards: HSBC design specialised credit card for different people such as for small

business directors, students and others. The credit card with lower interest rate and lesser

fees generally attracts more customers. Any cash back policy or rewards related to card

can be beneficial to get number of customers. Banks can encourage parents to create

accounts for their children to develop them as co-user of their parents’ credit cards. The

teen who already has a bank account are more likely to continue with that bank after

becomes adult or start earning. Incorporation of technologies: A lot of customers emphasised online banking by using

their smartphones or laptops because it saves time and energy. HSBC apply various

innovative tools and techniques at work place as this is effective in attracting large

number of customers. The online banking is helpful for the users to monitor their account

balance and transfer money from different locations. Apart from this, the banks can

provide information about its services to the accounts of the customers and also helps in

taking an effective decision regarding account management (Wu, 2011). Green Marketing: The green marketing is a new concept that refers to selling the

products or services an organisation based on the benefits of the environments. The

products or services developed by an organisation need to consume lesser energy and the

pricing, distribution and other related strategies need to contribute to this process. The

green marketing is a holistic process of management that identify, anticipate and satisfy

the demands of the consumers with a sustainable way (Hautsch, Schaumburg and

Schienle, 2014). The green marketing strategy in banking sector includes introducing

green services that reduces the use of natural resources. As example, the online service

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

given by banks helps to reduce the use of papers. Therefore, it is an environment friendly

policy that can be implemented by the banks for sustainable development. CSR Activities: As a most popular and famous bank HSBC perform various CSR

activities at work place. It is more effective in gaining attention of customers and clients

towards their firm and offered products and services. HSBC bank conducts various CSR

activities in which promoting education, environmental sustainability, empowering

women, language and culture understanding are some essential activities. These all are

considered as the most appropriate tool of gaining attention of customers towards the

firm.

The importance of customers satisfaction in enhancing organisational performance

According to the opinion of Khan, 2012, Basically it concerned research with online

banking services in HSBC, UK and the customer satisfaction towards their services and because

of continuous growth of internet banking its main objective to study online banking situation in

HSBC business to see how this effect customer satisfaction and online banking provide platform

to conduct financial transactions on secured website by their retail or virtual banking, credit

union or at the time of building society. Some effective importance of customers satisfaction are

describes as follows: Appropriate security system: In the present era the main thing that need to be focus is the

functionality and usability of websites and proper security system must be installed to

reduce fraudulent conduct. According to an independent market analyst, emerging

primary areas for online banks include web content management that assist in customer

profiling, personnel technologies to develop more customer service so we can say that

internet is only platform that facilitates online service and that become earning source for

banks by adopting online banking facilities and make it more vigilant that ensure safety

and secure customer transactions in all over world which ensure customer loyalty and

increase customer base for HSBC bank. Quick response on consumers request: This is the best way to know the feedback of

customers at the time of availing online banking services and the main objectives behind

it to know the satisfaction level of customers who provide large funds to them and get a

chance to know the weakness of bank that need to be improved so that they can achieved

6

policy that can be implemented by the banks for sustainable development. CSR Activities: As a most popular and famous bank HSBC perform various CSR

activities at work place. It is more effective in gaining attention of customers and clients

towards their firm and offered products and services. HSBC bank conducts various CSR

activities in which promoting education, environmental sustainability, empowering

women, language and culture understanding are some essential activities. These all are

considered as the most appropriate tool of gaining attention of customers towards the

firm.

The importance of customers satisfaction in enhancing organisational performance

According to the opinion of Khan, 2012, Basically it concerned research with online

banking services in HSBC, UK and the customer satisfaction towards their services and because

of continuous growth of internet banking its main objective to study online banking situation in

HSBC business to see how this effect customer satisfaction and online banking provide platform

to conduct financial transactions on secured website by their retail or virtual banking, credit

union or at the time of building society. Some effective importance of customers satisfaction are

describes as follows: Appropriate security system: In the present era the main thing that need to be focus is the

functionality and usability of websites and proper security system must be installed to

reduce fraudulent conduct. According to an independent market analyst, emerging

primary areas for online banks include web content management that assist in customer

profiling, personnel technologies to develop more customer service so we can say that

internet is only platform that facilitates online service and that become earning source for

banks by adopting online banking facilities and make it more vigilant that ensure safety

and secure customer transactions in all over world which ensure customer loyalty and

increase customer base for HSBC bank. Quick response on consumers request: This is the best way to know the feedback of

customers at the time of availing online banking services and the main objectives behind

it to know the satisfaction level of customers who provide large funds to them and get a

chance to know the weakness of bank that need to be improved so that they can achieved

6

their objectives keeping in mind customer as their first priority (Jamil, Ilahi and Kazmi,

2014). Affordable Product and services: Beside general facility provided by every banks but

the uniqueness that enhance the brand value of HSBC is that offer some specialised

product and service according to the customers they served and this bank divided its

customer into two categories I.e. corporate customers and individual customers and

corporates customers are generally large business houses who avail services like availing

loan, funds in bulk and also deal in mutual funds of banks on the other hands individual

customers are daily or routine customers to whom bank provide financial goods and

services according to their paying capacity and advise them to invest on those

instruments which gives more returns and less risk and increase their satisfaction.

The relationship between various marketing activities and consumer satisfaction in HSBC

Bank.

As per the view point of Jeon and Choi, 2012, HSBC is one of the largest bank in the

United Kingdom that provides wide amount of services to its customers. The organisation

segmented its market and implement strategies to reach its target customers. HSBC bank has

mainly segmented its market based on geographic and demographic segmentation and develop

its products and services for individual and corporate customers. The geographic segmentation is

based on the customers resides in urban or rural areas and serves for them are different based on

the demands. In demographic segmentation, the services are based on the customer's’ income,

age, family size, education and more factors. HSBC bank use differentiation targeting strategy in

which it promotes different services for different target market. The organisation designs the

services specifically for its different target market and the promotional campaigns are created

based on those. Apart from this, the HSBC uses value based positioning in order to connect its

different market segmentation (Molyneux, Schaeck and Zhou, 2014). The banks are the most

common financial service providers beside of insurance and saving organisations. In current

scenario, the competition in banking sector is high and customers are more critical due to

increasing number of nationalised and private banks. In order to cope up with the competition

and demand of the customers, the banking sector needs to develop new services and implement

different strategies. The marketing of banks can be termed as marketing for immaterial goods or

services. The services given by banking industry is more complex as compared to other services.

7

2014). Affordable Product and services: Beside general facility provided by every banks but

the uniqueness that enhance the brand value of HSBC is that offer some specialised

product and service according to the customers they served and this bank divided its

customer into two categories I.e. corporate customers and individual customers and

corporates customers are generally large business houses who avail services like availing

loan, funds in bulk and also deal in mutual funds of banks on the other hands individual

customers are daily or routine customers to whom bank provide financial goods and

services according to their paying capacity and advise them to invest on those

instruments which gives more returns and less risk and increase their satisfaction.

The relationship between various marketing activities and consumer satisfaction in HSBC

Bank.

As per the view point of Jeon and Choi, 2012, HSBC is one of the largest bank in the

United Kingdom that provides wide amount of services to its customers. The organisation

segmented its market and implement strategies to reach its target customers. HSBC bank has

mainly segmented its market based on geographic and demographic segmentation and develop

its products and services for individual and corporate customers. The geographic segmentation is

based on the customers resides in urban or rural areas and serves for them are different based on

the demands. In demographic segmentation, the services are based on the customer's’ income,

age, family size, education and more factors. HSBC bank use differentiation targeting strategy in

which it promotes different services for different target market. The organisation designs the

services specifically for its different target market and the promotional campaigns are created

based on those. Apart from this, the HSBC uses value based positioning in order to connect its

different market segmentation (Molyneux, Schaeck and Zhou, 2014). The banks are the most

common financial service providers beside of insurance and saving organisations. In current

scenario, the competition in banking sector is high and customers are more critical due to

increasing number of nationalised and private banks. In order to cope up with the competition

and demand of the customers, the banking sector needs to develop new services and implement

different strategies. The marketing of banks can be termed as marketing for immaterial goods or

services. The services given by banking industry is more complex as compared to other services.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The main asset of this bank is its employees which is more than 2, 50000 worldwide who

contributes to the profitability of this bank. The bank focused on “Go global act local” strategy to

consolidate its operation and structure its products and services for the customers (Lam and et.

al., 2011). The strategy is helpful for them to develop competitive advantage over different other

financial institutions. In current scenario, HSBC is using green marketing strategies to promote

its products or services to its customers. HSBC has developed its services accordingly and

environment friendly promotional strategies contribute to sustainable development.

Essential ways by which HSBC Bank can attain higher competitive edge at market place.

According to the perception of Lewis and Thornbory, 2012, in this modern era each

business firm is focused on attaining higher competitive advantage at market place through

serving variety of products and services to their potential buyers. Competitive advantage helps in

providing high competition to their rivals as to maintain their position at market place. HSBC

bank use various ways in order to attaining high competitive edge, in which some are describes

as under: One screen solutions: HSBC recently introduced new app known as Beta app for UK

costumers and the USP of this is that it provide banking solutions at one screen only and

its main target are millennial market which is designed to managing the savings of

customers and its main objective is give customers a complete and joined up view of their

financial life and make it easier for them to choose confidently which provide

competitive advantage over rivalry (Lee, Lee and Kang, 2012). CSR Activities: CSR basically doing something good for society and this bank also

contributing in social activity by promoting education and environment sustainability and

specially supporting environmental sustainability by aligning with the HSBC group

flagship programmes and bank also enforce for employee engagement and it related

employment investments in community social, programmes which help in increasing

goodwill and costumer trust (Lusch and Webster Jr, 2011).

Marketing strategies: The main focus under marketing strategy is to maintain the competitive

position in market for which bank focus on either on targeting, segmenting or positioning

strategy of company. HSBC is a global bank its target customers are all the global customer who

fit in their policy and segmenting means segment the market according to customer needs and

positioning means maintaining competitive position in the eye of costumers which increase their

8

contributes to the profitability of this bank. The bank focused on “Go global act local” strategy to

consolidate its operation and structure its products and services for the customers (Lam and et.

al., 2011). The strategy is helpful for them to develop competitive advantage over different other

financial institutions. In current scenario, HSBC is using green marketing strategies to promote

its products or services to its customers. HSBC has developed its services accordingly and

environment friendly promotional strategies contribute to sustainable development.

Essential ways by which HSBC Bank can attain higher competitive edge at market place.

According to the perception of Lewis and Thornbory, 2012, in this modern era each

business firm is focused on attaining higher competitive advantage at market place through

serving variety of products and services to their potential buyers. Competitive advantage helps in

providing high competition to their rivals as to maintain their position at market place. HSBC

bank use various ways in order to attaining high competitive edge, in which some are describes

as under: One screen solutions: HSBC recently introduced new app known as Beta app for UK

costumers and the USP of this is that it provide banking solutions at one screen only and

its main target are millennial market which is designed to managing the savings of

customers and its main objective is give customers a complete and joined up view of their

financial life and make it easier for them to choose confidently which provide

competitive advantage over rivalry (Lee, Lee and Kang, 2012). CSR Activities: CSR basically doing something good for society and this bank also

contributing in social activity by promoting education and environment sustainability and

specially supporting environmental sustainability by aligning with the HSBC group

flagship programmes and bank also enforce for employee engagement and it related

employment investments in community social, programmes which help in increasing

goodwill and costumer trust (Lusch and Webster Jr, 2011).

Marketing strategies: The main focus under marketing strategy is to maintain the competitive

position in market for which bank focus on either on targeting, segmenting or positioning

strategy of company. HSBC is a global bank its target customers are all the global customer who

fit in their policy and segmenting means segment the market according to customer needs and

positioning means maintaining competitive position in the eye of costumers which increase their

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

market share and maintain sustainability and working with top 500 companies has helped the

company in increasing positive word of mouth and visibility and indirectly increase their brand

equity (Li and Zinna, 2014).

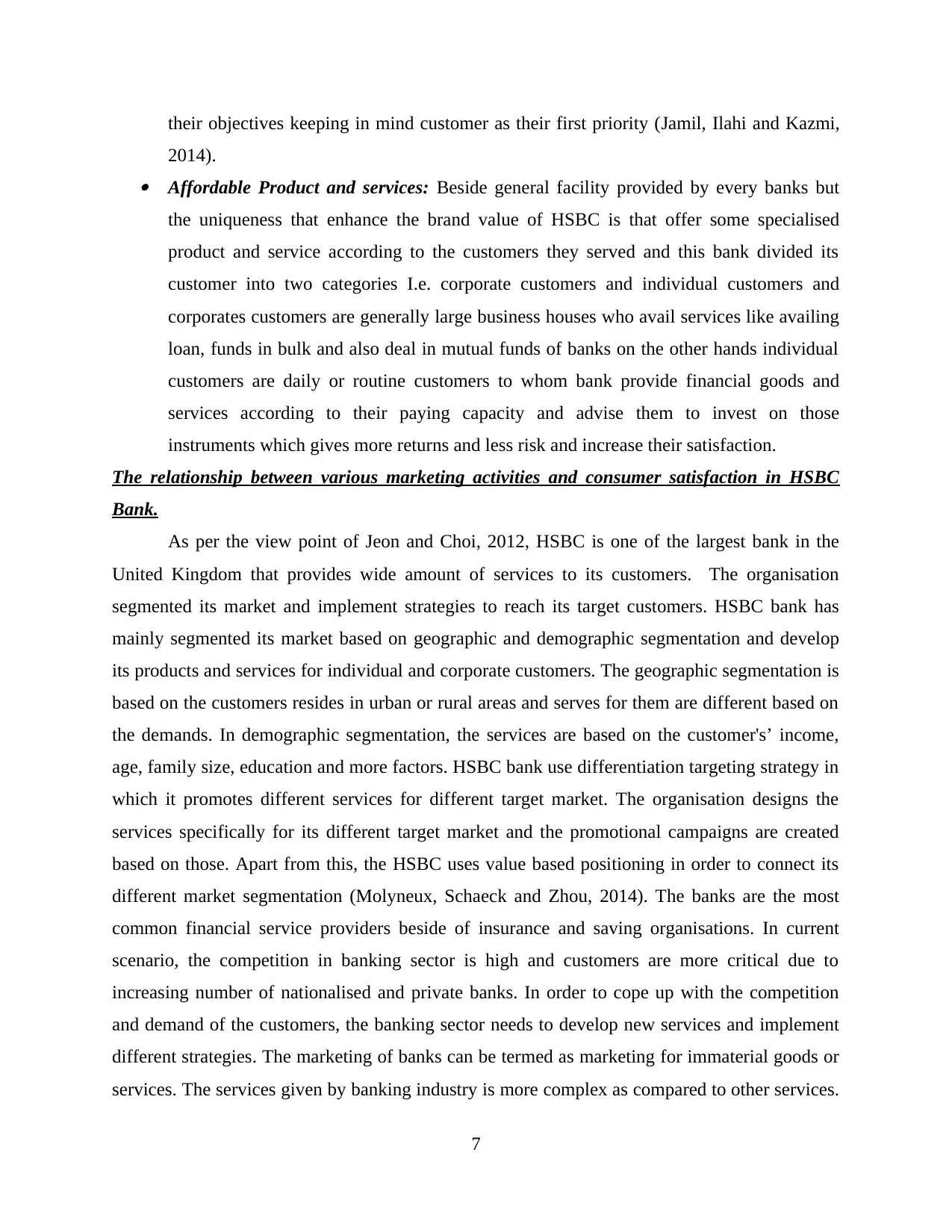

1.4 Structure of the project

1.5 Gantt Chart

9

company in increasing positive word of mouth and visibility and indirectly increase their brand

equity (Li and Zinna, 2014).

1.4 Structure of the project

1.5 Gantt Chart

9

TASK 2

2.1 Research Methodology

This can be considered as the most effective part of research as it helps in carry out the

whole research work in right direction. This chapter is based on various applications that are

used by researcher while conducting research work as it is effective in articulate the definite

conclusion on the above subjected topic. In this section of research project the author will outline

all the process that will be used in the research work (Naheem, 2015). It is the major

responsibility of research to select the most suitable methodology in order to providing

assistance to the researcher for moving forward towards right direction. This section has various

components on which the research work is based on, some essential elements are described

which are having a vast importance in completion of research work.

Type of investigation

This section of research methodology has categorise among two major parts such as

qualitative and quantitative research. A research either qualitative or quantitative in nature.

Qualitative research is based on quality of data which are gathered by the researcher for gaining

appropriate outcome. Quantitative research is depend on quality of data. Qualitative method will

suit the descriptive design of the research because this technique is descriptive itself. The

qualitative method will collected data via questionnaires and interview which will be descriptive

in nature (Naheem, 2015). The quantitative method of research will focus on the frequency of the

responds in the survey conduct. The survey will focus on determining the behaviours an

approach off each respondent towards different aspect of the subjected topic. In this present

research project qualitative research has to be taken in to proper action by researcher as it is

effective in accumulating best outcomes for the research work. The advantages of using this

method is that it is descriptive method and will provide in detailed analysis on the subjected

topic.

2.2 Data Sampling

Sampling is one of the most important processes in research project so it is very essential

that the researcher uses a specific sampling methods in the research process to draw a proper

conclusion on the subjected topic. The technique of sampling represents through selecting the

sample which replicates from the original population. In this section researcher either select

10

2.1 Research Methodology

This can be considered as the most effective part of research as it helps in carry out the

whole research work in right direction. This chapter is based on various applications that are

used by researcher while conducting research work as it is effective in articulate the definite

conclusion on the above subjected topic. In this section of research project the author will outline

all the process that will be used in the research work (Naheem, 2015). It is the major

responsibility of research to select the most suitable methodology in order to providing

assistance to the researcher for moving forward towards right direction. This section has various

components on which the research work is based on, some essential elements are described

which are having a vast importance in completion of research work.

Type of investigation

This section of research methodology has categorise among two major parts such as

qualitative and quantitative research. A research either qualitative or quantitative in nature.

Qualitative research is based on quality of data which are gathered by the researcher for gaining

appropriate outcome. Quantitative research is depend on quality of data. Qualitative method will

suit the descriptive design of the research because this technique is descriptive itself. The

qualitative method will collected data via questionnaires and interview which will be descriptive

in nature (Naheem, 2015). The quantitative method of research will focus on the frequency of the

responds in the survey conduct. The survey will focus on determining the behaviours an

approach off each respondent towards different aspect of the subjected topic. In this present

research project qualitative research has to be taken in to proper action by researcher as it is

effective in accumulating best outcomes for the research work. The advantages of using this

method is that it is descriptive method and will provide in detailed analysis on the subjected

topic.

2.2 Data Sampling

Sampling is one of the most important processes in research project so it is very essential

that the researcher uses a specific sampling methods in the research process to draw a proper

conclusion on the subjected topic. The technique of sampling represents through selecting the

sample which replicates from the original population. In this section researcher either select

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.